We present a medium-term investment review of the NZD/USD currency pair. The “bullish” scenario for the asset’s movement remains relevant. The American dollar, although in a local upward trend, looks less stable than the New Zealand currency.

At the end of November, the Reserve Bank of New Zealand (RBNZ) kept the key interest rate at 5.50% in response to slowing inflation, with the consumer price index reaching 1.8% in the third quarter, down from 6.0% to 5.6% YoY. According to preliminary estimates, further development of the negative dynamics of the indicator is expected. Despite this, representatives of the regulator believe that inflation may remain high for a long time, and it is premature to switch to dovish rhetoric. On the other hand, against a decline in Q3 gross domestic product (GDP) from 0.5% to –0.3% and from 1.5% to –0.6% YoY, officials may begin lowering interest rates as early as possible, giving priority to supporting the economy. Meanwhile, credit card spending adjusted to 3.3% from –2.8% in December, reflecting improved household purchasing power.

The American dollar, despite the correction, is still fragile and the global downward trend is likely to continue as the US Federal Reserve is likely to keep interest rates at 5.25–5.50% until at least the summer. Thus, the Chicago Mercantile Exchange (CME) FedWatch Instrument estimates this probability at 95.3%. The regulator’s rhetoric hurts the national currency, which is trading around 102.000 points in the USDX, well below the mid-autumn levels of 107.000, and after the current local correction, the long-term downtrend could reach the key level of 100.000. So, the main scenario remains the upward dynamics of the NZD/USD pair.

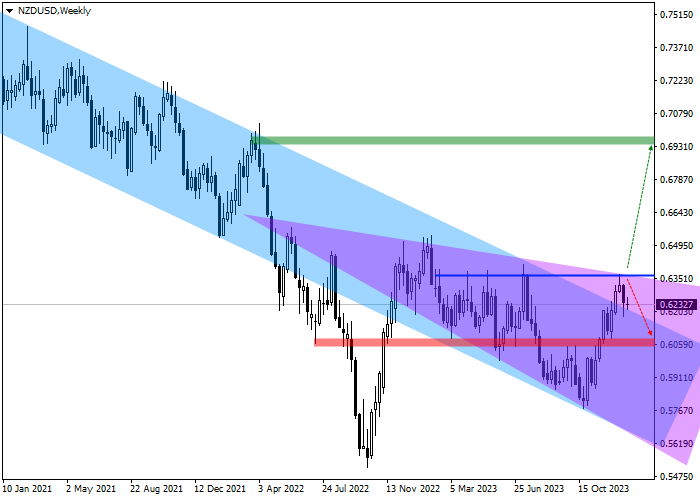

Technical indicators confirm the likelihood of continued growth: on the weekly chart, the price is trying to consolidate above the resistance line of the global downward channel with dynamic boundaries of 0.6230–0.5760, backtesting 0.6230.

As the chart shows, the exit of the quotes from the range should be considered the main scenario, which will mean the end of a more than 37-month cycle of decline in the asset.

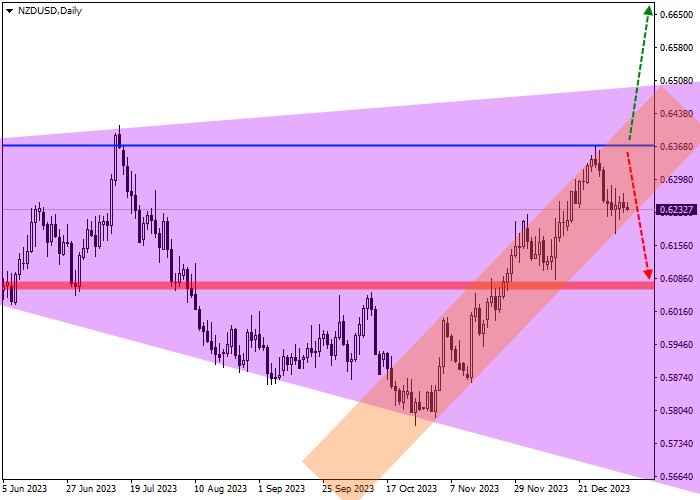

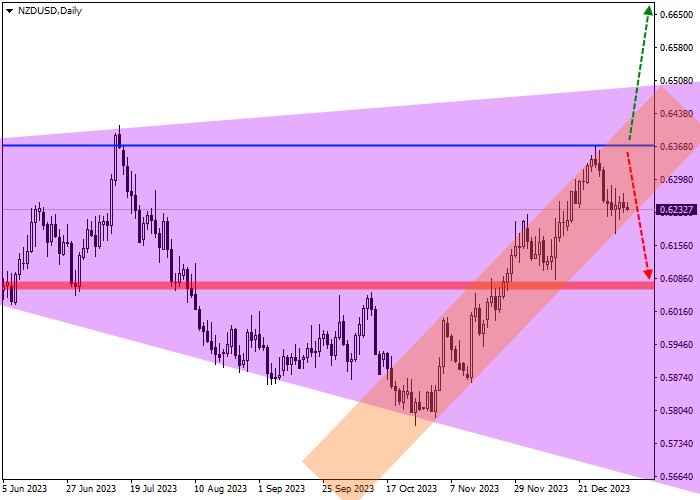

We suggest considering key levels on a daily chart.

As can be seen on the chart, a local Expanding formation pattern formed inside the global channel, and the price approaches its upper limit within the fifth wave, the last of the mandatory ones, at which a breakdown of one of the pattern boundaries most often occurs. If the level reaches 0.6050, the global upward scenario will be canceled, and it is better to liquidate the buy positions. Around the high of March 27, 2022, at 0.6960, there is the target zone, if reached, it is better to take profit on open buy positions.

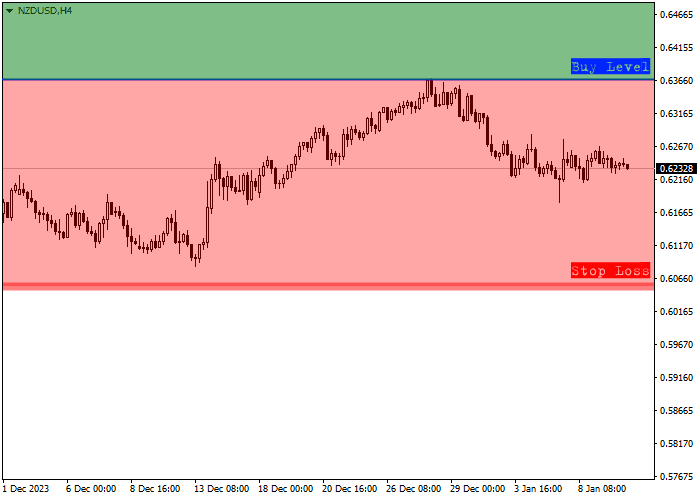

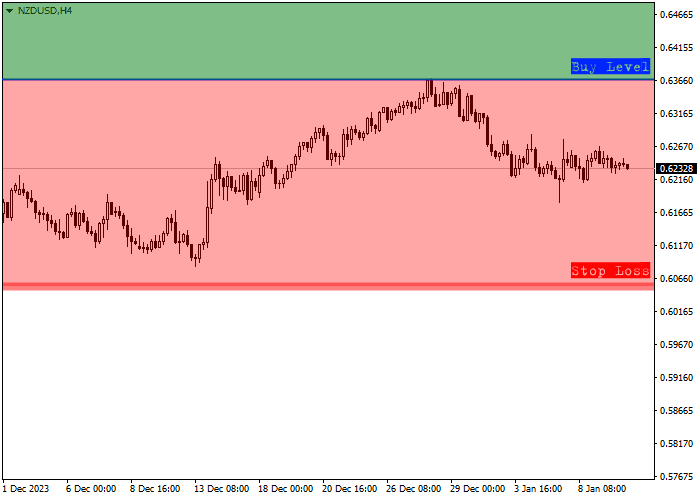

Let's assess the trade entry levels in more detail on the four-hour chart.

The entry level for buy trades is at 0.6370, which coincides with the high of the last week of last year, and a local signal will be received after it is broken soon.

Considering the average daily volatility of a trading instrument over the last month, which is 67.5 points, movement to the target zone of 0.6960 may take approximately 49 trading sessions but if volatility increases, this time may reduce to 38 trading days.

Hot

No comment on record. Start new comment.