Current trend

The USD/CHF pair is correcting around 0.8672 after the decision of the Swiss monetary authorities.

Last week, the Swiss National Bank kept the interest rate at 1.75%, as analysts had expected. During a subsequent press conference, the head of the regulator, Thomas Jordan, said that the issue of easing monetary policy is not of the matter but the officials are ready to intervene in the market in any direction if necessary. The accompanying statement noted that inflation pressure in the country decreased slightly in the last quarter of this year: thus, in September and October, the consumer price index amounted to 1.7%, falling below 2.0% for the first time since January 2022, and in November it reached 1.4%. However, the situation remains uncertain, and officials noted that they will continue to monitor incoming macroeconomic data to make timely adjustments to current parameters. Inflation is projected to average 2.1% in 2023, 1.9% in 2024, and 1.6% in 2025, with gross domestic product (GDP) expected to increase by 1.0% in 2023 and by 0.5–1.0% in 2024.

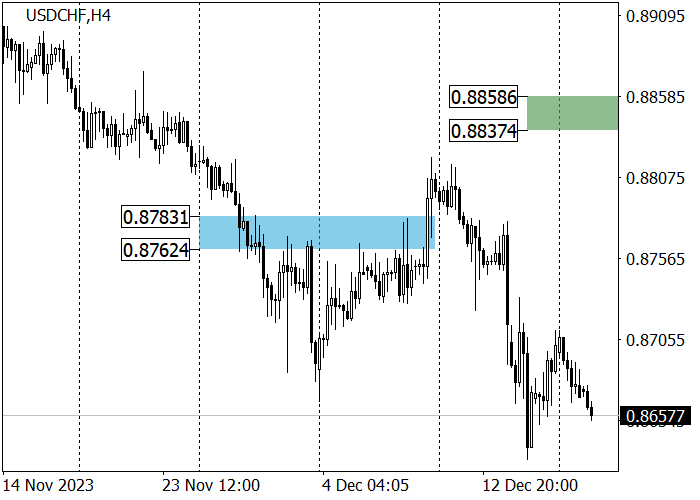

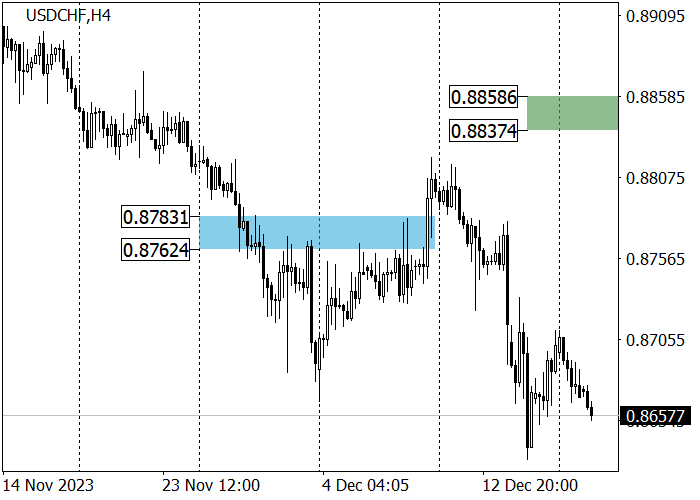

Against this background, the trading instrument is below 0.8677 as part of a correction to the upward dynamics observed from July to October. After the price consolidates below 0.8677, the decline will transform into a full-fledged downward trend with the update of the July low of 0.8570, after which the next target will be 0.8402. The RSI indicator and the price chart form a divergence, signaling a possible upward reversal in the medium term.

The medium-term trend is downward: in November, the quotes broke through zone 2 (0.8783–0.8762) and headed towards zone 3 (0.8578–0.8558). At the moment, an upward corrective model is implementing, within which the asset can reach the key trend resistance area of 0.8858–0.8837, after which short positions with the target at last week’s low of 0.8634 are relevant.

Support and resistance

Resistance levels: 0.8807, 0.8898.

Support levels: 0.8677, 0.8570, 0.8402.

Trading tips

Long positions may be opened above 0.8718 with the target at 0.8807 and stop loss 0.8677. Implementation time: 9–12 days.

Short positions may be opened from 0.8807 with the target at 0.8677 and stop loss 0.8850.

Hot

No comment on record. Start new comment.