Current trend

The USD/JPY pair is showing relatively strong growth, developing the weak "bullish" impetus formed the day before and testing 144.80 for a breakout. The instrument is supported by macroeconomic statistics from the United States, published yesterday: the National Federation of Independent Business (NFIB) Business Optimism Index in December increased from 90.6 points to 91.9 points, while analysts expected 90.7 points, and the RealClearMarkets/TIPP Economic Optimism in January went up from 40.0 points to 44.7 points with a forecast of 42.0 points.

Meanwhile, Japanese statistics did not support the yen: the Consumer Price Index in the Tokyo region slowed down from 2.7% to 2.4% in December, while the CPI excluding Food and Energy adjusted from 3.6% to 3.5% reducing expectations that the Bank of Japan will abandon its negative interest rate policy in the near future. The Japanese currency is under pressure today from labor market statistics, where Labor Cash Earnings in November fell from 1.5% to 0.2%, while analysts expected the same growth rate to continue. Tomorrow the focus of investors' attention will be on December statistics on consumer inflation in the United States. Forecasts assume an acceleration of annual dynamics from 3.1% to 3.2%.

Bank of Japan officials said they would reduce monthly purchases of long-term government bonds, recalling that the regulator could move to a more "hawkish" monetary policy as early as this year. On Tuesday, the Bank of Japan purchased 10- to 25-year debt for 150.0 billion yen - the same as on December 25, but given the fact that the regulator has reduced monthly operations, this indicates a decrease in purchases in the first month of the year, as it initially announced its intention to buy at least 100.0 billion yen in long-term bonds in one transaction, according to the Bank of Japan's quarterly plan.

Support and resistance

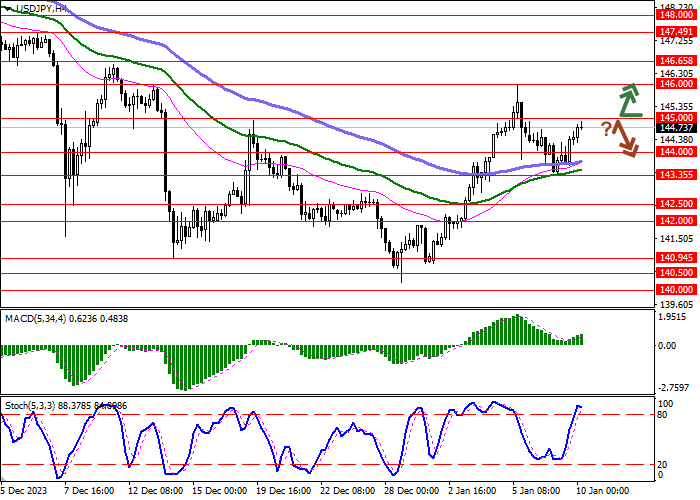

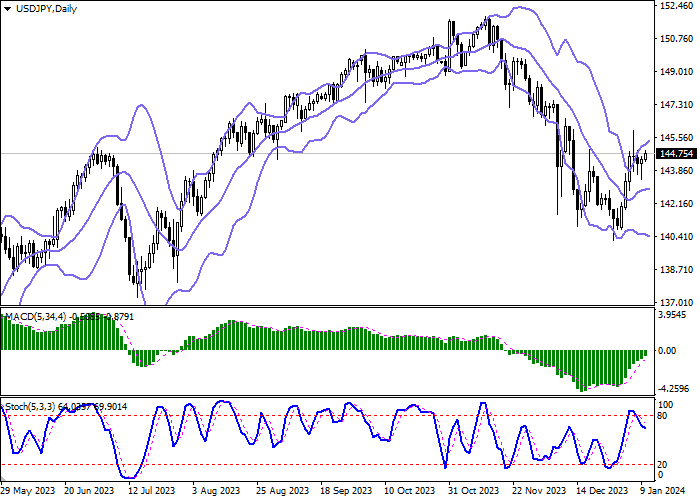

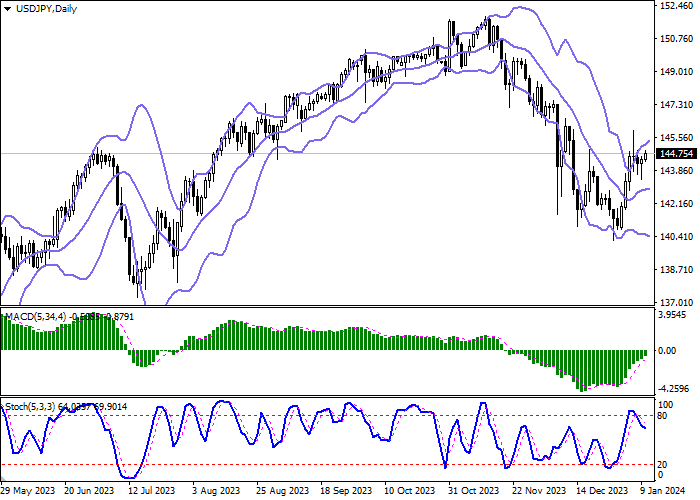

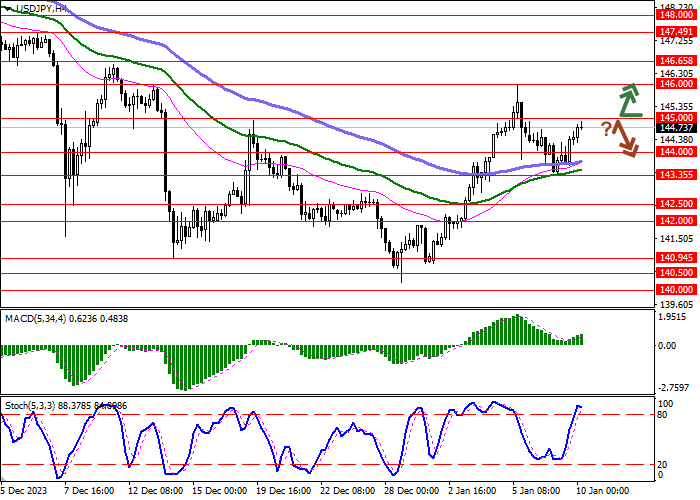

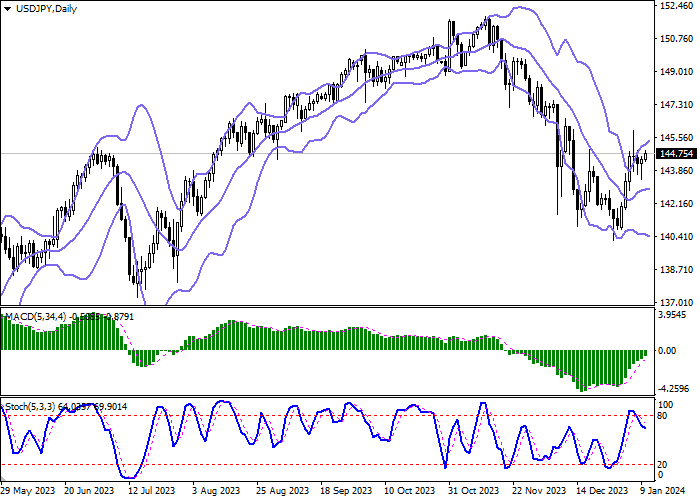

Bollinger Bands in D1 chart show moderate growth. The price range is expanding actively from above, freeing a path to new local highs for the "bulls". MACD grows, preserving a stable buy signal (located above the signal line). Stochastic, having demonstrated a downward rebound at the end of last week, maintains a downward direction, which weakly correlates with real market dynamics.

Resistance levels: 145.00, 146.00, 146.65, 147.49.

Support levels: 144.00, 143.35, 142.50, 142.00.

Trading tips

Long positions can be opened after a breakout of 145.00 with the target of 146.65. Stop-loss — 144.30. Implementation time: 2-3 days.

A rebound from 145.00 as from resistance, followed by a breakdown of 144.00 may become a signal for opening of new short positions with the target at 143.00. Stop-loss — 144.50.

Hot

No comment on record. Start new comment.