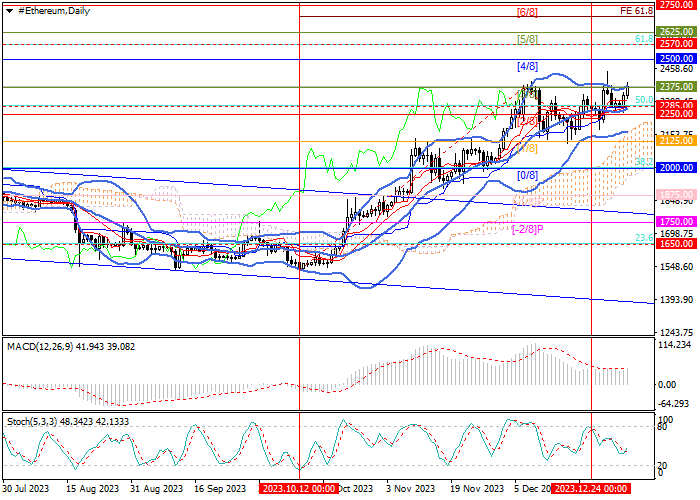

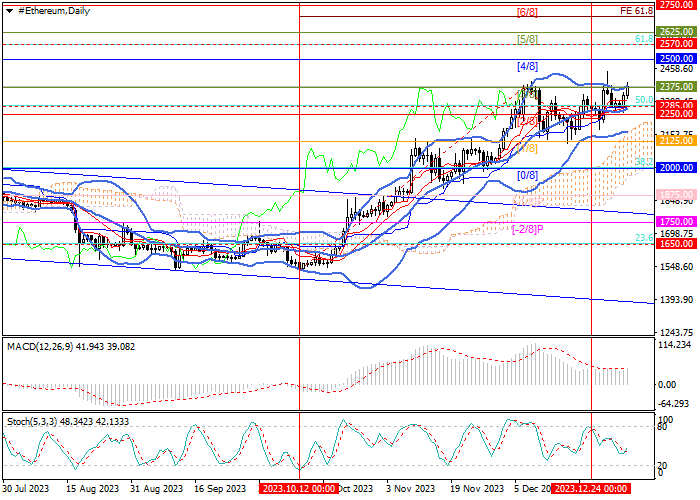

Current trend

The ETH/USD pair is moving within the overall market upward trend but has not yet been able to consolidate above the key “bullish” level 2375.00 (Murrey level [3/8]): last week, the price reached 2444.65 but then corrected to the middle line of Bollinger bands (2285.00). Investors are hoping for soon approval by the US Securities and Exchange Commission (SEC) of the launch of a Bitcoin ETF and maybe a similar instrument based on ETH, against which the quotes have resumed growth. After crossing 2375.00, the positive trend will continue to the area of 2500.00 (Murrey level [4/8]), 2625.00 (Murrey level [5/8]) and 2750.00 (Murrey level [6/8]). In case of a breakdown of 2125.00 (Murrey level [1/8], lower line of Bollinger bands), the downward trend is expected to reverse, and the price will reach the area of 2000.00 (Murrey level [0/8], Fibonacci correction 38.2%) and 1875.00 (Murrey level [–1/8]).

Technical indicators confirm the continuation of the upward trend: Bollinger Bands and Stochastic reverse upwards, the MACD histogram is stable in the positive zone.

Support and resistance

Resistance levels: 2375.00, 2500.00, 2625.00, 2570.00.

Support levels: 2125.00, 2000.00, 1875.00.

Trading tips

Long positions may be opened above 2375.00 with the targets at 2500.00, 2625.00, 2570.00 and stop loss 2285.00. Implementation time: 5–7 days.

Short positions may be opened below 2125.00 with the targets at 2000.00, 1875.00 and stop loss 2215.00.

Hot

No comment on record. Start new comment.