Current trend

During the Asian session, the GBP/USD pair remains near 1.2680, demonstrating an uncertain tendency to regain the positions lost at the beginning of the week against positive macroeconomic statistics from the UK.

Thus, December services PMI increased from 50.9 points to 53.4 points, reaching a July high, as a result of which the composite PMI amounted to 52.1 points after 50.7 points earlier, renewing a six-month record. The situation in the banking sector also improved, where the volume of consumer lending in November increased from 1.411B pounds to 2.005B pounds, and the number of approved mortgage loans – from 47.89K to 50.07K, while the markets expected an increase only to 48.50K

Yesterday, the American dollar strengthened to 102.200 in USDX on the back of labor market data: nonfarm payrolls are beginning to approach the stable levels of the summer, rising by 164.0K in December from 101.0K previously, and initial jobless claims adjusted from 220.0K to 202.0, reducing the total claims from 1.886M to 1.855M.

The focus of investors’ attention on Friday will be British statistics on house price dynamics from Halifax, as well as data on December construction PMI. In the US, the December labor market report is expected to be published during the day, which may influence future decisions by the US Federal Reserve on monetary policy: forecasts suggest a slowdown in the growth of new jobs outside the agricultural sector from 199.0K to 170.0K, the unemployment rate could adjust from 3.7% to 3.8%, and average hourly wages – from 4% to 3.9%.

Support and resistance

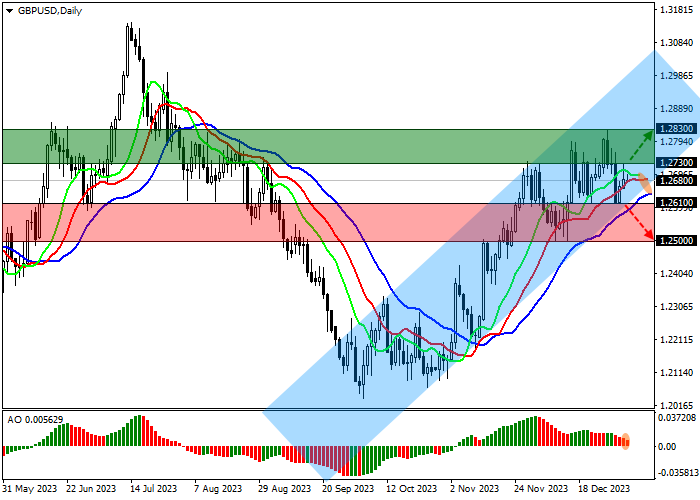

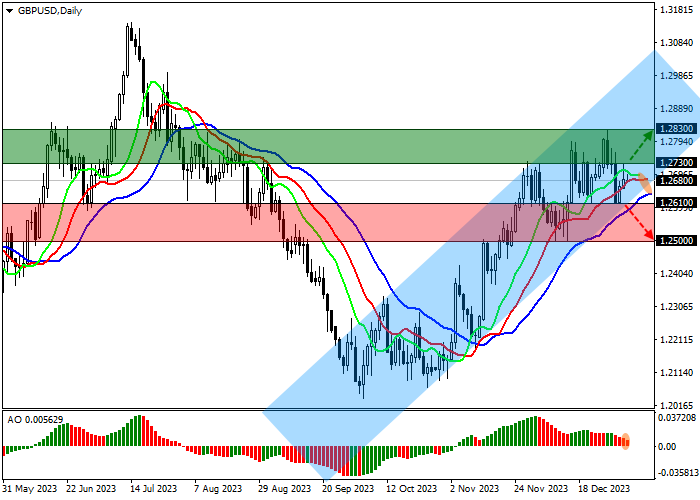

On the daily chart, the currency pair continues to correct, holding just above the support line of the local ascending channel with dynamic boundaries of 1.2850–1.2550.

Technical indicators continue to maintain a buy signal, which is quite stable, despite the local slowdown. Fast EMAs on the Alligator indicator continue to be above the signal line, and the AO histogram forms new corrective bars, being in the buy zone.

Support levels: 1.2610, 1.2500.

Resistance levels: 1.2730, 1.2830.

Hot

No comment on record. Start new comment.