Current trend

After Friday’s publication of strong data on the US labor market, the NZD/USD pair is trading at 0.6225.

Thus, December nonfarm payrolls amounted to 216.0K, higher than analysts’ forecast of 170.0K and the previous value of 173.0K, and the unemployment rate decreased from 3.8% to 3.7%, supporting the national currency. The dollar is under pressure due to the December non-manufacturing PMI from the Institute for Supply Management (ISM), which did not live up to preliminary estimates of 52.6 points: the actual value consolidated at 50.6 points, worse than 52.7 points. The employment in the non-manufacturing sector (ISM) reached 43.3 points compared to expectations of 51.0 points and the previous value of 50.7 points.

The position of the New Zealand dollar remains quite strong. In the long term, the key role in its dynamics will be the difference in the rhetoric of financial authorities: given that American inflation is declining, reaching 3.1%, the US Fed is likely to gradually move to lower interest rates, weakening the American dollar. New Zealand’s consumer price index, despite its latest cut from 6.0% to 5.6%, remains above its 2.0% target, and the Reserve Bank of New Zealand (RBNZ) may keep borrowing costs at 5.50% much longer and even increase it since the cycle of tightening monetary policy is not over yet.

Support and resistance

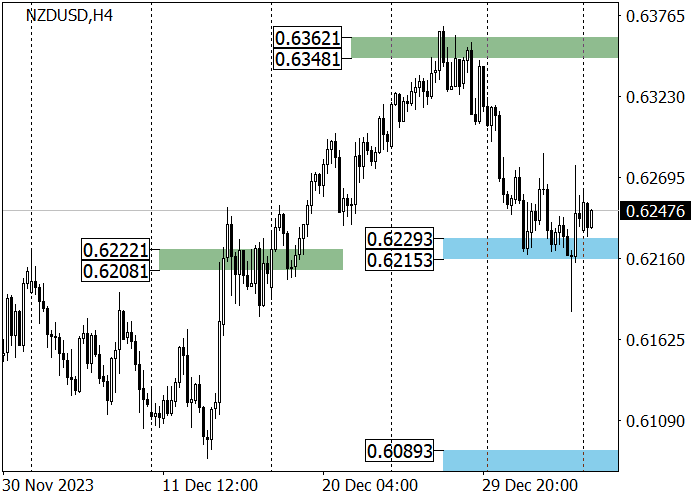

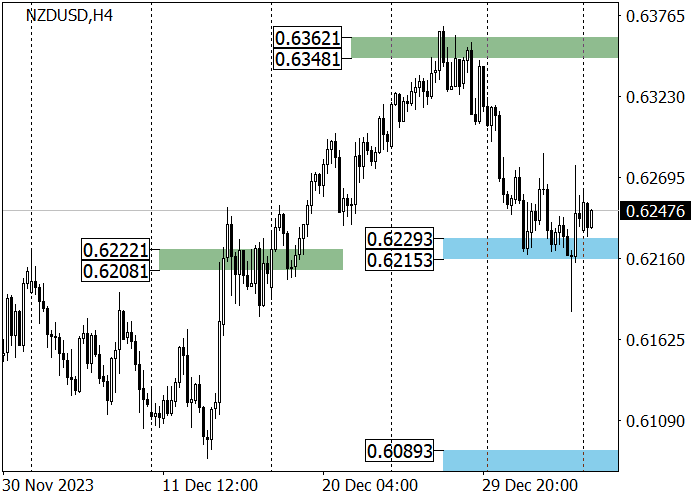

The long-term trend is upward: after reaching the resistance level of 0.6351, a correction began, within which the price dropped to the support level of 0.6205. If held, the upward dynamics will continue to 0.6351.

The medium-term trend is also upward, and last week, the quotes corrected to support levels of 0.6229–0.6215, and when a technical buy signal appears, long positions with the target in zone 4 (0.6362–0.6348) are relevant. If the area 0.6229–0.6215 is overcome, the trend will reverse downwards to the lower target zone 2 (0.6089–0.6075).

Resistance levels: 0.6351, 0.6530.

Support levels: 0.6205, 0.6097, 0.6050.

Trading tips

Long positions may be opened from 0.6205 with the target at 0.6351 and stop loss around 0.6165. Implementation time: 9–12 days.

Short positions may be opened below 0.6165 with the target at 0.6097 and stop loss around 0.6196.

Hot

No comment on record. Start new comment.