Current trend

The leading Japanese stock index NI 225 is correcting near the level of 33747.0. The global corporate reporting period starts next week, so quotes are still influenced by macroeconomic data and dynamics in the bond market.

The Consumer Price Index in Japan in December was fixed at 2.7%, as in the month earlier, the CPI in the Tokyo region adjusted from 2.7% to 2.4%, and the Core CPI from 2.3% to 2.1%, giving a not very positive signal for supporters of changing the monetary policy course to a "hawkish" one. In addition, Household Spending in November decreased by 1.0% after -0.1% a month earlier, and in annual terms the figure was -2.9% after -2.5%.

The bond market is seeing a minor correction, with the 10-year bonds trading at 0.5940%, little changed from 0.5963% at the end of last year, and the 20-year bonds yield at 1.3640% after the 1.3344% recorded previously.

The growth leaders in the index are DeNA Co., Ltd. ( 8.45%), Advantest Corp. ( 5.79%), Omron Corp. ( 5.89%), Hitachi Co., Ltd. ( 3.86%).

Among the leaders of the decline are Kawasaki Kisen Kaisha Co., Ltd. (-3.54%), DIC Corp. (-2.55%), Taiyo Yuden Co., Ltd. (-2.23%).

Support and resistance

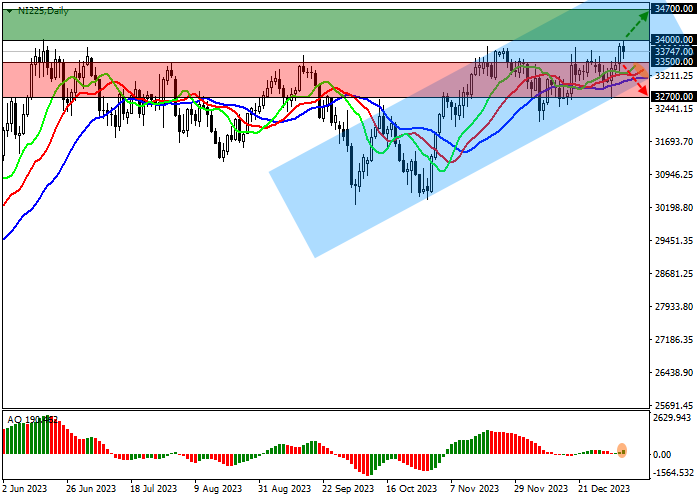

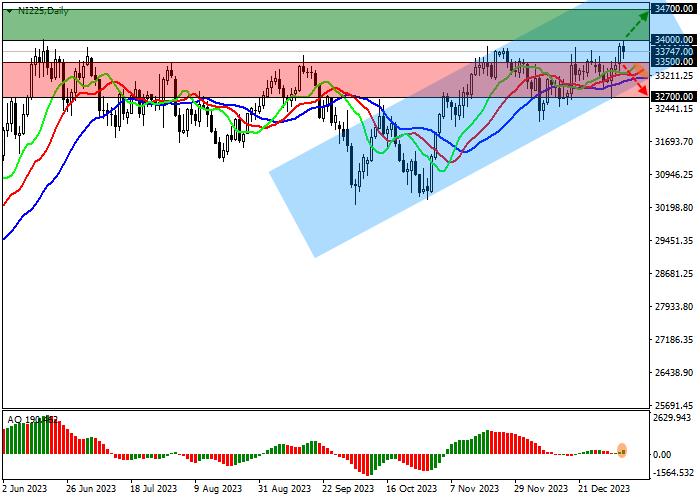

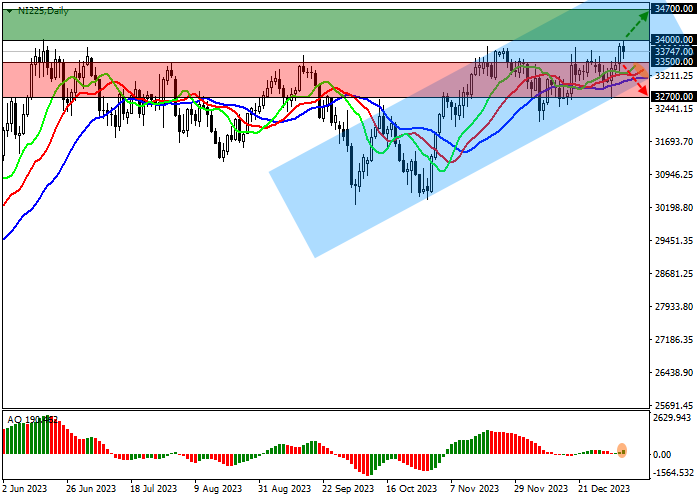

On the daily chart, the price is kept within the local ascending channel with dynamic boundaries of 34000.0–32700.0.

Technical indicators have reversed and keep a stable buy signal: the AO histogram is forming new corrective bars, and fast EMAs on the Alligator indicator are moving away from the signal line.

Support levels: 33500.0, 32700.0.

Resistance levels: 34000.0, 34700.0.

Trading tips

If the asset continues growing and the price consolidates above the resistance level of 34000.0, long positions will be relevant with target at 34700.0. Stop-loss — 33800.0. Implementation time: 7 days and more.

If the asset reverses and continues local decline and the price consolidates below the support level of 33500.0, short positions can be opened with the target at 32700.0. Stop-loss — 33800.0.

Hot

No comment on record. Start new comment.