Current trend

Shares of Bank of America Corp., one of the largest banks and research agencies in the United States, are moving sideways at 34.00.

Yesterday, the company announced the appointment of 334 employees to the position of managing directors, which is 8.0% less than last year, and its main competitor, The Goldman Sachs Group Inc., announced the promotion of 608 employees to managers, which is also below the 2023 figure at 643 people. Despite the personnel changes, the head of the corporation, Brian Moynihan, said that he expects to increase the total commission for investment banking services to 1.0B dollars. According to the businessman, conditions in the industry are improving, and the likelihood of new mergers and acquisitions, through which the organization earns the majority of such payments, is quite high.

The financial report will be released on January 12: analysts expect revenue to be 23.98B dollars, down from 25.20B dollars previously, and earnings per share to adjust to 0.62 dollars from 0.90 dollars.

Support and resistance

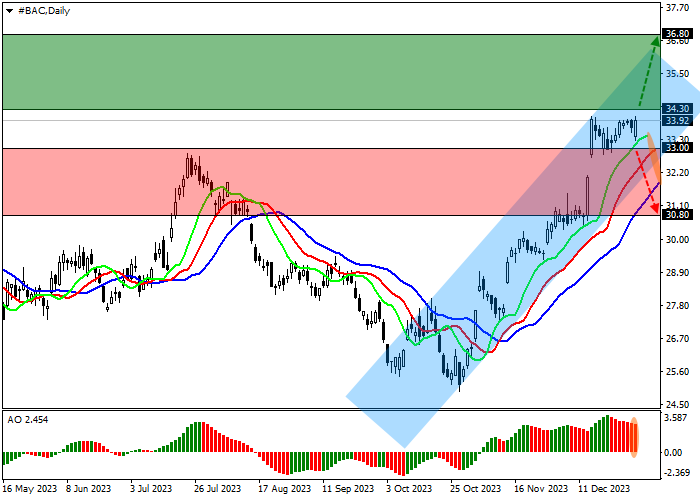

On the daily chart, the trading instrument is moving within a local ascending corridor, holding near last year’s high of 34.00.

Technical indicators maintain a stable buy signal: the EMA fluctuation range on the Alligator indicator is directed upward, fast EMAs are above the signal line, and the AO histogram is in the buy zone.

Resistance levels: 34.30, 36.80.

Support levels: 33.00, 30.80.

Trading tips

Long positions may be opened after the price rises and consolidates above 34.30 with the target at 36.80 and stop loss 33.70. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 33.00 with the target at 30.80. Stop loss – 34.00.

Hot

No comment on record. Start new comment.