Current trend

As a result of the strengthening of the American dollar, the AUD/USD pair is correcting around 0.6762.

Negative dynamics are developing after the publication of macroeconomic statistics from Australia: thus, manufacturing PMI dropped from 47.7 points to 47.6 points, worse than the predicted 47.8 points, and prices for raw materials amounted to –10.7% YoY instead of –12.8% previously. This morning, the Reserve Bank of Australia (RBA) released data for the last autumn period, but with most exchanges closed over the Christmas period, investors largely ignored the statistics.

The American dollar strengthened significantly, ending yesterday’s trading at 101.800 in the USDX, despite a poor manufacturing PMI, which fell from 49.4 points to 47.9 points in December. Today, manufacturing PMI from the Institute for Supply Management (ISM) is expected to be released but analysts expect the indicator to strengthen from 46.7 points to 47.1 points, while the number of job openings from JOLTs in November may increase from 8,733M to 8.850M, supporting the US currency.

Support and resistance

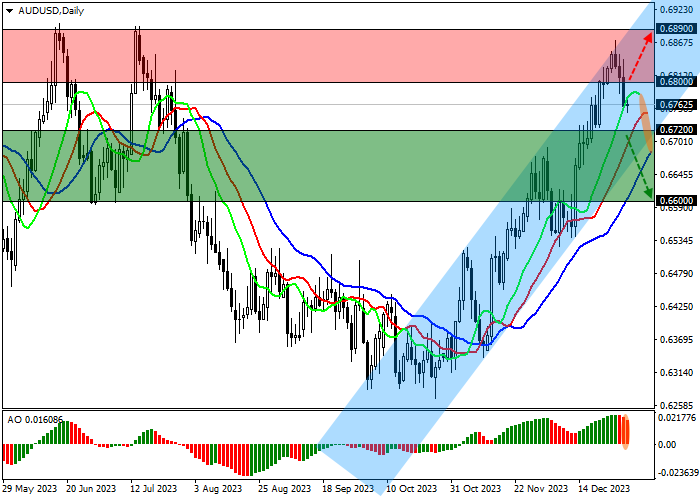

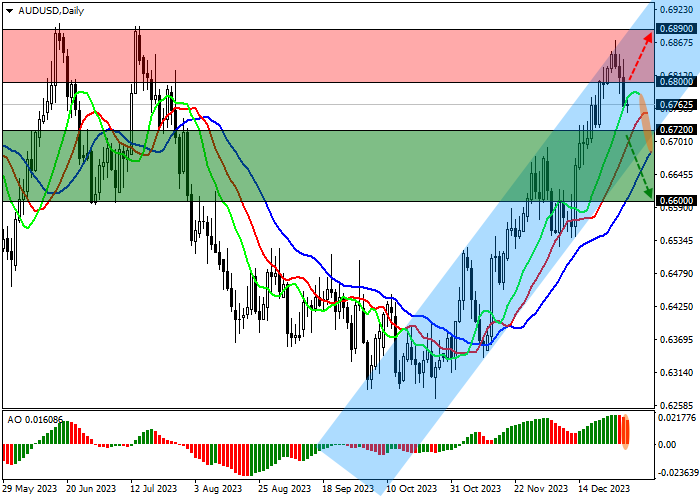

On the daily chart, the price is moving within the global ascending channel 0.6860–0.6700, reversing towards the support line.

Technical indicators are weakening the global buy signal against a local correction: fast EMAs on the Alligator indicator are above the signal line, narrowing the range of fluctuations, and the AO histogram forms downward bars in the buy zone.

Resistance levels: 0.6800, 0.6890.

Support levels: 0.6720, 0.6600.

Trading tips

Short positions may be opened after the price declines and consolidates below 0.6720 with the target at 0.6600. Stop loss – 0.6800. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 0.6800 with the target at 0.6890. Stop loss – 0.6730.

Hot

No comment on record. Start new comment.