Current trend

The USD/TRY pair is developing rapid upward dynamics, testing 29.8500 for a breakout. The Turkish currency fell to a historic low after Minister of Labour and Social Security Vedat Isikhan announced an increase in the monthly low to 17.002 thousand liras this year, which exceeds the July figure by 49.0% and the January figure by 100.0%. Wages will be indexed to almost seven million residents of the country; however, according to experts, this will become a catalyst for accelerating already high inflation: in December 2023, the Consumer Price Index increased by 2.93% to 64.77%, reaching an annual peak. According to the forecast of the Central Bank of the Republic of Türkiye, the highest value will occur in May 2024 and will be more than 70.0%, and then stabilize at 36.0% at the end of next year.

The instrument, as before, is supported by technical factors. In addition, the US dollar reacts to the publication of macroeconomic statistics. The day before, a December report from Automatic Data Processing (ADP) reflected an increase in Employment Change from 101.0 thousand to 164.0 thousand, exceeding the forecast of 115.0 thousand. In addition, Continuing Jobless Claims for the week ended December 22 decreased from 1.886 million to 1.855 million, while the markets were counting on 1.882 million, and Initial Jobless Claims (for the week ended December 29) went down from 220.0 thousand to 202.0 thousand with expectations at around 216.0 thousand.

Today, investors will pay attention to the December labor market report, which may have a significant impact on the US Federal Reserve's rhetoric at its upcoming meetings. Currently, it is expected that growth in Nonfarm Payrolls will slow down from 199.0 thousand to 170.0 thousand, and the Unemployment Rate will increase from 3.7% to 3.8%. In turn, the Average Hourly Earnings may adjust from 0.4% to 0.3% on a monthly basis and from 4.0% to 3.9% on an annual basis.

Support and resistance

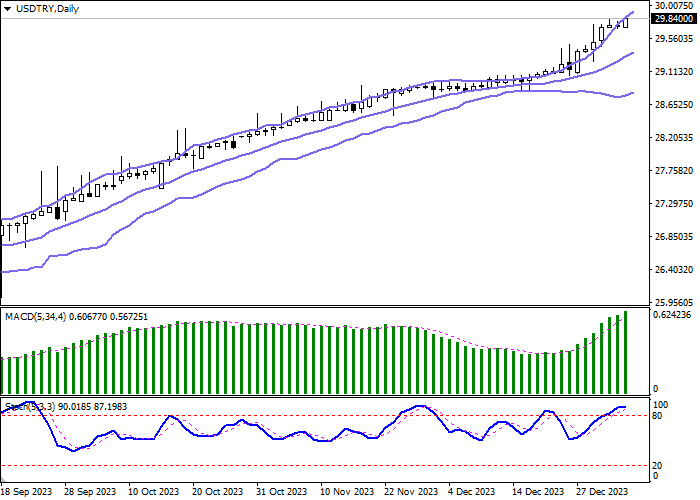

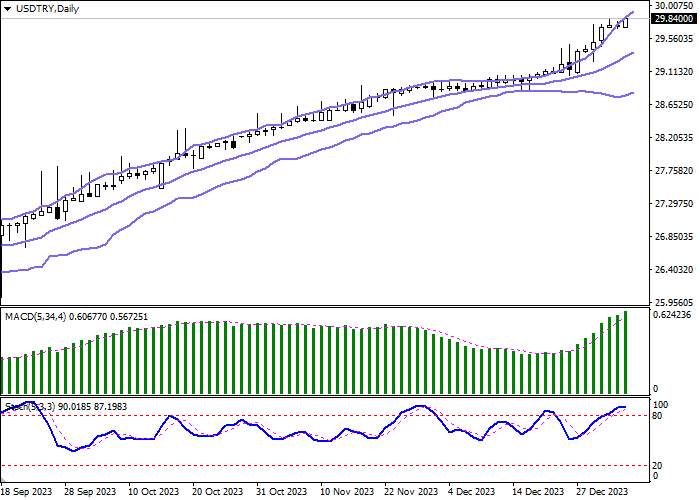

Bollinger Bands on the daily chart show a steady increase. The price range expands, freeing a path to new record highs for the "bulls". MACD grows, preserving a stable buy signal (located above the signal line). Stochastic approached its highs and reversed into a horizontal plane, indicating the risks of the US currency being overbought in the ultra-short term.

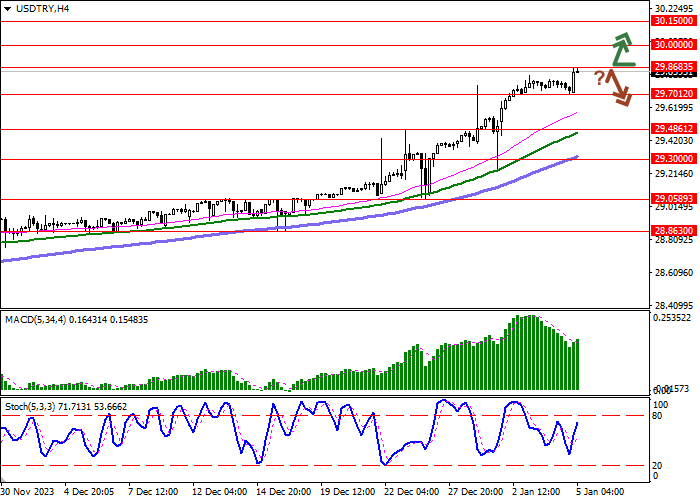

Resistance levels: 29.8683, 30.0000, 30.1500, 30.3000.

Support levels: 29.7012, 29.4861, 29.3000, 29.0589.

Trading tips

Long positions can be opened after a breakout of 29.8683 with the target of 30.1500. Stop-loss — 29.7012. Implementation time: 2-3 days.

A rebound from 29.8683 as from resistance, followed by a breakdown of 29.7012 may become a signal for opening of new short positions with the target at 29.4861. Stop-loss — 29.8683.

Hot

No comment on record. Start new comment.