Current trend

The GBP/USD pair is changing slightly, trying to continue the development of the upward trend formed last week. The instrument is trading near 1.2750 and local highs of December 29, 2023. At the same time, activity on the market remains restrained, as trading participants await the publication of macroeconomic statistics from the United States on inflation dynamics, which will take place on Thursday. Forecasts suggest an acceleration of the Consumer Price Index in December by 0.2%, which roughly corresponds to an annual increase of 3.2%, while the CPI excluding Food and Energy could slow down from 4.0% to 3.8%.

In addition, investors are analyzing December data on the US labor market presented last week. The national economy created about 216.0 thousand new jobs outside the agricultural sector with expectations at 170.0 thousand, the Average Hourly Earnings remained at 0.4% on a monthly basis, while in annual terms the figure was revised from 4.0% to 4.1%, defying forecasts of a slowdown to 3.9%, and the Unemployment Rate remained unchanged at 3.7%, while analysts had expected 3.8%.

On Friday, November statistics on the dynamics of Industrial Production and Gross Domestic Product (GDP) will be published in the UK. Production is projected to grow by 0.3%, after -0.8% in the previous month, and GDP to increase by 0.2%, after contracting by 0.3% the previous month.

Meanwhile, UK Treasury Secretary Jeremy Hunt said that attacks by the Yemeni Houthis on commercial ships in the Red Sea could have a negative impact on the national economy and become a driver of increased inflation, while the official did not specify what actions the authorities would take to change the situation and whether they would direct additional naval ships to the region. Almost 15.0% of global maritime trade passes through the Red Sea, including 8.0% in grain, 12.0% in oil and 8.0% in liquefied natural gas.

Support and resistance

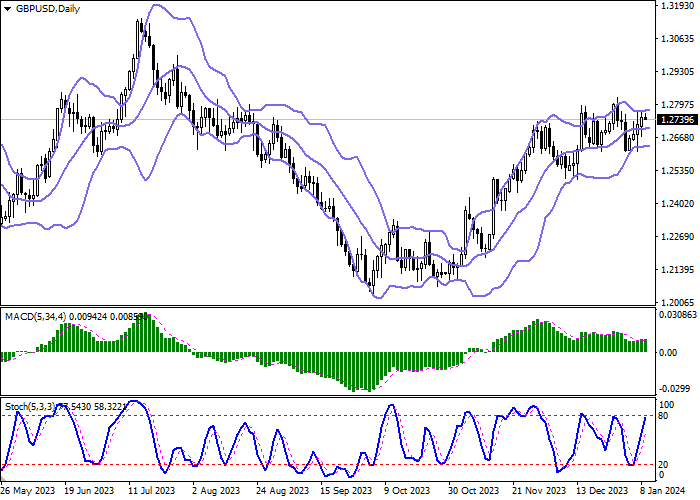

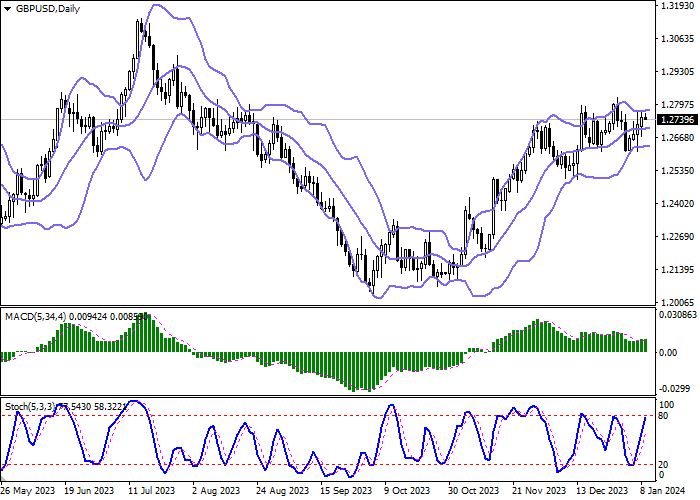

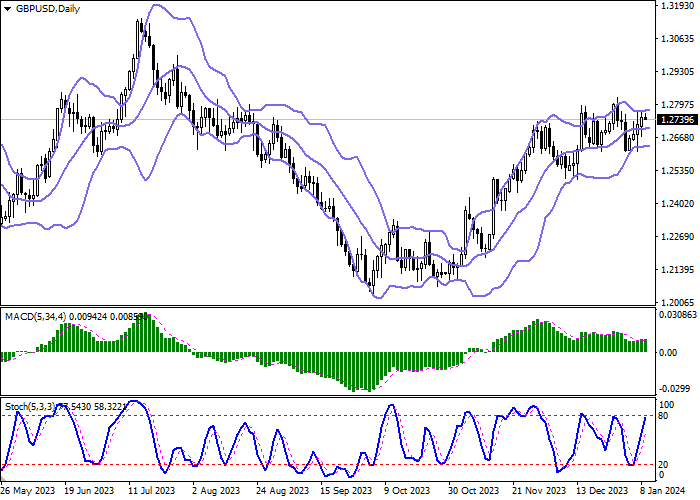

Bollinger Bands in D1 chart show weak growth. The price range practically does not expand, limiting the development of "bullish" dynamics in the near future. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought pound in the ultra-short term.

Resistance levels: 1.2800, 1.2850, 1.2900, 1.2963.

Support levels: 1.2747, 1.2700, 1.2650, 1.2600.

Trading tips

Short positions may be opened after a breakdown of 1.2700 with the target at 1.2600. Stop-loss — 1.2747. Implementation time: 2-3 days.

The return of the "bullish" trend with the breakout of 1.2800 may become a signal for new purchases with the target of 1.2900. Stop-loss — 1.2747.

Hot

No comment on record. Start new comment.