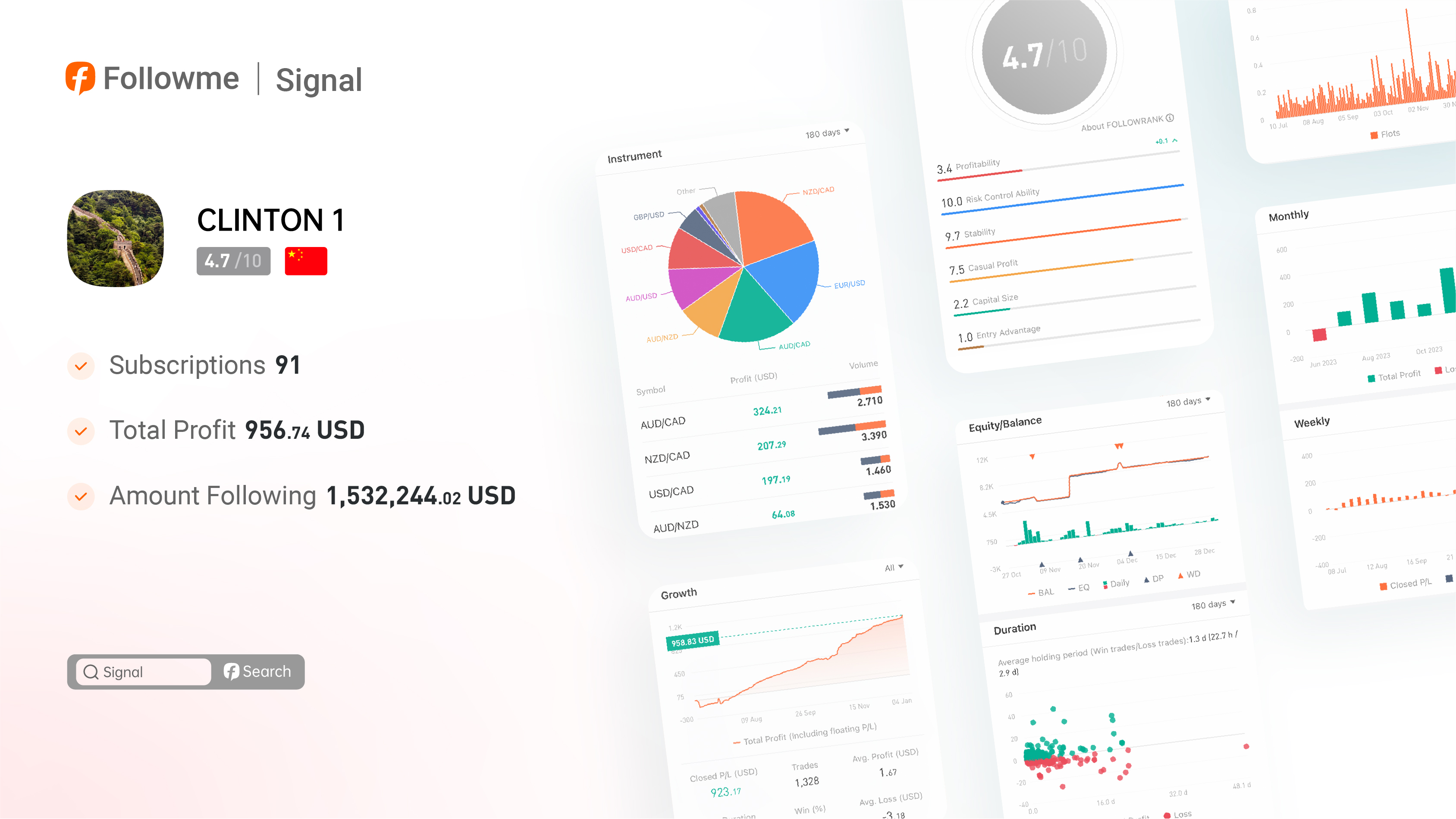

Signal | Follower equity reaches a staggering $1.53 million

𝙉𝙞𝙘𝙠𝙣𝙖𝙢𝙚: @CLINTON 1

𝙉𝙞𝙘𝙠𝙣𝙖𝙢𝙚: @CLINTON 1

Region: Taiwan

𝘽𝙧𝙤𝙠𝙚𝙧: #Tickmill Global #

𝘽𝙧𝙞𝙚𝙛 𝙘𝙤𝙢𝙢𝙚𝙣𝙩:

Today, let's take a look at the first signal analysis of 2024—@CLINTON 1. This can be considered a renowned signal source, with a follower equity reaching a staggering $1.53 million.

Trading Preferences

Excluding the GBP/USD with its low trading volume and the complex cross pair EUR/CAD, this is a trading system that focuses on six currency pairs.

Let's start with the AUD/CAD, NZD/CAD, and AUD/NZD among the six currency pairs. These three pairs are familiar to us, and skilled traders like the renowned WAKAWAKA excel in trading them. The three-pair system allows for hedging, and during market pullbacks, the strategy involves adding to positions despite initial losses.

Among the three pairs, NZD/CAD stands out with the highest profitability and lowest drawdown—a true gem in the world of currencies. On the other hand, while AUD/NZD may appear to have the smallest fluctuations normally and the economic differences between the two countries are not significant, the currency pair often experiences unpredictable swings, making it the prime culprit behind the signal "东北路" blow-up last year.

Next, we have USD/CAD and AUD/USD, which are generally stable. However, when faced with global inflation or deflation, they can be as unpredictable as a rhino hiding in the grass, ready to surprise you at any moment.

Lastly, we have EUR/USD, which has seen increased volatility after Brexit. Its advantages include ample liquidity and relatively low spreads, making it a popular choice in many direct currency systems.

When it comes to currency pair selection, @CLINTON 1 balances returns and risks to make a relatively reasonable choice.

Returns

Over 28 weeks, this signal has generated a profit of $917 USD, resulting in a monthly return of 3%. Although it falls slightly short of the stated "5%" in the strategy description, considering that it is a free subscription account, this signal is still a very good choice.

Risks

Currently, the signal's maximum drawdown stands at a mere 2.35%—an impressive feat! However, the strategy does not explicitly outline a maximum hard stop loss. Additionally, since October last year, approximately 80% of the time has been spent in a floating loss state. For a system that incorporates hedging and martingale techniques, this falls short of meeting expectations.

In summary, this system demonstrates promising potential for generating positive returns. With effective management of factors such as hard stop losses and single currency optimization, we believe it has the potential to maintain a strong performance.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.