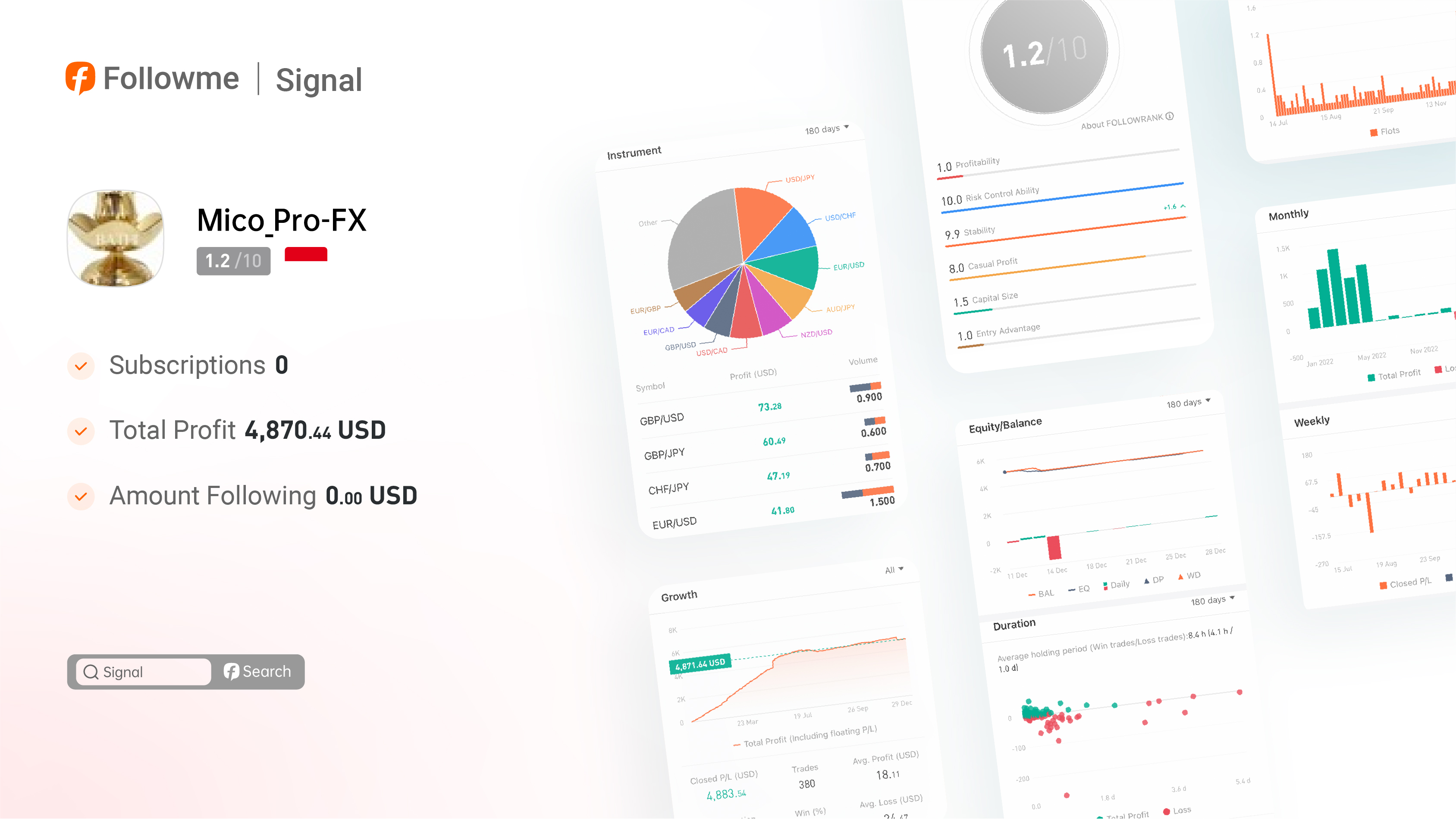

Trader @Mico_Pro-FX 's Strategy and Risk Management System in Response to Market Volatility

Under the backdrop of global inflation, the continued possibility of market volatility due to the Federal Reserve's interest rate hikes has led to over 60% of the community's traders trading XAU/USD, 30% trading the Dow Jones Industrial Average (US30) and crude oil, and the remaining 10% favouring safe-haven currencies. Today, we will introduce @Mico_Pro-FX #1, which belongs to that 10%.

Let's first look at the current situation of the account. The average holding time is only 7.8 hours, indicating a preference for quick trades. The strategy relies on a win rate of over 87% to generate profits. While there are many small profitable trades, the losing trades result in larger losses, although they occur less frequently.

In terms of trading volume, there are approximately 2.5 trades per trading day based on the May 377 ratio. The position size is relatively stable at 0.1 lots, but there are occasional trades with a size of 1 lot. Considering the current account balance of $4,788 and the absence of a typical adding-to-losing-positions structure, the position sizing is within a reasonable range. The account also maintains a maximum drawdown of 5.07%.

Interestingly, this drawdown occurred on 14 December this year. On that day, the trader intended to go long on USD/JPY, but the market experienced a sharp surge. Subsequently, the trader hedged the position by going short on the same currency pair, but the outcome was unfavourable. However, this hedging approach to mitigate risks is consistent with the trader's overall system, which includes hedging on currency pairs such as USD/CHF-USD/CAD, AUD/JPY-GBP/JPY, GBP/AUD-GBPNZD in the long direction, and USD/CHF-GBP/USD, USD/JPY-EUR/USD in the reverse direction.

As 2023 comes to an end, 2024 is expected to bring even more turbulent and capricious market conditions. During that time, safe-haven currencies may no longer provide the same level of safety. Of course, we also look forward to the future performance of @Mico_Pro-FX!

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.