Current trend

During the Asian session, the USD/CAD pair shows ambiguous trading, holding close to 1.3400. Yesterday, the asset retreated from its lows since early August amid the American dollar strengthening.

On Monday, investors noted a moderate rise in the US Home Builders Market Value Index from the National Association of Home Builders (NAHB) in December from 34.0 points to 37.0 points, better than market expectations of 36.0 points. In turn, the Canadian indicator of real estate prices on the primary market in November corrected by 0.2% after zero dynamics in October, and by –0.9% YoY after increasing by 3.1% earlier.

Today in Canada, the consumer price index will be published, which is expected to slow down in November from 3.1% to 2.9% YoY and by 0.2% after an increase of 0.1% MoM. The core rate, according to preliminary estimates, will remain at 0.3% and 2.7%, respectively. Bank of Canada Governor Tiff Macklem noted that officials continue to debate whether interest rates have increased enough and how long they should be kept at those levels, as there is no clear evidence that inflation is on a sustainable path to the 2.0% target. However, he said, the global economy is experiencing increased volatility, requiring financial authorities to be flexible. Macklem’s comments were intended to cool market expectations for monetary easing in early 2024, which contrasts with US Federal Reserve Chairman Jerome Powell, who signaled a focus on the timing of interest rate cuts.

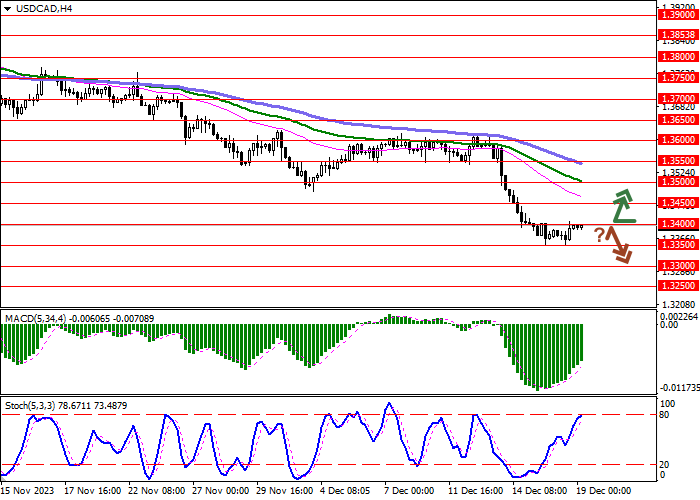

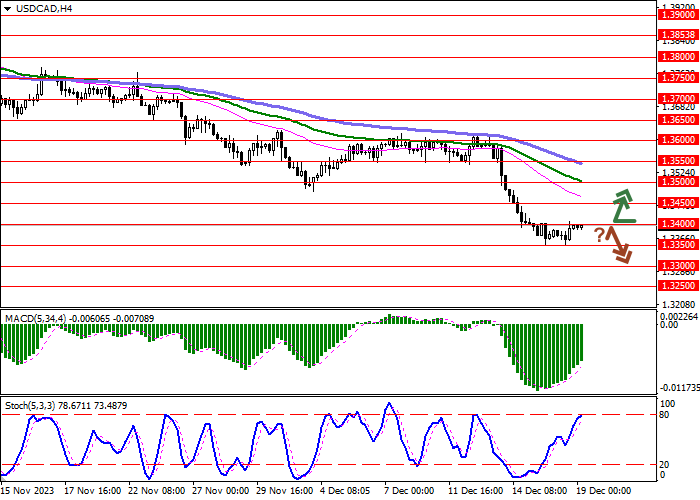

Support and resistance

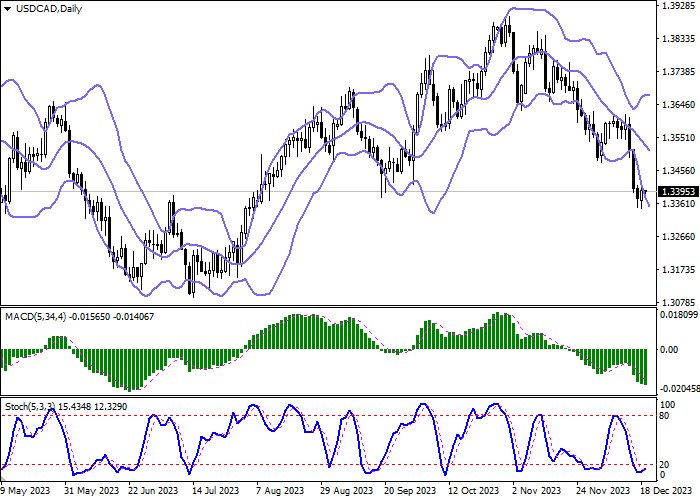

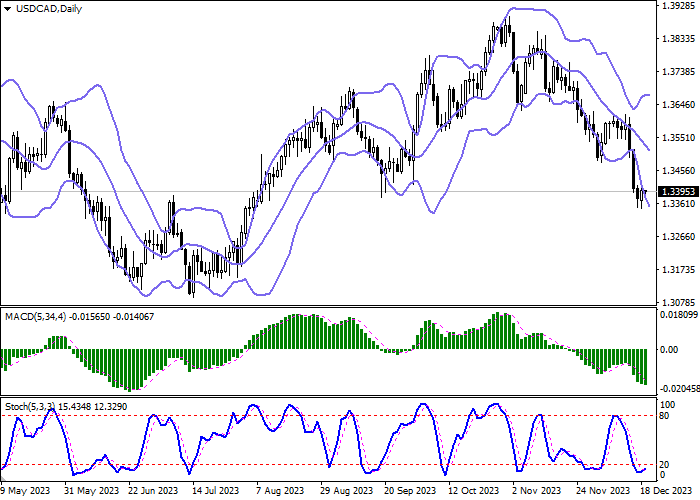

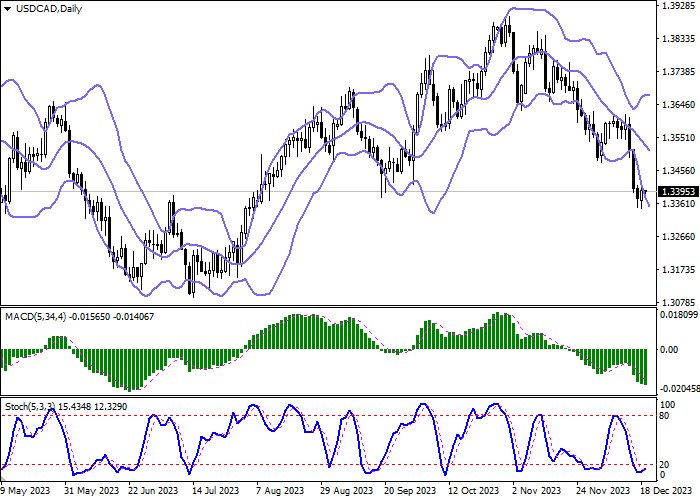

On the daily chart, Bollinger Bands are steadily declining: the price range is expanding from below, letting the “bears” renew local lows. The MACD indicator is declining, maintaining a strong sell signal (the histogram is below the signal line). Stochastic, having reached lows, tries to reverse upwards, signaling in favor of the development of corrective dynamics soon.

Resistance levels: 1.3400, 1.3450, 1.3500, 1.3550.

Support levels: 1.3350, 1.3300, 1.3250, 1.3200.

Trading tips

Long positions may be opened after a breakout of 1.3400 with the target at 1.3500. Stop loss – 1.3350. Implementation time: 2–3 days.

Short positions may be opened after a rebound from 1.3400 and a breakdown of 1.3350 with the target at 1.3250. Stop loss – 1.3400.

Hot

No comment on record. Start new comment.