Current trend

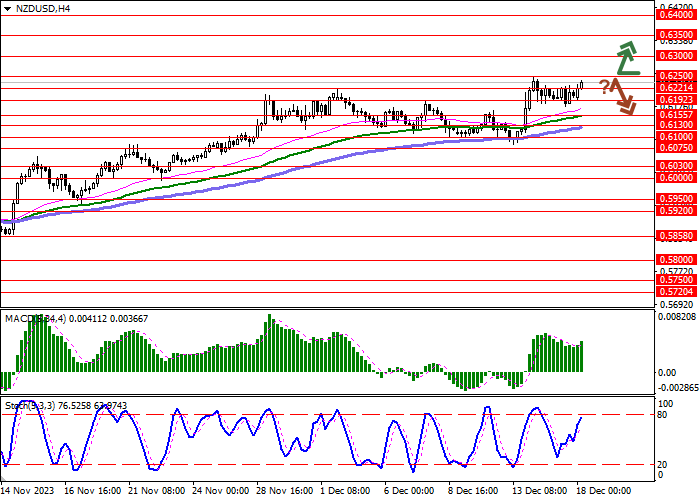

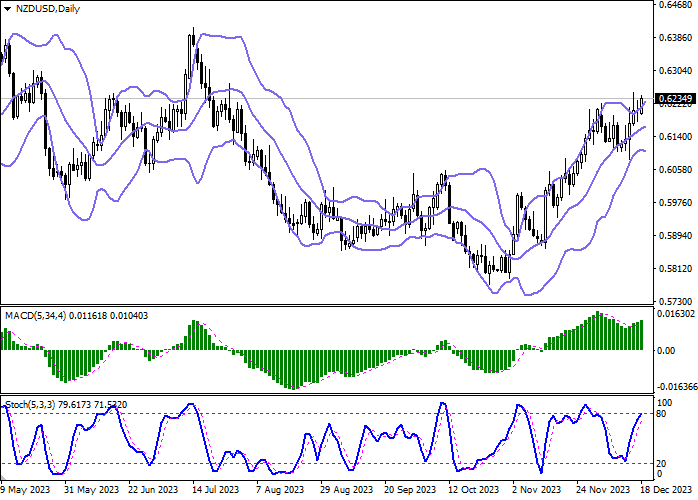

The NZD/USD pair is showing active growth, developing the "bullish" signal formed last week. The instrument is testing 0.6235 for a breakout, preparing to update the local highs from July 27.

The quotes are supported by macroeconomic statistics from New Zealand: the Consumer Sentiment index from Westpac in the fourth quarter rose from 80.2 points to 88.9 points, and the Business NZ Performance of Services Index in November strengthened from 48.9 points to 51.2 points, supporting the buying sentiment for the instrument. Last Friday, investors also turned their attention to data from China, where Industrial Production rose 6.6% in November after rising 4.6% the previous month, while analysts had expected 5.6%, and Retail Sales accelerated from 7.6% to 10.1%, which turned out to be worse than preliminary estimates of 12.5%.

In turn, American statistics failed to meet market expectations. Industrial Production volumes in November added 0.2% after a decline of 0.8% in the previous month, with a forecast of 0.3%; the Manufacturing PMI from S&P Global in December dropped from 49.4 points to 48.2 points with expectations at 49.3 points, and the NY Empire State Manufacturing Index went down from 9.1 points to -14.5 points, while experts expected a decrease to only 2.0 points.

Support and resistance

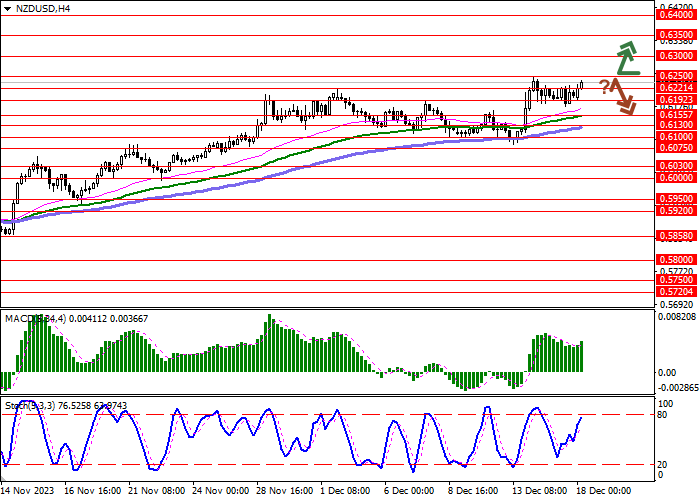

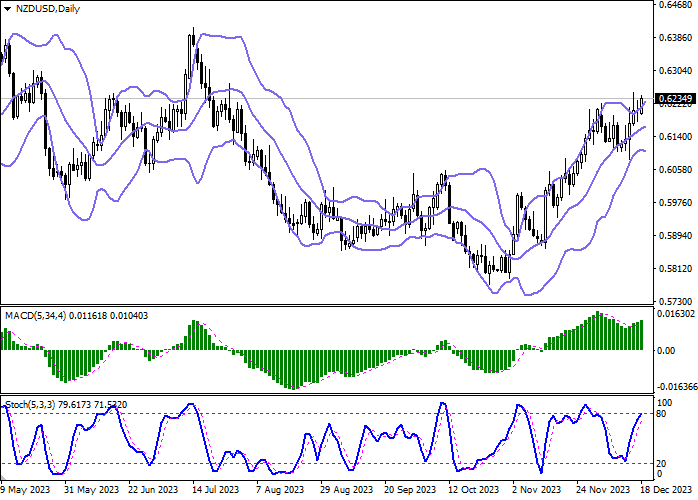

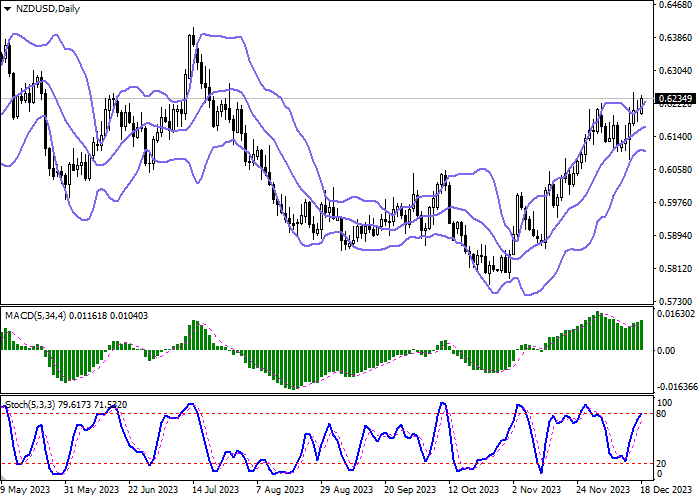

Bollinger Bands in D1 chart show moderate growth. The price range is expanding, but it fails to keep pace with the "bullish" activity of recent days. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic demonstrates similar dynamics; however, the indicator is located in close proximity to its highs, indicating the risks of the instrument being overbought in the ultra-short term.

Resistance levels: 0.6250, 0.6300, 0.6350, 0.6400.

Support levels: 0.6221, 0.6192, 0.6155, 0.6130.

Trading tips

Long positions can be opened after a breakout of 0.6250 with the target of 0.6350. Stop-loss — 0.6200. Implementation time: 2-3 days.

A rebound from 0.6250 as from resistance, followed by a breakdown of 0.6192 may become a signal for opening of new short positions with the target at 0.6100. Stop-loss — 0.6250.

Hot

No comment on record. Start new comment.