Current trend

The AUD/USD pair is showing moderate growth, correcting after a two-day decline at the end of last week, when the instrument retreated from local highs dated July 14, 2023.

As before, the instrument is supported by growing expectations regarding a change in the vector of monetary policy by the US Federal Reserve at the beginning of 2024. About 70.0% of analysts suggest that interest rates could be cut by 25 basis points as early as March. Additional pressure on the US currency was exerted by December data on Chicago PMI, presented last Friday: the indicator dropped from 55.8 points to 46.9 points, with a forecast of 51.0 points.

The Australian dollar is strengthening amid the publication of December statistics on business activity in China. The Caixin Manufacturing PMI corrected from 50.7 points to 50.8 points, while analysts expected a decrease to 50.4 points, and the Non-Manufacturing PMI strengthened from 50.2 points to 50.4 points, with expectations at 50.5 points. In turn, the Australian Manufacturing PMI from S&P Global fell from 47.8 points to 47.6 points.

Tomorrow, the US will present December statistics on the Manufacturing PMI from the Institute for Supply Management (ISM) and the minutes of the latest meeting of the US Federal Reserve, and in Australia, data on the Services PMI from the Commonwealth Bank will be released.

Support and resistance

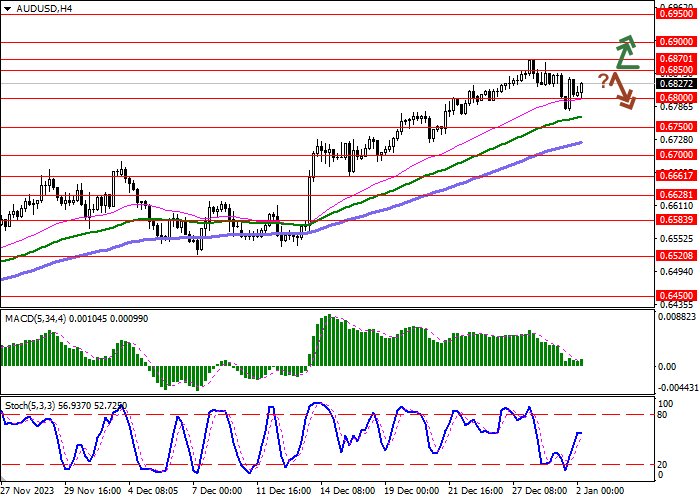

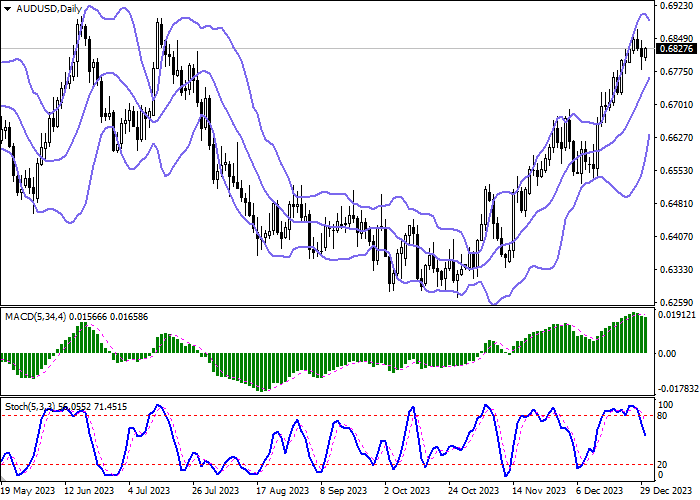

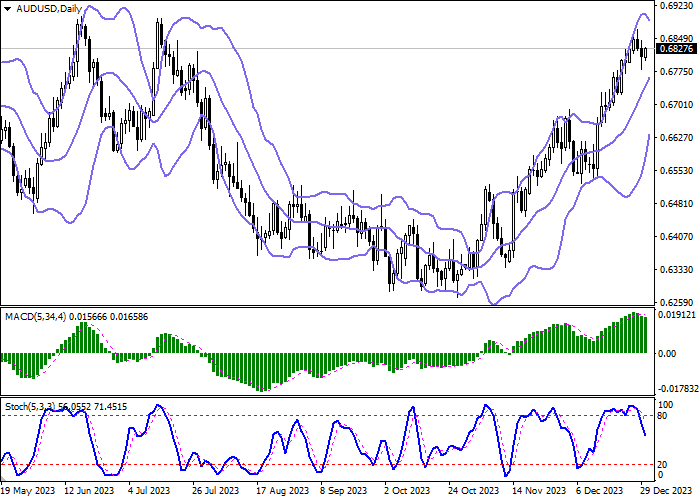

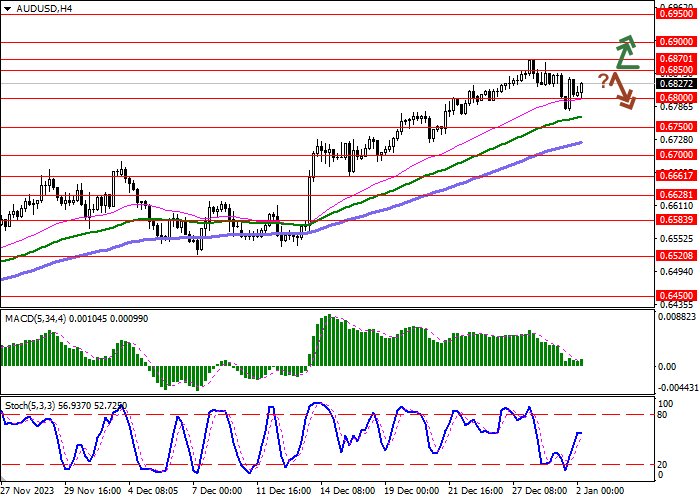

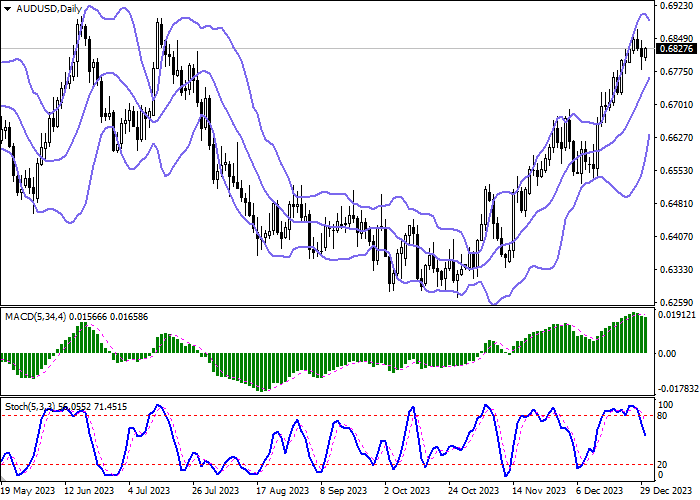

Bollinger Bands on the daily chart show a steady increase. The price range is narrowed, being spacious enough for the current activity level in the market. MACD is reversing downwards forming a new sell signal (trying to consolidate below the zero level). Stochastic is showing a more active decline being located in the middle of its area.

Resistance levels: 0.6850, 0.6870, 0.6900, 0.6950.

Support levels: 0.6800, 0.6750, 0.6700, 0.6661.

Trading tips

Long positions can be opened after a breakout of 0.6850 with the target of 0.6950. Stop-loss — 0.6800. Implementation time: 2-3 days.

A rebound from 0.6850 as from resistance, followed by a breakdown of 0.6800 may become a signal for opening of short positions with the target at 0.6700. Stop-loss — 0.6850.

Hot

No comment on record. Start new comment.