Current trend

The GBP/USD pair is slightly strengthening, testing the level of 1.2750 for a breakout. Market activity remains quite low as markets in the US are closed due to Martin Luther King Day celebrations. At the same time, investors are in no hurry to open new positions ahead of tomorrow's publication of the UK labor market report for November-December.

Forecasts suggest the country's Unemployment Rate has risen over the past three months through November from 4.2% to 4.3%. The Average Earnings Excluding Bonus in November could slow down sharply from 7.3% to 6.6%, and the Average Earnings Including Bonus - from 7.2% to 6.8%. On Wednesday, January 17, the UK will present December inflation statistics: analysts expect the Consumer Price Index to add 0.2% in December after declining by 0.2% in the previous month, with the annual CPI adjusted from 3.9% to 3.8%, and the Core CPI from 5.1% to 4.9%.

The pound received minor support from Friday's data from the UK. Gross Domestic Product (GDP) grew by 0.3% in November after -0.3% a month earlier, while experts expected an increase of 0.2%. Industrial Production increased by 0.3% compared to -1.3% in October, and in annual terms the figure fell 0.1% from -0.5% with a forecast of 0.7%, which, according to the National Statistical Service (ONS), indicates the possibility of a technical recession in the fourth quarter, although it is expected to be shallow.

Analysts at Bank of America Global Research adjusted previous estimates regarding monetary policy changes by the Bank of England: officials are now expected to keep the interest rate at 5.25% until August, although earlier forecasts included February 2025; however, according to them, the British regulator will be among the last ones to begin reducing borrowing costs as inflation risks remain. A negative impact on the national economy, according to the Governor of the regulator Andrew Bailey, in particular, may be caused by problems with shipping in the Red Sea, which have already caused changes in the routes of commercial ships and an increase in the cost of delivering goods.

Support and resistance

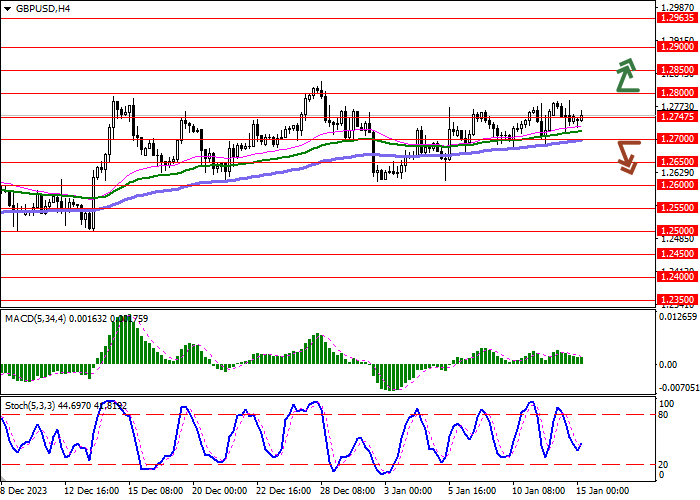

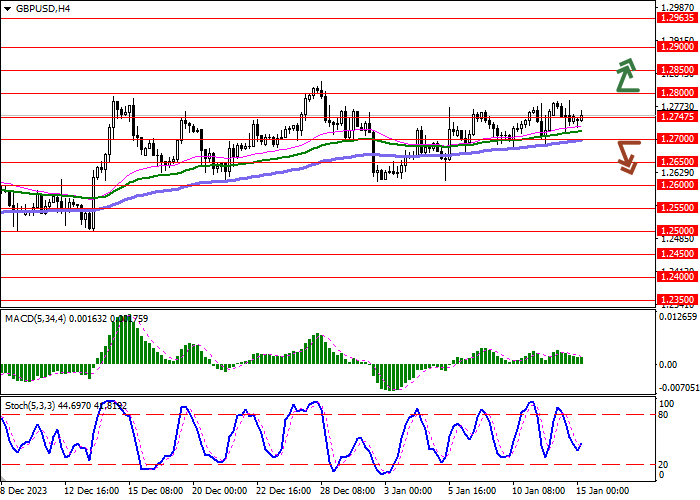

Bollinger Bands in D1 chart show insignificant growth. The price range is almost constant, remaining rather spacious for the current level of activity in the market. MACD is slightly declining keeping a weak sell signal (located below the signal line). Stochastic, having approached the level of "80", reversed into a horizontal plane, indicating the risks of overbought pound in the ultra-short term.

Resistance levels: 1.2800, 1.2850, 1.2900, 1.2963.

Support levels: 1.2747, 1.2700, 1.2650, 1.2600.

Trading tips

Short positions may be opened after a breakdown of 1.2700 with the target at 1.2600. Stop-loss — 1.2747. Implementation time: 2-3 days.

The return of the "bullish" trend with the breakout of 1.2800 may become a signal for new purchases with the target of 1.2900. Stop-loss — 1.2747.

Hot

No comment on record. Start new comment.