Current trend

The XAU/USD pair is practically unchanged, holding near 2020.00. Slight support for quotes comes from a decline in the American currency index in response to a fairly neutral macroeconomic background from the United States.

Last week, investors paid attention to the growth of the Services PMI from S&P Global in December from 50.8 points to 51.3 points, while analysts expected a decrease to 50.6 points, while the Manufacturing PMI fell from 49.4 points to 48.2 points, which turned out to be worse than expectations at 49.3 points. US Industrial Production increased 0.2% in November after -0.8% in the previous month, while experts had expected 0.3%.

At the same time, the US currency is supported by a slightly stronger position of the US Federal Reserve regarding the prospects for monetary policy. The Chair of the regulator, Jerome Powell, emphasized that the Fed is in no hurry to ease monetary conditions and will closely monitor incoming macroeconomic statistics. As a result, analysts have revised their forecasts for a possible reduction in borrowing costs during the US Federal Reserve's March meeting and are now looking at a May or June meeting. The European Central Bank (ECB) and the Bank of England are also in no hurry to return to "dovish" rhetoric. The British regulator often advocates another increase in the rate in response to continued high consumer inflation in the country.

The period of correction continues in the market of gold contracts. According to the report of the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in gold declined to 188.2 thousand from 203.5 thousand a week earlier. There is a new local upward trend: the balance of swap dealers was fixed at 73.712 thousand for the "bulls" versus 246.876 thousand for the "bears". Last week, buyers increased the number of contracts by 1.080 thousand, and sellers reduced them by 14.036 thousand, signaling a new attempt of the instrument to grow and the return of buyers to the asset.

Support and resistance

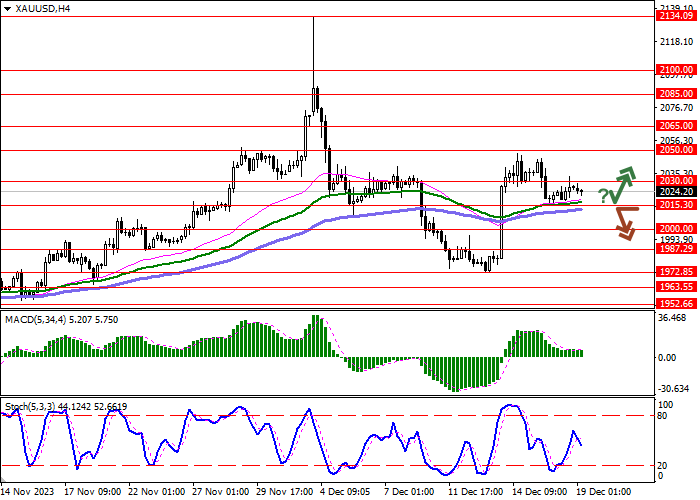

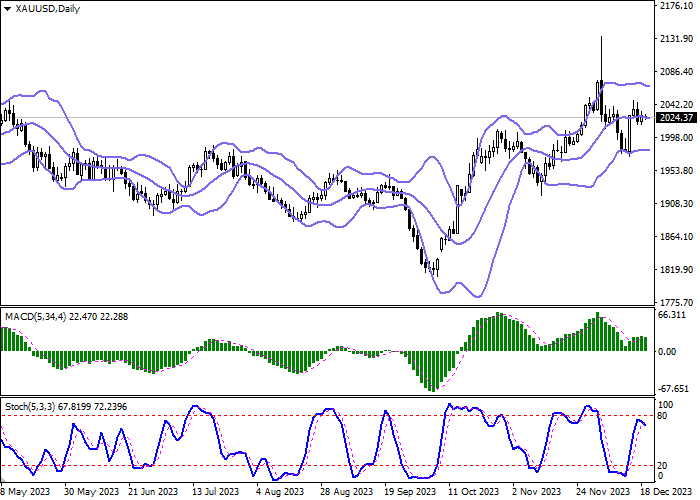

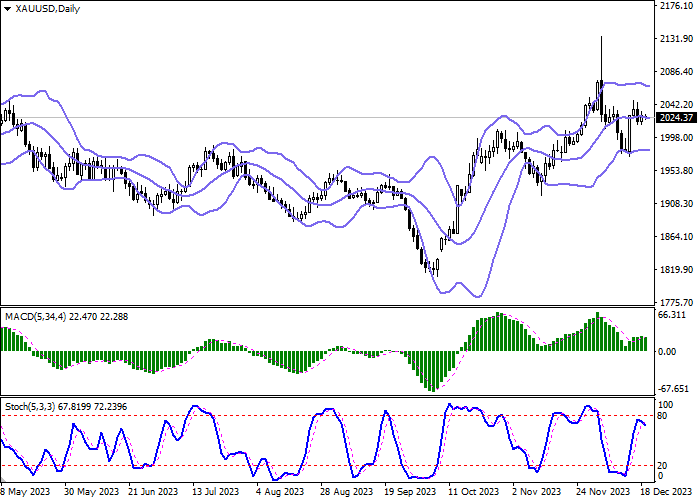

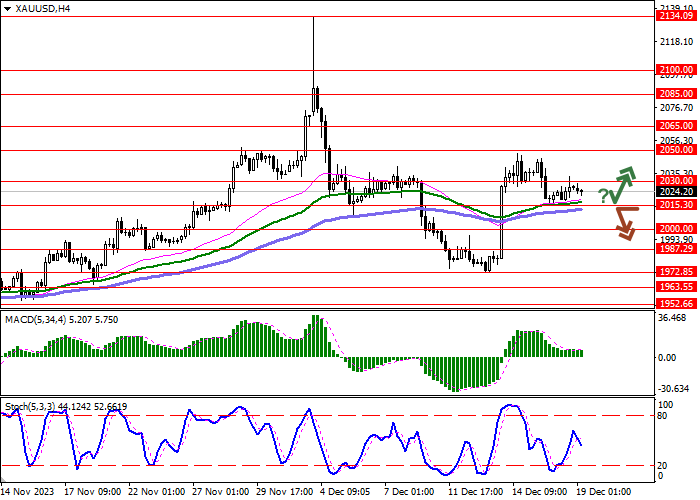

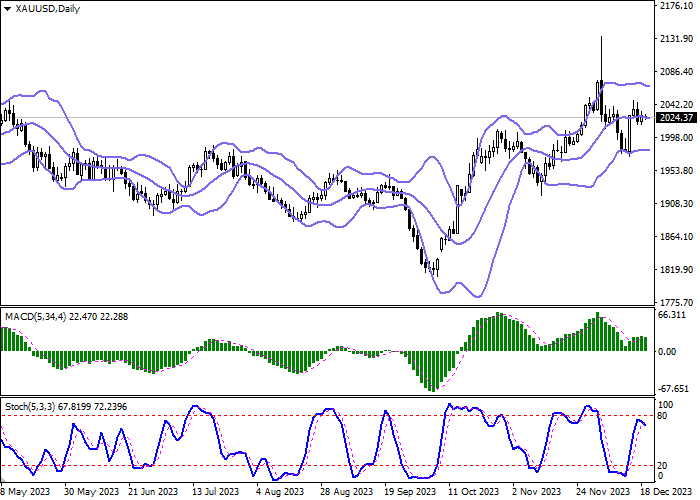

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is almost constant, remaining rather spacious for the current level of activity in the market. MACD reversed downwards having formed a new sell signal (located below the signal line). Stochastic shows similar dynamics and reverses downwards near the level of "80", which indicates the risks of gold being overbought in the ultra-short term.

Resistance levels: 2030.00, 2050.00, 2065.00, 2085.00.

Support levels: 2015.30, 2000.00, 1987.29, 1972.85.

Trading tips

Short positions may be opened after a breakdown of 2015.30 with the target at 1987.29. Stop-loss — 2030.00. Implementation time: 2-3 days.

A rebound from 2015.30 as from support followed by a breakout of 2030.00 may become a signal for opening new long positions with the target at 2065.00. Stop-loss — 2015.30.

Hot

No comment on record. Start new comment.