Current trend

The USD/CAD pair shows a slight increase, testing 1.3360 for a breakout and updating local highs from December 21.

Trading participants are in no hurry to open new positions ahead of today's publication of the December report on the US labor market. Forecasts assume a slowdown in Nonfarm Payrolls from 199.0 thousand to 170.0 thousand. At the same time, the Unemployment Rate is expected to adjust from 3.7% to 3.8%, and the Average Hourly Earnings – from 4.0% to 3.9%. At the moment, investors are evaluating a report from Automatic Data Processing (ADP), which reflected an increase in Employment Change from 101.0 thousand to 164.0 thousand, while analysts expected 115.0 thousand. In turn, Initial Jobless Claims for the week ended December 29 decreased from 220.0 thousand to 202.0 thousand, with a forecast of 216.0 thousand. The American currency is receiving support after the publication of the minutes of the meeting of the Federal Open Market Committee of the US Federal Reserve (FOMC), according to which officials may begin a cycle of interest rate cuts by the end of this year, while pointing to continued uncertainty in the economy.

A report on the Canadian labor market will also be presented today. It is expected that Net Change in Employment in December will add 13.5 thousand after an increase of 24.9 thousand in the previous month, while the Unemployment Rate may adjust from 5.8% to 5.9%, and the Average Hourly Wages may remain unchanged at around 5.0%.

Support and resistance

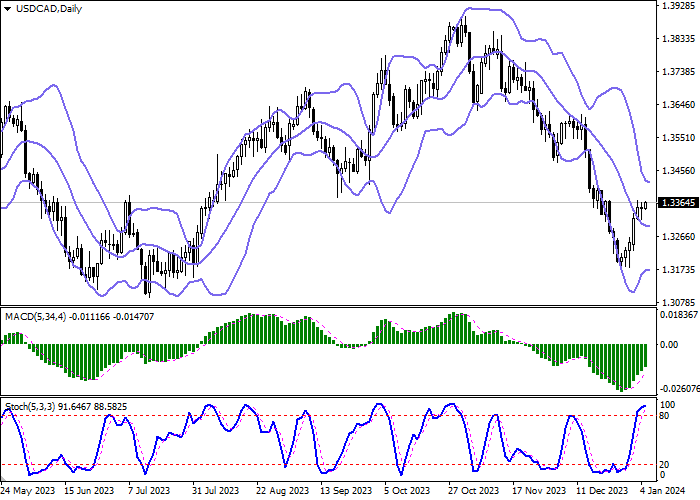

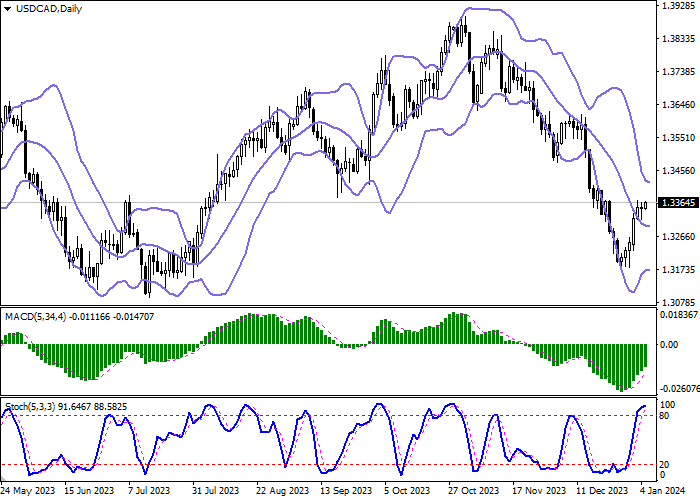

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is slightly narrowed, being spacious enough for the current activity level in the market. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic maintains a confident upward direction, located in close proximity to its highs, which indicates the risks of overbought US currency in the ultra-short term.

Resistance levels: 1.3400, 1.3450, 1.3500, 1.3550.

Support levels: 1.3350, 1.3300, 1 3250, 1.3200.

Trading tips

Long positions can be opened after a breakout of 1.3400 with the target of 1.3500. Stop-loss — 1.3350. Implementation time: 2-3 days.

The return of a "bearish" trend with the breakdown of 1.3350 may become a signal for new short positions with the target at 1.3250. Stop-loss — 1.3400.

Hot

No comment on record. Start new comment.