Current trend

Brent Crude Oil quotes have been continuously rising for four consecutive sessions and are currently trying to break above the central line of Bollinger Bands in the area of 78.12. Prices are supported by the expectation of a change in the vector of the US Federal Reserve's monetary policy and a reduction in freight traffic in the Red Sea.

Last week, the US regulator once again left the key rate at 5.50%, and also announced a triple reduction in the cost of borrowing in 2024. Such actions should lead to a weakening of the dollar against alternative assets, including commodities, which pushes oil prices up.

Another reason for the uptrend in quotes is the actual blockade of the exit from the Red Sea by the Yemeni Houthis: after the outbreak of hostilities in the Gaza Strip, representatives of the movement announced that they would attack all ships going to Israel or belonging to Israeli owners. As a result, the largest shipping companies MSC, Hapag-Lloyd, CMA CGM, and Maersk refused to transport goods through the Suez Canal, and yesterday they were joined by the oil giant BP Plc. It should be noted that up to 15.0% of all maritime logistics flows passed through this route until recently. Currently, shipping companies are forced to change routes, increasing costs and expenses, which will inevitably affect the prices of "black gold" in the medium term, since the problem is unlikely to be solved in the near future. Nevertheless, Goldman Sachs experts believe that the current situation will cause an increase in the cost of major oil grades by no more than 3.0–4.0 dollars per barrel and will not be able to offset long-term pressure factors on the market.

Support and resistance

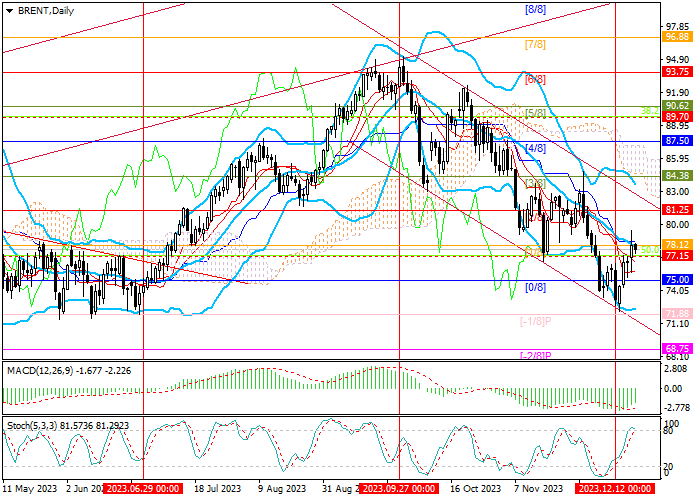

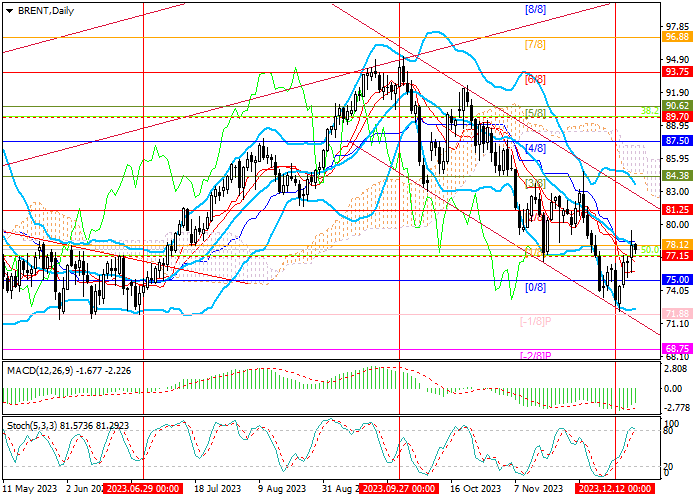

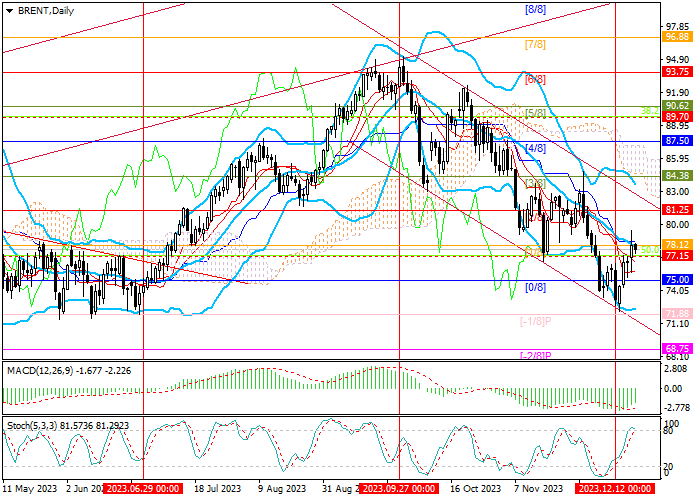

The instrument is growing within the descending channel, having bounced from its lower border. Now the quotes are testing the level of 78.12 (the central line of Bollinger Bands, Murrey level [1/8]), the breakout of which will allow them to continue growing to 81.25 (Murrey level [2/8], the upper border of the descending channel), 84.38 (Murrey level [3/8]). The key for the "bears" is the level of 75.00 (Murrey level [0/8]), after consolidation below which the decline can continue to 71.88 (Murrey level [-1/8]) and 68.75 (Murrey level [-2/8]).

Technical indicators confirm the continuation of the downtrend: Bollinger Bands are directed upwards, MACD is decreasing in the negative zone, and Stochastic is reversing down from the overbought zone.

Resistance levels: 78.12, 81.25, 84.38.

Support levels: 75.00, 71.88, 68.75.

Trading tips

Short positions can be opened below the 75.00 mark with targets at 71.88, 68.75 and stop-loss around 77.15. Implementation period: 5–7 days.

Long positions should be opened above the level of 78.12 with targets at 81.25, 84.38 and stop-loss around 76.00.

Hot

No comment on record. Start new comment.