Current trend

At the beginning of the new year, Brent Crude Oil prices resumed growth after declining in the last three sessions.

Positive dynamics are developing with the support of two main factors – the continued disruption of shipping in the Red Sea and the expectation of Chinese economy stimulation. Thus, over the weekend, the Yemeni Houthis once again attacked a Maersk AS container ship and, according to some reports, were able to damage it. Although the US Navy repelled the attempted hijacking of the vessel, the company repeated a 48-hour suspension of the Suez Canal shipping route, raising concerns upon the worsening of the supply problems in the market. According to experts, the tension in the region will continue soon, despite the presence of escort forces, and will prevent oil prices from falling.

According to December data, Chinese manufacturing PMI has been declining for the third month, reaching 49.0 points. Analysts believe that Chinese authorities may introduce additional economic support measures, potentially supporting oil demand in the second world economy.

Support and resistance

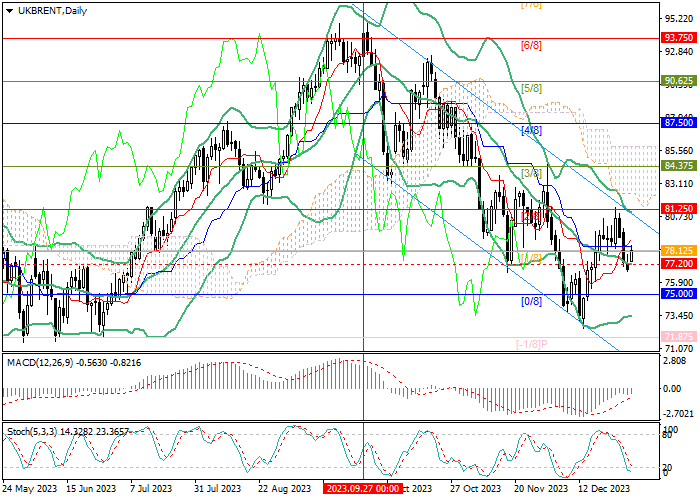

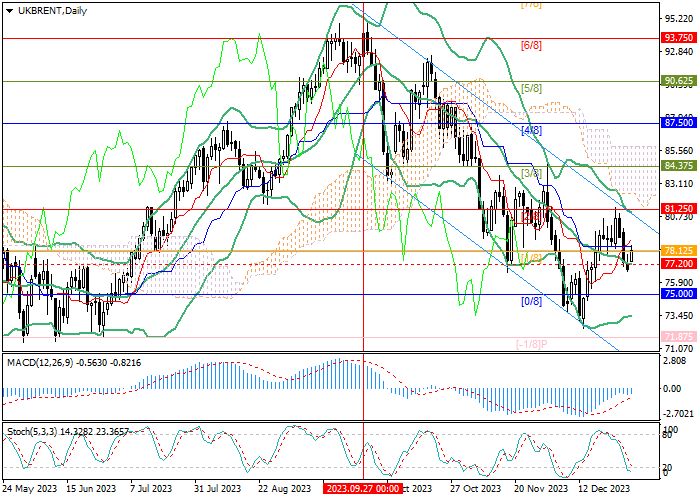

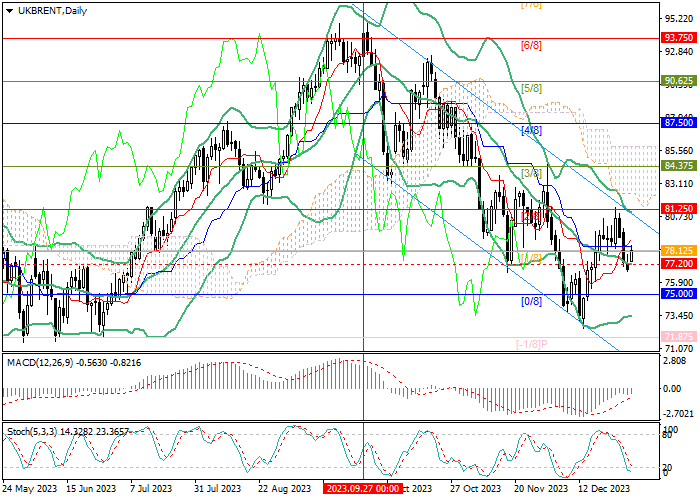

The trading instrument is moving within a long-term downward channel. After consolidation below the middle line of Bollinger bands around 77.20, a decline to the area of 75.00 (Murrey level [0/8]) and 71.87 (Murrey level [–1/8]) is possible. A breakout of 78.12 (Murrey level [1/ 8]) will allow the quotes to reach the area of 81.25 (Murrey level [2/8], upper line of Bollinger Bands) but is unlikely to lead to a change in the current downward trend.

Technical indicators reflect a continuation of the negative movement: Bollinger Bands and Stochastic are directed downwards, and the MACD histogram is stable in the negative zone.

Resistance levels: 78.12, 81.25.

Support levels: 77.20, 75.00, 71.87.

Trading tips

Short positions may be opened below 77.20 or after a reversal at 81.25 with the targets at 75.00, and 71.87 and stop losses at 79.00 and 83.00, respectively. Implementation time: 5–7 days.

Hot

No comment on record. Start new comment.