Current trend

During the Asian session, the USD/CHF pair is declining slightly, consolidating near 0.8475: market activity remains low as traders await the publication of key American macroeconomic statistics on Thursday at 15:30 (GMT 2).

Forecasts suggest an increase in the consumer price index in December from 3.1% to 3.2% YoY and by 0.2% MoM, and their implementation will significantly affect the likelihood of an early launch of the US Federal Reserve’s monetary easing program. Earlier, the market was counting on a possible reduction in the interest rate by 25 basis points during the March meeting of the regulator. Experts also focus on the December report on the labor market, which reflected an increase of 216.0K in nonfarm payrolls, noticeably higher than the estimates of 170.0K but the November figure was revised from 199.0K to 173.0K. The unemployment rate remained at 3.7%, and average hourly wages rose from 4.0% to 4.1%, contrary to preliminary estimates of a decline to 3.9%.

The franc is receiving support after the publication of data on consumer inflation in Switzerland: in December, the consumer price index adjusted from 1.4% to 1.7% YoY, significantly above expectations of 1.5%, and showed zero dynamics after –0.2% MoM.

Support and resistance

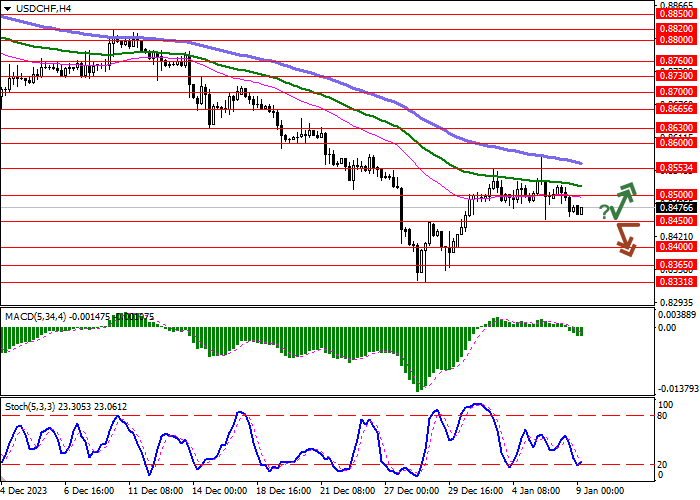

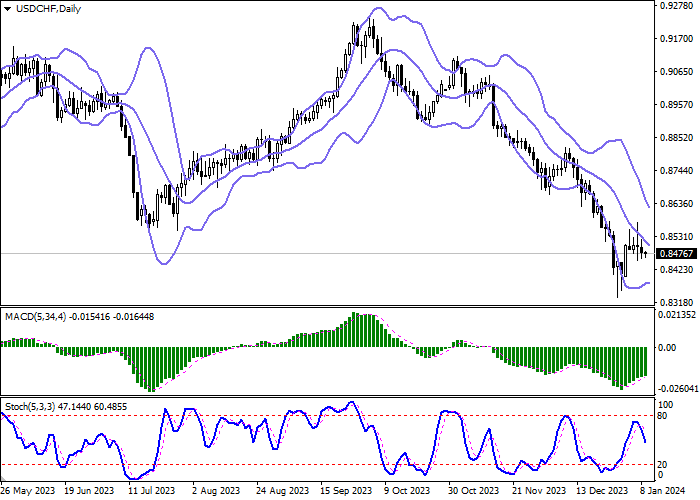

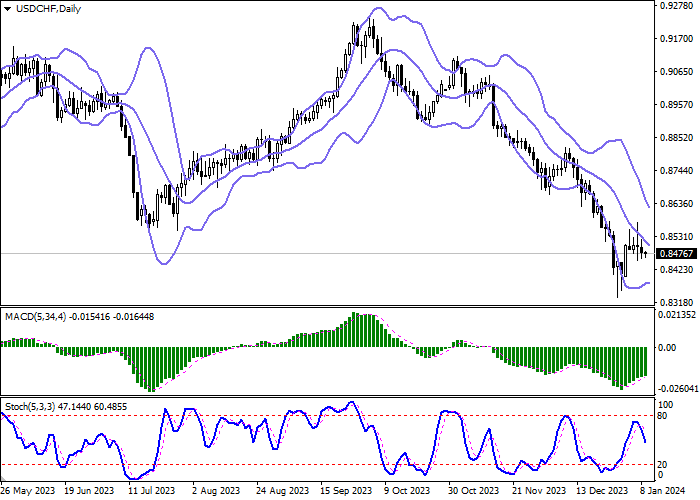

On the daily chart, Bollinger Bands are steadily declining: the price range is narrowing, reflecting the ambiguous nature of trading in the short term. The MACD indicator is growing, maintaining a poor buy signal (the histogram is above the signal line). Stochastic, having failed to reach “80” last week, reversed downwards, signaling the predominance of the “bearish” sentiment in the ultra-short term.

Resistance levels: 0.8500, 0.8553, 0.8600, 0.8630.

Support levels: 0.8450, 0.8400, 0.8365, 0.8331.

Trading tips

Short positions may be opened after a breakdown of 0.8450 with the target at 0.8365. Stop loss – 0.8500. Implementation time: 2–3 days.

Long positions may be opened after a rebound from 0.8450 and a breakout of 0.8500 with the target at 0.8600. Stop loss – 0.8450.

Hot

No comment on record. Start new comment.