Current trend

During the Asian session, the USD/CHF pair shows near-zero trading dynamics, remaining around 0.8700, as investors are in no hurry to open positions in anticipation of new drivers for the movement of the trading instrument.

On Tuesday, Switzerland will publish data on the dynamics of foreign trade for November: previously, exports decreased from 24.79B francs to 23.09B francs, and imports – from 18.51B francs to 18.49B francs, reducing the trade surplus balance from 6.28B francs to 4.60B francs. In addition, the Swiss National Bank (SNB) will publish a quarterly report, in which analysts expect to see new comments on the rate of inflation growth and future monetary policy. Note that last week, the regulator at the last meeting of the year on the interest rate kept it at 1.75%.

On Thursday, the market will receive renewed information on the dynamics of US Q3 gross domestic product (GDP): analysts assume that the figure will remain at 5.2%. On Friday, statistics on the price index of personal consumption expenditures will be published, which, according to preliminary estimates, will slow down from 3.5% to 3.4%.

Support and resistance

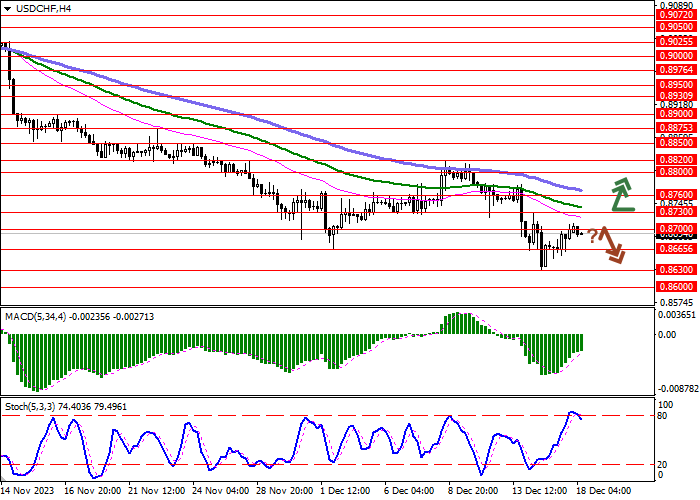

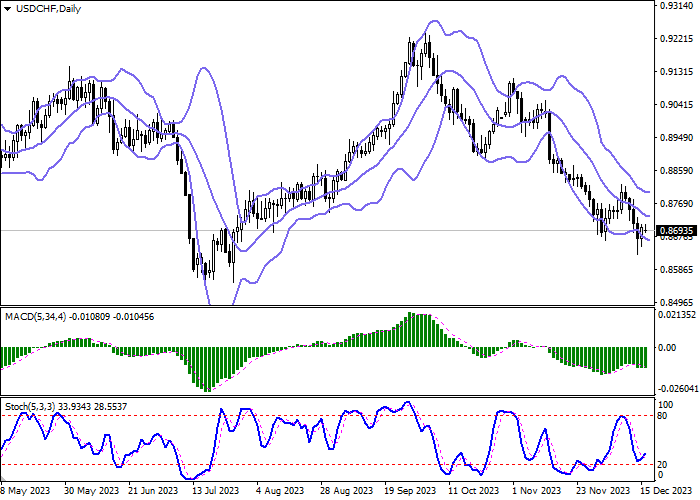

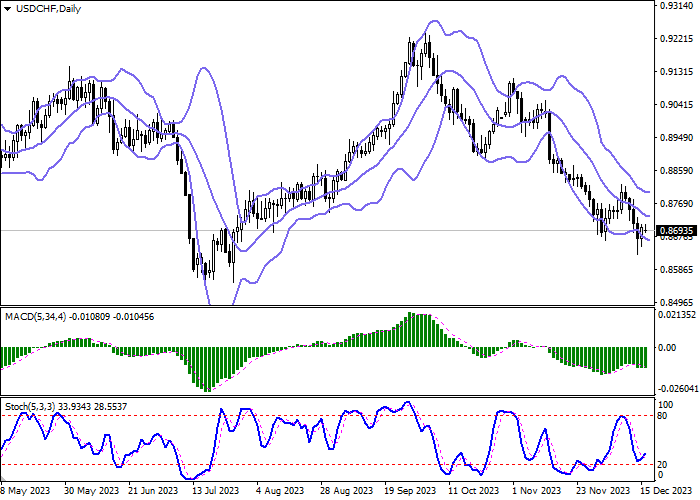

On the daily chart, Bollinger bands are declining moderately, remaining wide enough for the market activity. The MACD indicator tries to reverse upwards and form a new buy signal (the histogram tends to be above the signal line). Stochastic, reversed upwards at “20”, indicates that a full-fledged upward correction may develop soon.

Resistance levels: 0.8700, 0.8730, 0.8760, 0.8800.

Support levels: 0.8665, 0.8630, 0.8600, 0.8553.

Trading tips

Short positions may be opened after a downward reversal near the current levels and a breakdown of 0.8665 with the target at 0.8600. Stop loss – 0.8700. Implementation time: 2–3 days.

Long positions may be opened after growth and breakdown of 0.8730 with the target at 0.8800. Stop loss – 0.8690.

Hot

No comment on record. Start new comment.