Current trend

The EUR/USD pair is correcting around 1.0915 after a sharp decline on Friday, when it retreated from the highs of November 29.

Last week, the European Central Bank (ECB) kept the main monetary policy parameters unchanged: the key interest rate remained at 4.50%, the margin rate at 4.75%, and the deposit rate at 4.00%. In the accompanying statement, officials noted their intention to reduce inflation to the target of 2.0%, and the “hawkish” policy initiated by the financial authorities for such a long time is likely to make a significant contribution to this. According to preliminary estimates, price pressure will slow down significantly only in two years: in 2023, the figure will be 5.4%, in 2024 – 2.7%, in 2025 – 2.1%, and in 2026 – 1.9%. At the same time, against growing real incomes of the population and improving external demand, the region’s economy will recover from 0.6% to 0.8% next year and to 1.5% in 2025. In November, manufacturing PMI remained at 44.2 points compared to forecasts for growth to 44.6 points, and services PMI decreased from 48.7 points to 48.1 points, reducing the composite PMI from 47.6 points up to 47.0 points. The German manufacturing PMI corrected from 42.6 points to 43.1 points, less than the expected 43.2 points, and the services PMI – from 49.6 points to 48.4 points.

Previously, investors hoped that the European regulator would be one of the first to ease monetary policy in response to the slowdown in economic growth. In October, the consumer price index dropped to the low of July 2021 of 2.9%, Q3 gross domestic product (GDP) showed zero dynamics YoY after a slowdown from 1.8% in Q4 2022, although preliminary estimates recorded an increase of 0.1%. Against this background, the head of the Bank of France and a member of the ECB, Francois Villeroy de Galhau, said that the regulator’s next step should be to reduce interest rates from record highs but first, it is necessary to maintain borrowing costs at current levels for some time to assess the effectiveness of the measures taken.

In the US on Friday, S&P Global manufacturing PMI was published, which in December decreased from 49.4 points to 48.2 points compared to forecasts of 49.3 points. The Federal Reserve Bank of New York manufacturing PMI corrected from 9.1 points to –14.5 points, significantly worse than market expectations of 2.0 points, putting pressure on the American dollar.

Support and resistance

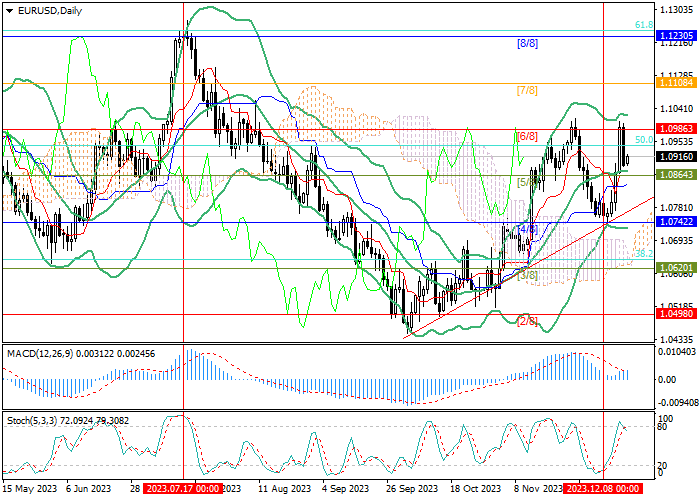

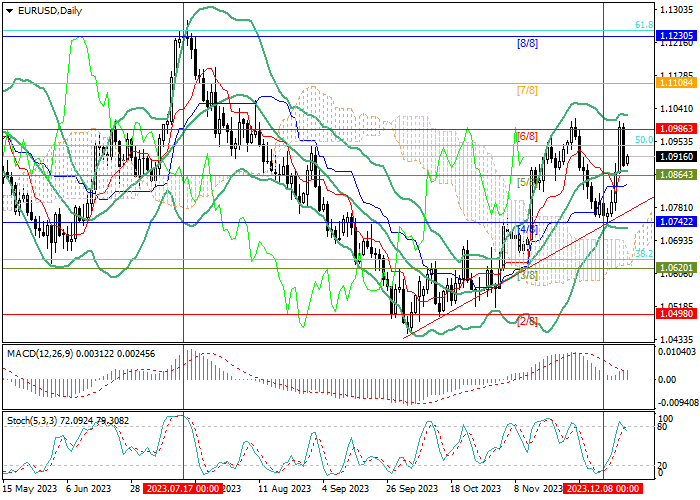

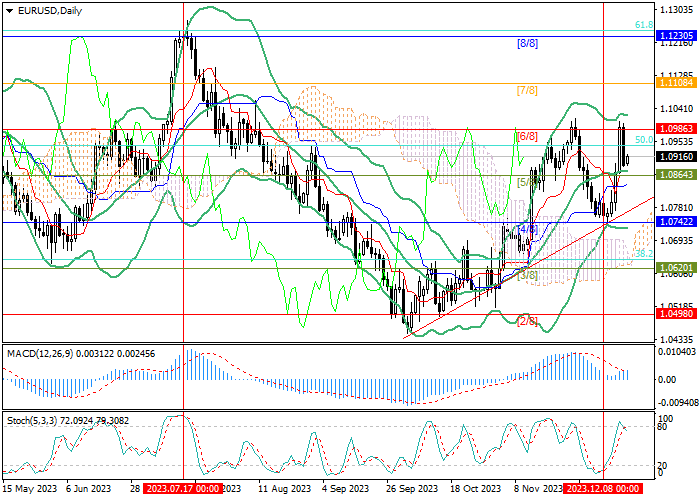

The trading instrument is trying to resume growth from the middle line of Bollinger bands but for a significant increase it needs to consolidate above 1.0986 (Murrey level [6/8]), tested earlier. In this case, the targets for positive dynamics will be the area of 1.1104 (Murrey level [7/8]) and 1.1230 (Murrey level [8/8], Fibonacci retracement 61.8%). The key “bearish” level is 1.0864 (Murrey level [5/8], the middle line of Bollinger bands), after consolidation below which, the price can reach the area 1.0742 (Murrey level [4/8]), 1.0620 (Murrey level [3/8], Fibonacci retracement 38.2%), and 1.0498 (Murrey level [2/8]).

Technical indicators do not give a single signal: Bollinger Bands are horizontal, the MACD histogram is increasing in the positive zone but Stochastic is reversing downwards from the overbought zone.

Support and resistance

Resistance levels: 1.0986, 1.1104, 1.1230.

Support levels: 1.0864, 1.0742, 1.0620, 1.0498.

Trading tips

Long positions may be opened above 1.0986 with the targets at 1.1104, 1.1230 and stop loss 1.0900. Implementation time: 5–7 days.

Short positions may be opened below 1.0864 with the targets at 1.0742, 1.0620, 1.0498 and stop loss 1.0950.

Hot

No comment on record. Start new comment.