Current trend

During the Asian session, the USD/CAD pair is growing moderately, testing the 1.3600 mark for a breakout and holding near the highs of November 30.

The positive dynamics are developing with the support of Friday’s report on the US labor market, which was ahead of forecasts, which may lead to a correction of the original plans regarding the transition to the “dovish” Fed’s rhetoric. In November, the American economy created 199.0K new jobs outside the agricultural sector, better than October’s 150.0K and expectations of 180.0K, while the unemployment rate fell from 3.9% to 3.7%, and the average hourly wages accelerated from 0.2% to 0.4%. The statistics may be an argument in favor of another increase in the interest rate, keeping it at the current level longer than investors expected. The dollar was supported by an increase in the consumer confidence index from the University of Michigan in December from 61.3 points to 69.4 points, significantly higher than expected at 62.0 points.

Before the regulator’s meeting, which will take place on Wednesday, the quotes will most likely show ambiguous trading dynamics. There is a lack of key data from Canada except a speech by the head of the Bank of Canada, Tiff Macklem, on Friday. Meetings of the Swiss National Bank, the European Central Bank (ECB), and the Bank of England, scheduled for Thursday, will add volatility to the market: experts do not expect any steps towards changing monetary policy.

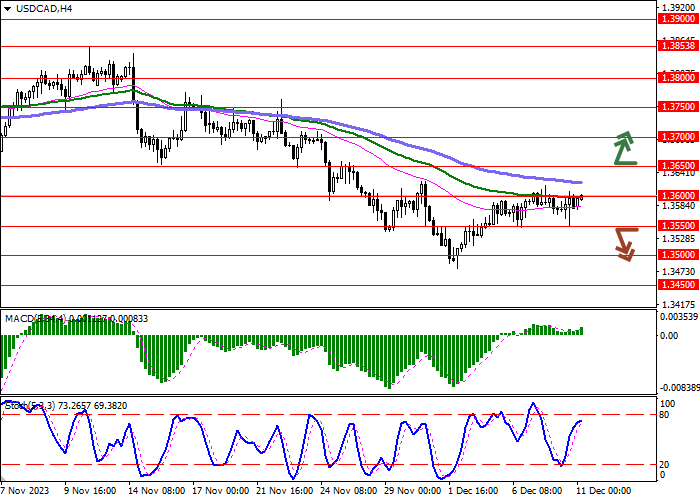

Support and resistance

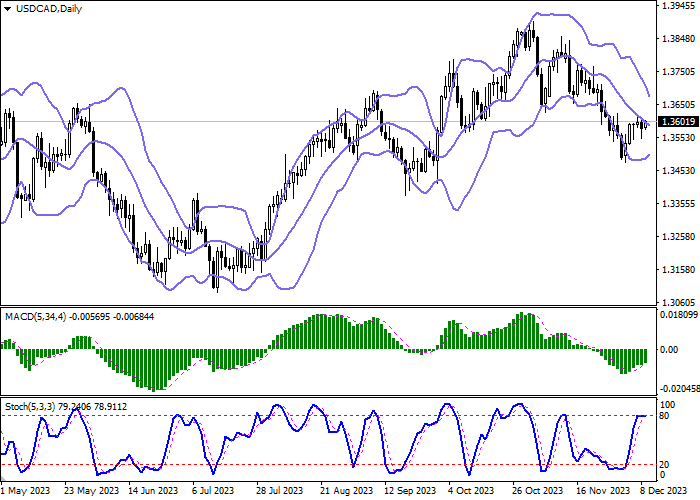

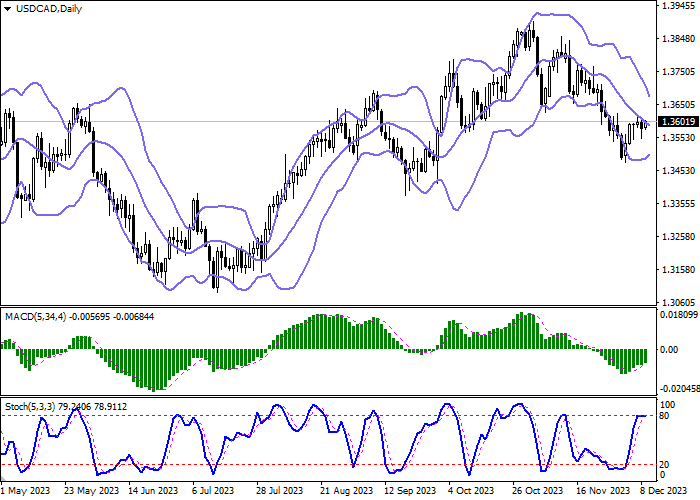

On the daily chart, Bollinger Bands are declining moderately: the price range is narrowing, reflecting the emergence of ambiguous trading dynamics in the short term. The MACD indicator is growing, maintaining a poor buy signal (the histogram is above the signal line). Stochastic, approaching the “80” mark, reversed horizontally, indicating that the US currency may become overbought in the ultra-short term.

Resistance levels: 1.3600, 1.3650, 1.3700, 1.3750.

Support levels: 1.3550, 1.3500, 1.3450, 1.3400.

Trading tips

Long positions may be opened after a breakout of 1.3650 is broken upward with the target at 1.3750. Stop loss – 1.3600. Implementation time: 2–3 days.

Short positions may be opened after a breakdown of 1.3550 with the target at 1.3450. Stop loss – 1.3600.

Hot

No comment on record. Start new comment.