Current trend

Prices for benchmark Brent Crude Oil are adjusted at 79.00: the quotes are reversing, starting the year with positive dynamics, which are developing against reports of the seizure of one of the largest fields in Libya, Al-Sharara, which produces about 300.0K barrels per day, as a result why his work was suspended.

The asset is also supported by the unchanged position of OPEC, confirmed during consultations yesterday: its members and countries cooperating with the organization fully confirmed their commitment to general principles and agreed to continue reducing oil production in 2024. Thus, excluding Angola, which withdrew from the agreement, the official quota for oil production amounted to 39.4M barrels per day, and considering the voluntary reductions of some participants – 37.8M barrels per day. For the first quarter, the limits will be slightly lower, reaching 36.1M barrels per day.

As for the local demand for oil contracts from investors, there is a serious increase in trading volumes: the volume of positions in WTI Crude Oil on the Chicago Mercantile Exchange (CME Group) on January 3 amounted to 814.4K contracts, much higher than on the last day of 2023 (489.2K).

Support and resistance

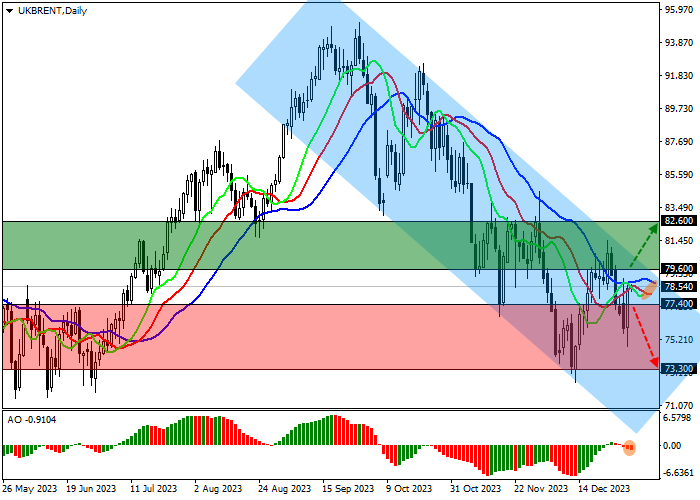

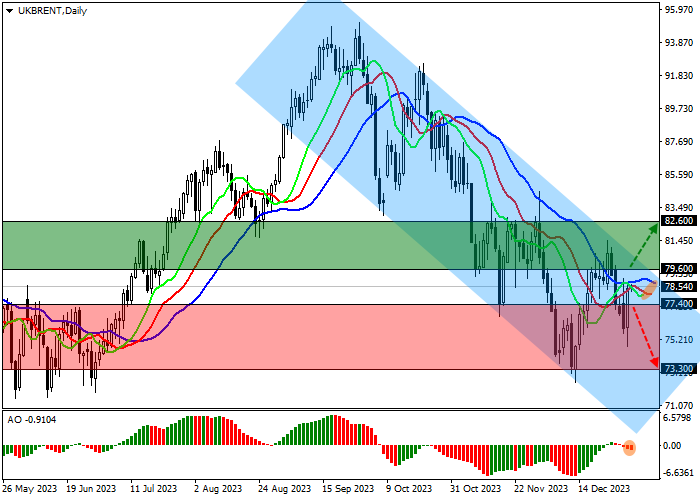

On the daily chart, the trading instrument is moving in a global downward trend, holding in a local channel with boundaries of 80.00–74.00, preparing to retest the resistance level.

Technical indicators are weakening the global sell signal: fast EMAs of the Alligator indicator are approaching the signal line, and the AO histogram is forming corrective bars in the sales zone.

Resistance levels: 79.60, 82.60.

Support levels: 77.40, 73.30.

Trading tips

Long positions may be opened after the price rises and consolidates above 79.60 with the target at 82.60. Stop loss – 79.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 77.40 with the target at 73.30. Stop loss – 79.00.

Hot

No comment on record. Start new comment.