Current trend

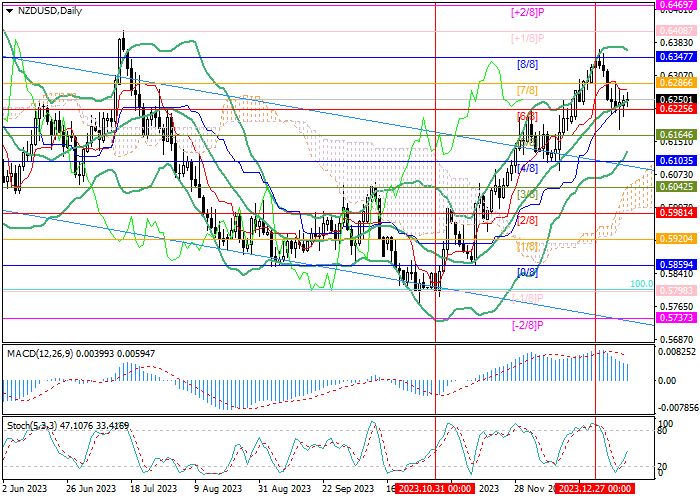

The NZD/USD pair is moving within the medium-term upward trend but at the beginning of this month, the price corrected downwards and has been remaining near the middle line of Bollinger bands for several sessions.

The market is in a state of uncertainty ahead of the publication of key US inflation statistics for December, which could significantly affect the decisions of US Federal Reserve officials. On Friday, labor market data confirmed the sector strength: employment rose by 216.0K, and unemployment remained at 3.7%, shaking investor confidence in the imminent start of a cycle of interest rate cuts. If the consumer price index shows an upward trend, the Fed may delay the monetary rhetoric change, supporting the American dollar. According to forecasts, the indicator may adjust from 0.1% to 0.2% MoM and from 3.1% to 3.2% YoY.

Comments by board member Michelle Bowman confirm the restrained position officials: yesterday, she said there would probably be no new increase in borrowing costs. Still, it was too early to reduce them since risks of rising consumer prices remained. The lack of a clear idea of the department’s immediate actions is holding back the resumption of asset growth but investors’ hope that monetary policy easing will begin within the year does not allow the quotes to weaken significantly.

Support and resistance

Technical indicators confirm the continuation of the upward trend: Bollinger Bands and Stochastic reverse upwards. Consolidation of the trading instrument above 0.6286 (Murrey level [7/8]) will allow it to reach the area of 0.6347 (Murrey level [8/8]), 0.6408 (Murrey level [ 1/8]), and 0.6469 (Murrey level [ 2/ 8]). The key “bearish” level is 0.6225 (Murrey level [6/8]) below the middle line of Bollinger bands, after consolidation below which the negative dynamics may continue to 0.6103 (Murrey level [4/8]), which seems less likely.

Resistance levels: 0.6286, 0.6347, 0.6408, 0.6469.

Support levels: 0.6286, 0.6103.

Trading tips

Long positions may be opened above 0.6286 with the targets at 0.6347, 0.6408, 0.6469, and stop loss around 0.6240. Implementation time: 5–7 days.

Short positions may be opened below 0.6286 with the target at 0.6103 and stop loss around 0.6280.

Hot

No comment on record. Start new comment.