Current trend

During the Asian session, the USD/CHF pair retreats from record lows of January 2015, testing the level of 0.8445 for a breakout.

Positive dynamics are developing against technical factors, as traders prefer to close some of their short positions ahead of the release of key American macroeconomic statistics. Thus, tomorrow, the minutes of the December meeting of the US Federal Reserve will be published: investors hope for confirmation of assumptions regarding monetary easing in the first half of the year, and about 70.0% of analysts expect the first interest rate cut by 25 basis points during the March meeting. During the week, experts expect December labor market data, suggesting a slowdown in average hourly wages from 4.0% to 3.9% and an increase in the unemployment rate from 3.7% to 3.8%, while nonfarm payrolls may decrease from 199.0K to 163.0K. In addition, December statistics on the dynamics of consumer inflation in the EU will be published, influencing the European Central Bank (ECB) decisions.

Analysts are monitoring the rhetoric of the Swiss National Bank (SNB), which adheres to a tighter monetary policy against other regulators. Earlier, the department’s manager, Thomas Jordan, noted that officials are ready to adjust the measures taken if necessary. Meanwhile, the financial authorities slightly reduced foreign currency sales in the third quarter of 2023.

Support and resistance

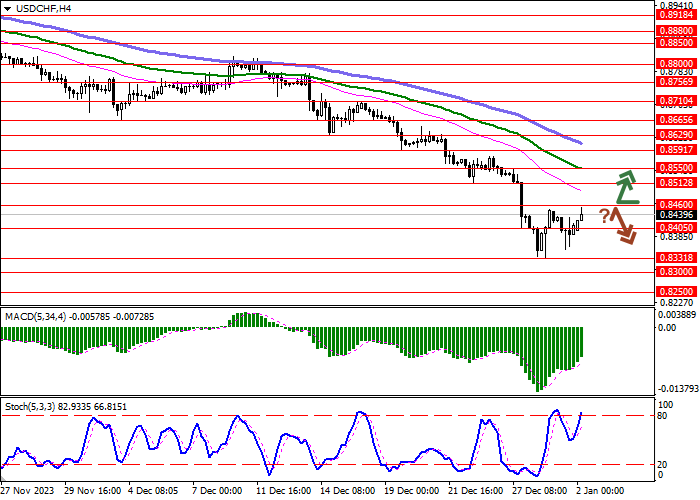

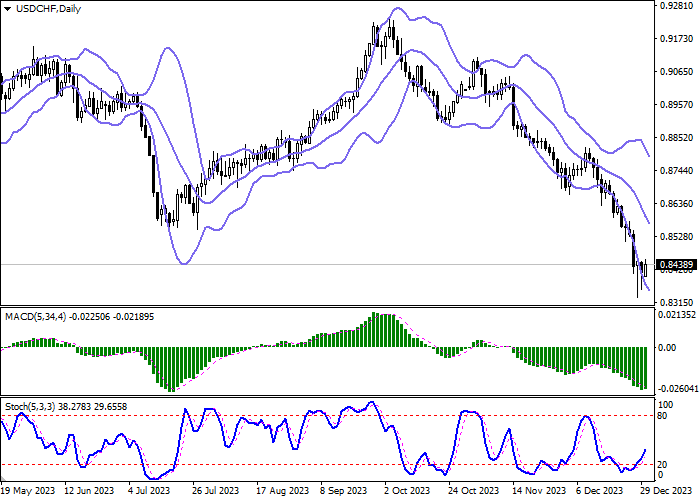

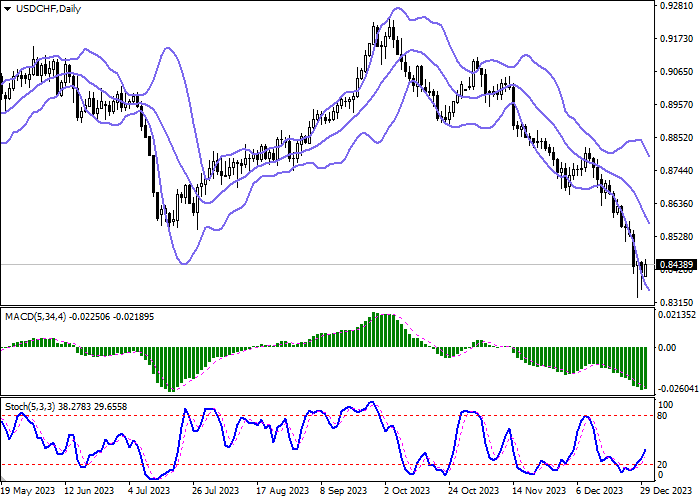

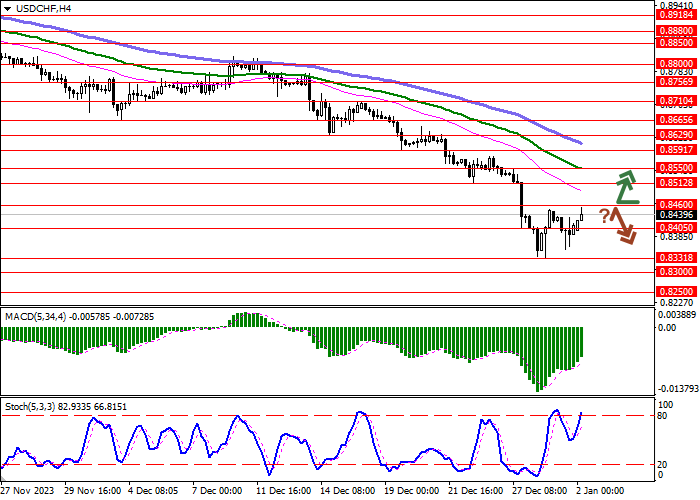

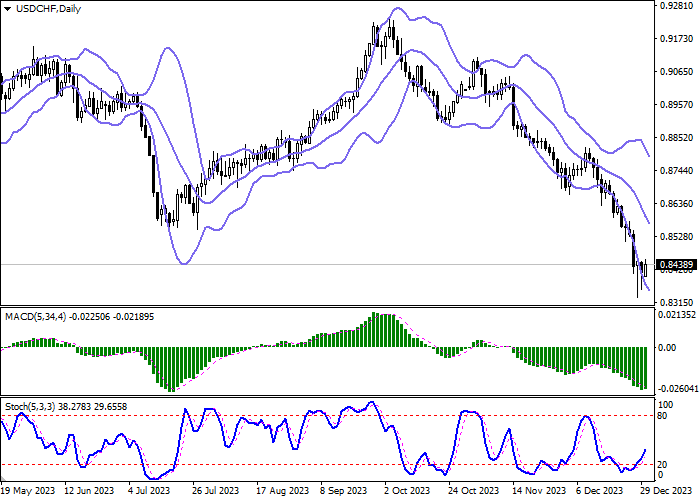

On the daily chart, Bollinger Bands steadily decline: the price range changes slightly, remaining quite spacious for the current market activity level. The MACD indicator tries to reverse upwards, maintaining a sell signal (the histogram is below the signal line). Stochastic is quickly retreating from the lows signaling that the American dollar was oversold in the ultra-short term.

Resistance levels: 0.8460, 0.8512, 0.8550, 0.8591.

Support levels: 0.8405, 0.8331, 0.8300, 0.8250.

Trading tips

Long positions may be opened after a breakout of 0.8460 with the target at 0.8550. Stop loss – 0.8405. Implementation time: 2–3 days.

Short positions may be opened after a rebound from 0.8460 and a breakdown of 0.8405 with the target at 0.8300. Stop loss – 0.8460.

Hot

No comment on record. Start new comment.