Current trend

Against the stabilization of the American currency, the USD/JPY pair is correcting at 143.52.

The yen retreated from its highs amid this morning’s Bank of Japan’s decision to keep the interest rate at –0.10% and not change the current monetary policy parameters: purchases of government bonds will continue without setting an upper limit to keep their yields near zero, and if this If the indicator exceeds the upper limit of the range of 1.0%, the regulator will increase the volume of purchases of all types of securities. Thus, officials ignore macroeconomic statistics but inflation in the country in November was about 2.9%, while in January the consumer price index peaked at 4.2%, and if the negative dynamics continue, the department’s rhetoric will remain “dovish.”

The American dollar completed an active decline, consolidating at 102.200 in the USD Index. Investor activity was low at the beginning of the week but data on the real estate market will be published this evening: analysts expect that the number of building permits issued in November will decrease from 1.498M to 1.470M, and the volume of construction of new houses – from 1.372M to 1.360M and will continue the negative trend in the industry, keeping the US Federal Reserve from cutting interest rates. Thus, the head of the regulator, Jerome Powell, repeated that officials would not rush to turn to easing monetary policy, monitoring incoming macroeconomic statistics. Against this background, analysts have revised their forecasts regarding a possible correction in borrowing costs in March and are counting more on the department’s May or June meeting.

Support and resistance

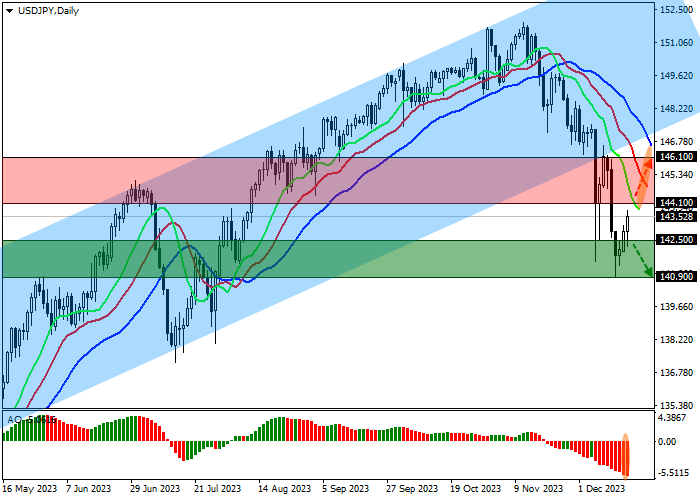

A downward trend is developing on the daily chart: despite local price increases, pressure remains, which does not allow a soon reversal.

Technical indicators maintain a stable sell signal: fast EMA on the Alligator indicator are significantly below the signal line, and the AO histogram forms downward bars in the sell zone.

Resistance levels: 144.10, 146.10.

Support levels: 142.50, 140.90.

Trading tips

Short positions may be opened after the price declines and consolidates below 142.50 with the target at 140.90. Stop loss – 143.40. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 144.10 with the target at 146.10. Stop loss – 143.00.

Hot

No comment on record. Start new comment.