Current trend

Against the stabilization of the American dollar, the USD/JPY pair is correcting at 144.42, despite the positive Japanese macroeconomic statistics.

Thus, December service PMI increased from 50.8 points to 51.5 points, corresponding to the autumn parameters, and the household confidence indicator increased from 36.1 points to 37.2 points, the highest since December 2022. Tomorrow, the November household spending indicator will be published, which is expected to rise by 0.2% MoM, driving a correction from –2.5% to –2.3% YoY, and the December core consumer price indicator in Tokyo, reflecting the dynamics of inflation throughout the country, which may drop from 2.3% to 2.1%.

The US currency reached 102.100 in USDX due to stable macroeconomic data: average hourly wages rose 0.4% in December, exceeding preliminary estimates of 0.3%, and compared with the same period last year, the increase was 4.1% against 4.0% earlier. Nonfarm Payrolls reached 216.0K compared to 173.0K in the previous period, and in the private sector – 164.0K, higher than 136.0K previously.

Support and resistance

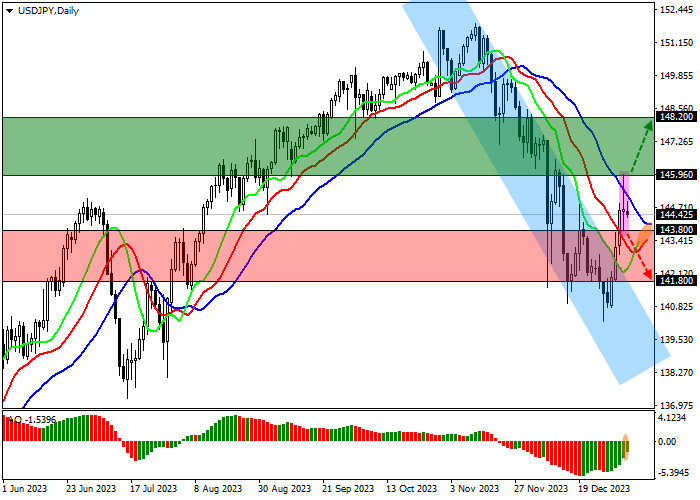

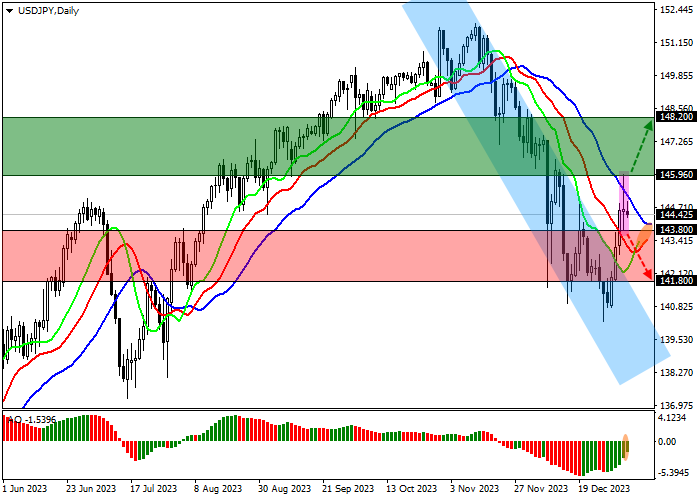

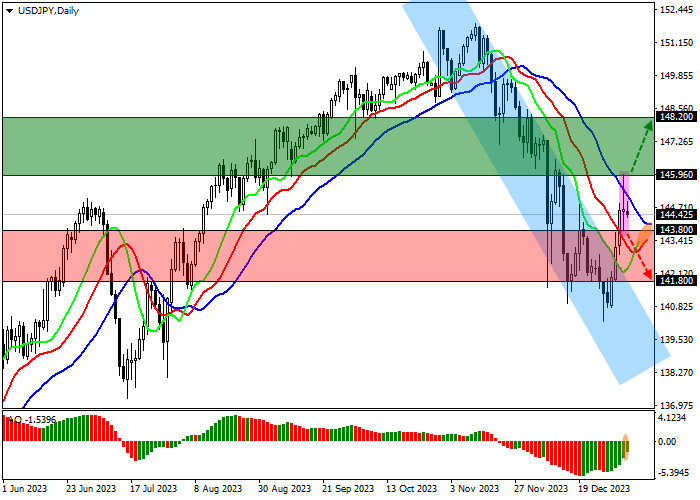

A Volume Candle candlestick analysis pattern has formed on the daily chart, and after the price leaves its boundaries, the movement will continue in the corresponding direction.

Technical indicators are weakening the sell signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO histogram is forming ascending bars in the sell zone.

Resistance levels: 145.96, 148.20.

Support levels: 143.80, 141.80.

Trading tips

Long positions may be opened after the price rises and consolidates above 145.96 with the target at 148.20. Stop loss – 144.50. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 143.80 with the target at 141.80. Stop loss – 144.50.

Hot

No comment on record. Start new comment.