Current trend

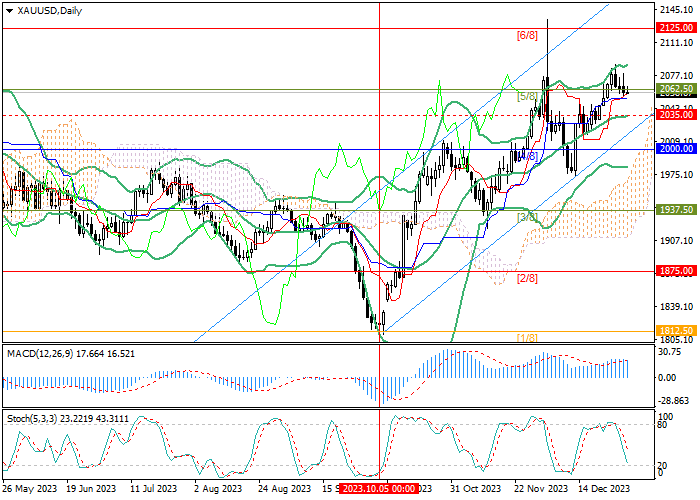

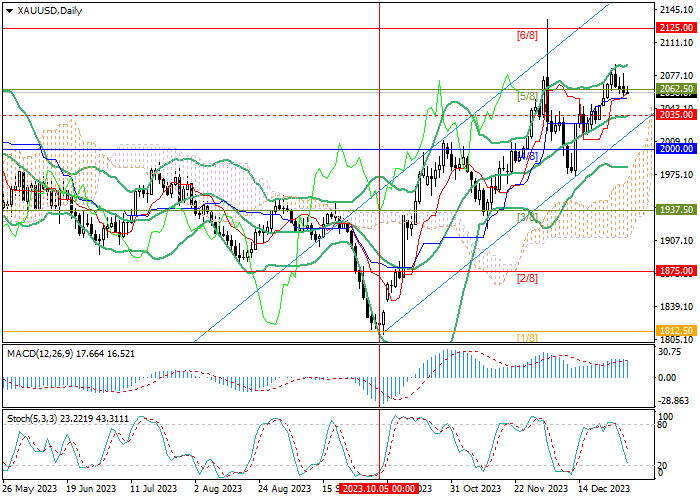

The XAU/USD pair started the new year with a corrective decline towards the medium-term uptrend but held above 2062.50 (Murrey level [5/8]), reflecting the possibility of renewed growth.

Positive dynamics in the medium term are developing against worsening geopolitical tensions in the Middle East: the armed conflict between Israel and the Hamas movement is becoming increasingly protracted and gradually expanding, having already caused a disruption in international commercial shipping in the Red Sea and with further escalation, the Hormuz Strait may also be blocked, which will cause even greater damage to the global economy. In these conditions, investors are increasingly turning to precious metals as shelter assets.

Meanwhile, the US currency remains under pressure as experts expect a quick change in the direction of the US Federal Reserve’s monetary policy. According to forecasts, officials may begin lowering interest rates in March, although most analysts are inclined to believe that the transition to the “dovish” rhetoric will begin in the second half of the year. Such prospects also increase investor demand for assets alternative to the dollar, including precious metals. Today, the minutes of the latest meeting of the US Federal Open Market Committee (FOMC) will be published, in which traders will look for hints on specific dates for the start of reducing borrowing costs, and if they are available, the growth of the XAU/USD pair will resume.

Support and resistance

The trading instrument is around 2062.50 (Murrey level [5/8]), repeated consolidation above which will lead to renewed growth to 2125.00 (Murrey level [6/8]). The key “bearish” level is the middle line of Bollinger Bands around 2035.00, after which breakdown, a decline to the area of 2000.00 (Murrey level [4/8]) and 1937.50 (Murrey level [3/8]) is possible.

Technical indicators confirm the continuation of the upward trend: Bollinger bands reverse upwards, and the MACD histogram is stable in the positive zone. Stochastic is directed downwards but is approaching the oversold zone, reflecting the possibility of a reversal.

Resistance levels: 2062.50, 2125.00.

Support levels: 2035.00, 2000.00, 1937.50.

Hot

No comment on record. Start new comment.