Current trend

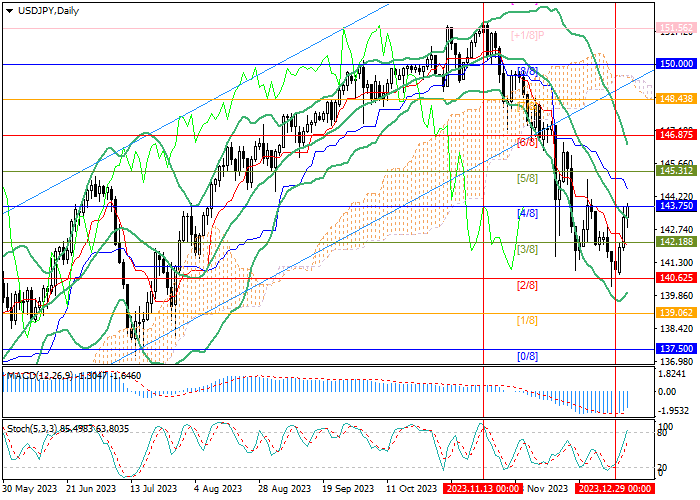

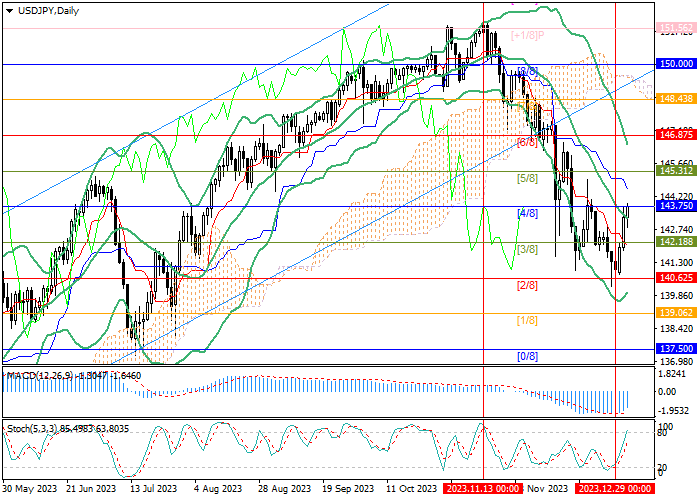

This week, the USD/JPY pair is correcting upwards to a medium-term downtrend and is now testing the 143.75 mark (Murrey level [4/8]): prices are supported by the release of weak data on business activity in Japanese industry and the release of the minutes of the December meeting of the US Federal Reserve.

The Japanese Manufacturing PMI fell from 48.3 points to 47.9 points in December, which turned out to be better than the projected 47.7 points, but the national industry is declining due to lower demand for its products from external consumers from China, the United States and the Eurozone. At the same time, the US currency is receiving support after the publication of the minutes of the meeting of the Federal Open Market Committee (FOMC), according to which American officials hope for the beginning of a rate cut by the end of 2024, but do not consider the probability of this guaranteed. Moreover, some members of the American regulator allow rates to remain at current high levels or even increase further, causing doubts in the market about the possibility of a threefold reduction in the cost of borrowing this year and putting pressure on assets alternative to the dollar.

The growth of the USD/JPY pair continues today, but is restrained by the latest comments of the head of the Bank of Japan Kazuo Ueda, who expressed hope for steady inflation and wage growth this year.

Support and resistance

The instrument is testing the 143.75 mark (Murrey level [4/8]), consolidating above which will allow quotes to continue rising to 145.31 (Murrey level [5/8]) and 146.87 (Murrey level [6/8]). The key mark for the "bears" is 142.18 (Murrey level [3/8]), after the breakdown of which the decline can resume to 140.62 (Murrey level [2/8]), 139.06 (Murrey level [1/8]) and 137.50 (Murrey level [0/8]).

Technical indicators do not give a clear signal: Bollinger Bands are pointing down, but Stochastic has reversed up, and MACD is decreasing in the negative zone.

Resistance levels: 143.75, 145.31, 146.87.

Support levels: 142.18, 140.62, 139.06, 137.50.

Trading tips

Long positions can be opened above the 143.75 mark with targets at 145.31, 146.87 and stop-loss around 142.90. Implementation period: 5–7 days.

Short positions should be opened below the level of 142.18 with targets at 140.62, 139.06, 137.50 and stop-loss around 143.40.

Hot

No comment on record. Start new comment.