Current trend

Shares of PayPal Holdings Inc., an American debit payment system, are corrected at 58.00.

In the United States, the Buy Now, Pay Later installment payment program is becoming increasingly popular, which is implemented by several services, including PayPal Holdings Inc. Based on the holiday period, Americans’ short-term debt increased by more than 23.0%, adding to the existing 1.0T dollars in credit card debt, according to statistics.

Despite the increase in the number of transactions, experts do not expect growth in the company’s shares, and analysts at Bank of America Securities Inc. downgraded their rating from Buy to Neutral and their target price from 77.0 dollars to 66.0 dollars, and poor revenue of 7.88B dollars in the new quarter, which will be reported on January 30, may become one of the reasons for the fall in quotes. However, earnings per share could be 1.36 dollars, up slightly from 1.30 dollars previously.

Support and resistance

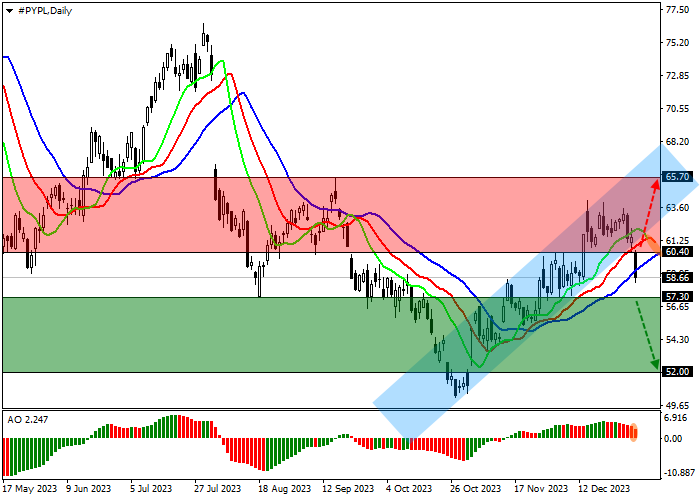

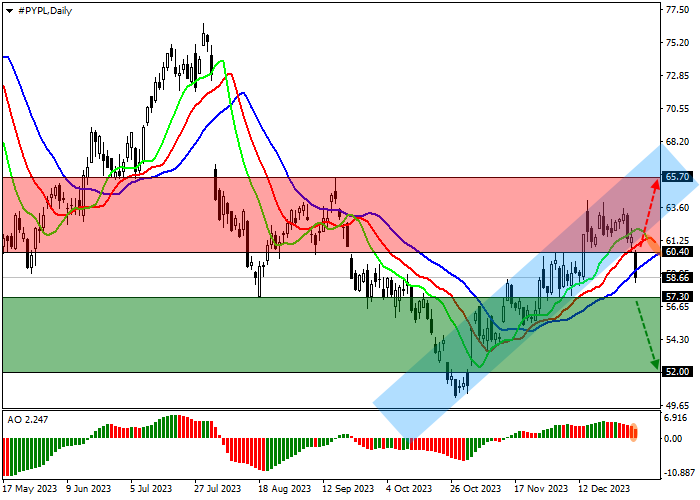

The corrective trend continues on the daily chart, and yesterday, the trading instrument left the local ascending channel with dynamic boundaries of 64.00–60.00.

Technical indicators hold a buy signal, reflecting the possibility of an imminent reversal: the EMA fluctuation range of the Alligator indicator is narrowing, and the AO histogram is forming corrective bars in the buy zone.

Resistance levels: 60.40, 65.70.

Support levels: 57.30, 52.00.

Trading tips

Short positions may be opened after the price declines and consolidates below 57.30 with the target at 52.00 and stop loss 60.00. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 60.40 with the target at 65.70. Stop loss is below 58.00.

Hot

No comment on record. Start new comment.