Current trend

Last week, the USD/JPY pair lost 3.5% in value, reaching 141.68 but then managed to compensate for half of this decline.

The negative dynamics developed after the publication of reports about a likely change in the rhetoric of the Bank of Japan against representatives of regional financial institutions appealing to the head of the department and their request to reconsider the current policy of negative interest rates. Investors, according to a Reuters poll, believe that monetary policy will begin to tighten by the end of 2024, and the value will be adjusted from –0.10%, where it has been since 2016. Q3 gross domestic product (GDP) data showed a contraction of 0.7%, rather than the 0.5% expected, as household consumer spending and business investment weakened, with capital spending adjusting by –0.4% and private consumption adjusting by – 0.2%, while real wages in October changed by –2.3%, reflecting the nineteenth consecutive month of negative dynamics.

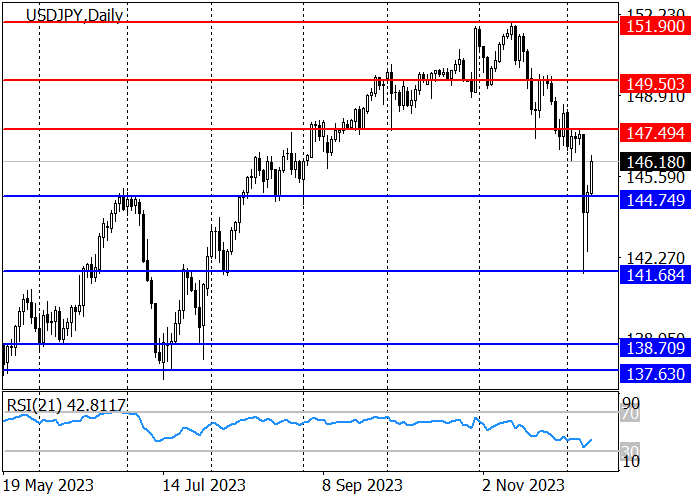

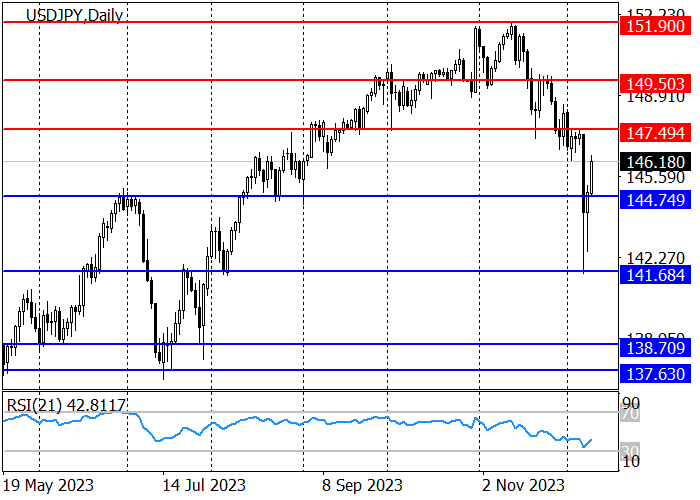

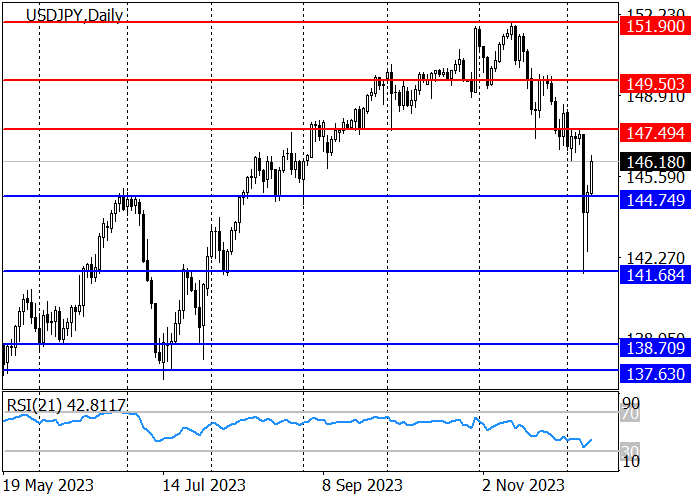

The long-term trend remains upward: after reaching the support level of 141.68, the price returned to the support level of 144.75, and we can expect continued growth with the target at 147.50, after which the asset can break through 149.50. If the support level of 144.75 is broken, a decline to last week’s low of 141.68 will follow. The RSI indicator is declining, approaching the oversold zone, and both long and short positions can be considered.

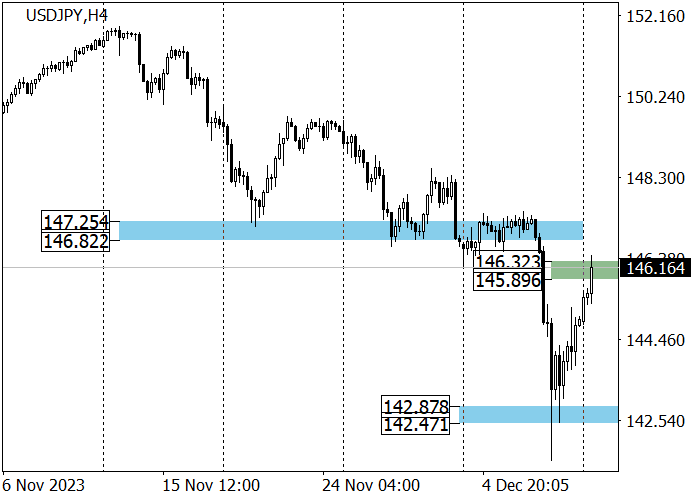

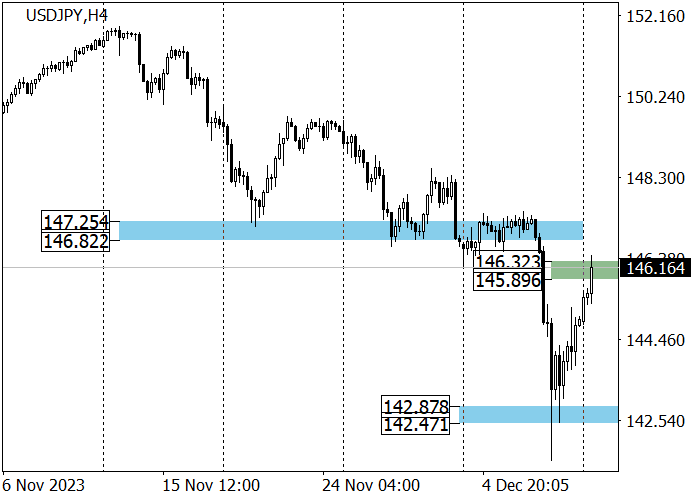

The medium-term trend changed to a downward one: the quotes overcame the zone 147.25–146.82 and reached zone 2 (142.87–142.47), from where a corrective growth began, within which the trading instrument reached the key resistance area of the medium-term downward trend 146.32–145.89, from where short positions within trend with the target at last week’s low around 141.68.

Support and resistance

Resistance levels: 147.50, 149.50, 151.90.

Support levels: 144.75, 141.70.

Trading tips

Short positions may be opened from 146.32 with the target at 141.70 and stop loss around 147.50. Implementation time: 9–12 days.

Long positions may be opened above 147.50 with the target at 149.50 and stop loss around 146.75.

Hot

No comment on record. Start new comment.