Current trend

This week, the GBP/USD pair had ambiguous dynamics: at first, the quotes fell to the area of 1.2610 but then regained the lost positions.

The strengthening of the pound is supported by the publication of positive data on business activity and lending in the UK: in December, the Services PMI rose from 50.9 points to 53.4 points, exceeding the 52.7 points predicted by experts, and the Composite PMI — from 50.7 points to 52.1 points with preliminary estimates of 51.7 points, as entrepreneurs expect a significant slowdown in inflation and growth demand from households during the year. In turn, the volume of consumer lending in November increased to a seven-year high of 2.005 billion pounds, and mortgage lending decreased by 0.04 billion pounds, but the number of approved mortgage loans reached 50.07 thousand, indicating the recovery of the UK construction market.

Nevertheless, positive statistics offset the negative effect after the publication of the minutes of the last meeting of the US Federal Reserve, in which American officials expressed hope for launching a cycle of rate cuts by the end of the year, but noted that such actions are not guaranteed, moreover, it is not excluded that the interest rates will remain at current high levels or even their further growth.

Support and resistance

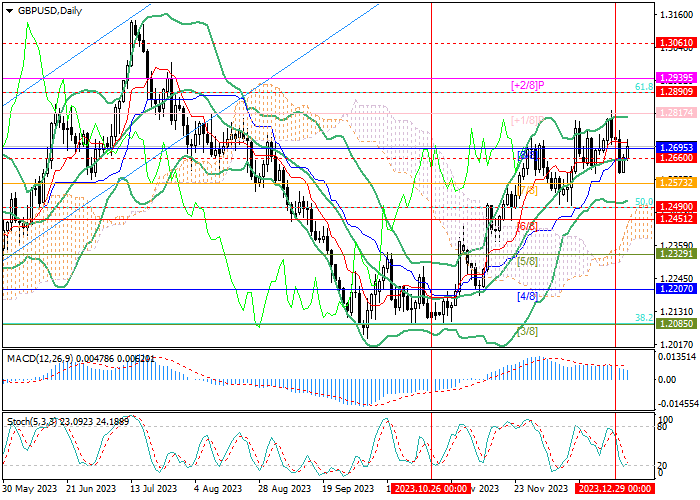

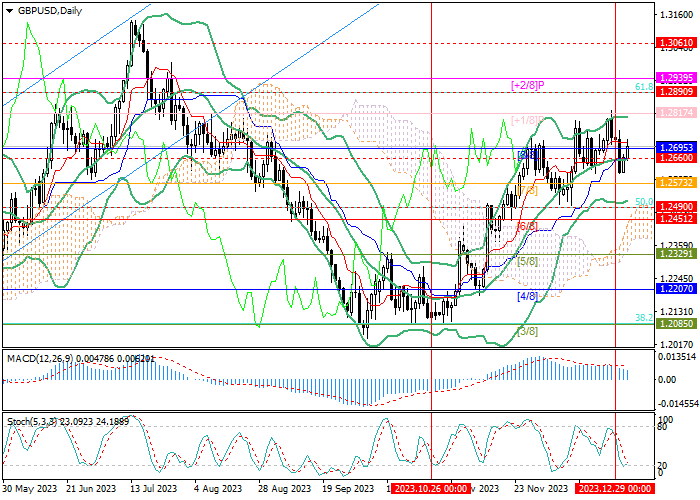

The instrument is trading within a medium-term uptrend: the price has consolidated above the central line of Bollinger Bands (1.2660) and is currently testing the 1.2695 mark (Murrey level [8/8]), after which growth can continue towards the targets of 1.2817 (Murrey level [ 1/8], the upper line of Bollinger Bands) and 1.2890 (61.8% Fibonacci retracement). The key for the "bears" is the 1.2490 mark (50.0% Fibonacci retracement), the breakdown of which will allow the quotes to decrease to 1.2329 (Murrey level [5/8]) and 1.2207 (Murrey level [4/8]).

Technical indicators do not give a clear signal: Bollinger Bands unfold horizontally after growth, MACD is stable in the positive zone, and Stochastic is pointing downwards, but approaches the oversold zone, which is fraught with a reversal.

Resistance levels: 1.2695, 1.2817, 1.2890.

Support levels: 1.2490, 1.2329, 1.2207.

Trading tips

Long positions can be opened above 1.2695 with targets at 1.2817, 1.2890 and stop-loss around 1.2610. Implementation period: 5–7 days.

Short positions should be opened below the level of 1.2490 with targets at 1.2329, 1.2207 and stop-loss at 1.2590.

Hot

No comment on record. Start new comment.