Current trend

Against the Christmas weekend in Japan, which ends only tomorrow, as well as the stabilization of the American dollar, the USD/JPY pair has recovered slightly after falling last week and is correcting at 141.92.

Today, the dynamics of the asset will depend mainly on the US currency but on Thursday the Japanese manufacturing PMI for December will be published, which is expected to remain at 47.7 points, putting pressure on the asset. The service PMI, which will appear at the end of the week, is projected to remain unchanged from 52.0 points earlier, supporting the yen.

Trading participants are in no hurry to open new positions ahead of Wednesday’s publication of the December minutes of the US Federal Reserve meeting, which may clarify the regulator’s plans regarding the expected reduction in interest rates soon. However, yesterday, the dollar rose almost 1.0 points to reach 101.800 in USDX, although key macroeconomic statistics are in the red zone: the manufacturing PMI fell from 49.4 points to 47.9 points in December. Manufacturing PMI from the Institute for Supply Management (ISM) will be published this evening, and analysts expect it to rise from 46.7 points to 47.1 points, despite forecasts for the manufacturing price index to decline from 49.9 points to 47.5 points. On Friday, investors will focus on labor market statistics: in December, nonfarm payrolls may change from 199.0K to 168.0K, the unemployment rate – from 3.7% to 3.8%, and the average hourly wage – from 4.0% to 3.9%.

Support and resistance

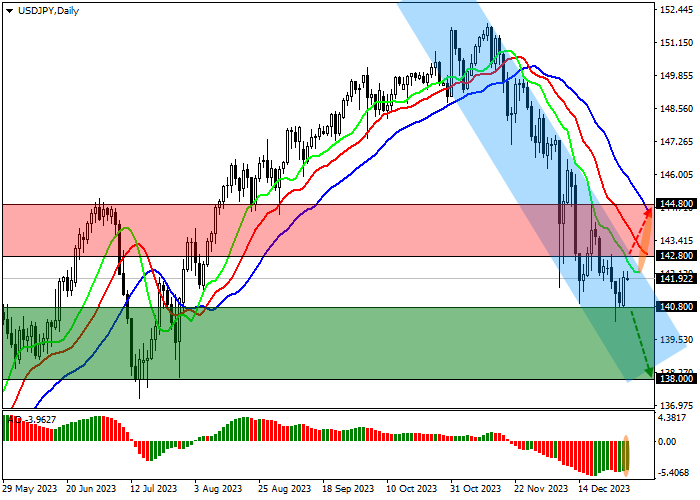

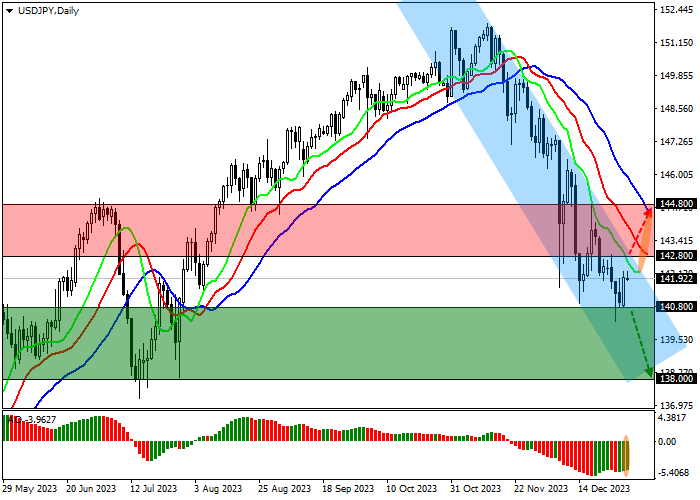

On the daily chart, the downward trend continues within the global channel of 142.80–140.80, and after a minor correction, the price is preparing to continue its decline.

Technical indicators maintain a stable sell signal: fast EMA on the Alligator indicator are significantly below the signal line, and the AO histogram forms downward bars in the sell zone.

Resistance levels: 142.80, 144.80.

Support levels: 140.80, 138.00.

Trading tips

Short positions may be opened after the price declines and consolidates below 140.80 with the target at 138.00. Stop loss – 141.50. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 142.80 with the target at 144.80. Stop loss – 142.00.

Hot

No comment on record. Start new comment.