Current trend

The EUR/USD pair is moving in a corrective trend, trading at 1.0937: market activity remains low as traders are in no hurry to open new positions ahead of the publication of European inflation statistics and the US labor market report for December.

Current forecasts suggest a moderate rise in the EU consumer price index from 2.4% to 3.0%, which could prompt European Central Bank (ECB) officials to pause the expected start of an interest rate cut cycle. The German CPI rose to 3.7% from 3.2% previously, which, harmonized with EU standards, showed a significant increase from 2.3% to 3.8%. The EU services PMI was 48.8 points, almost unchanged from 48.7 points a month earlier, thanks to indicators from France and Germany, which adjusted from 45.4 points to 45.7 points and from 49.6 points to 49.3 points, respectively. Thus, the composite PMI from S&P Global in the EU amounted to 47.6 points, the same as in November, reflecting the current poor dynamics of the region’s currency.

The American dollar is trading at 102.100 in USDX, up slightly yesterday on the back of positive labor market data for December: nonfarm payrolls from Automatic Data Processing (ADP) increased from 101.0K to 164.0K, and initial jobless claims amounted to 202.0K, lower than 220.0K last week, adjusting the total jobless claims from 1.886M to 1.855M and supporting the national currency.

Support and resistance

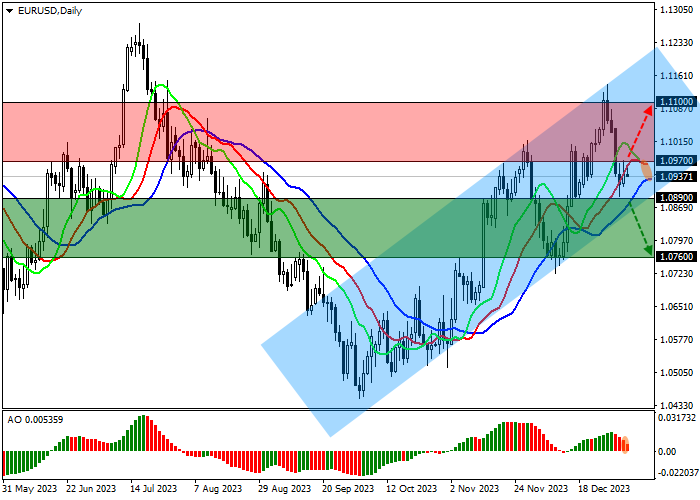

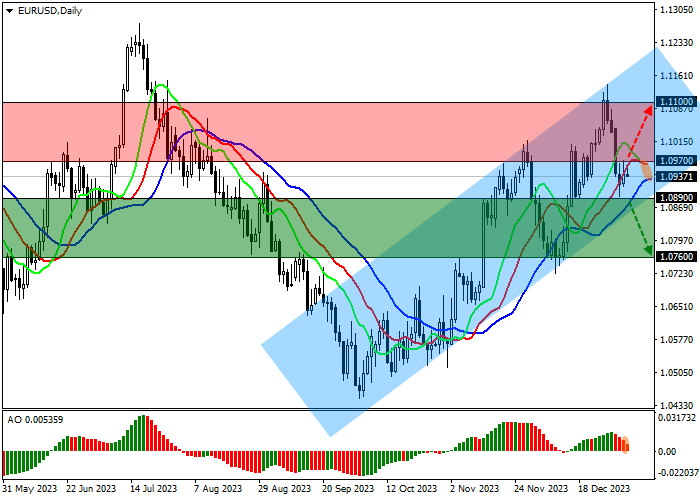

On the daily chart, the trading instrument is correcting within a narrow ascending channel with dynamic boundaries of 1.1080–1.0860.

Technical indicators are weakening the global buy signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO histogram is forming corrective bars, declining in the buy zone.

Resistance levels: 1.0970, 1.1100.

Support levels: 1.0890, 1.0760.

Trading tips

Short positions may be opened after the price declines and consolidates below 1.0890 with the target at 1.0760. Stop loss is around 1.0950. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 1.0970 with the target around 1.1100. Stop loss – 1.0920.

Hot

No comment on record. Start new comment.