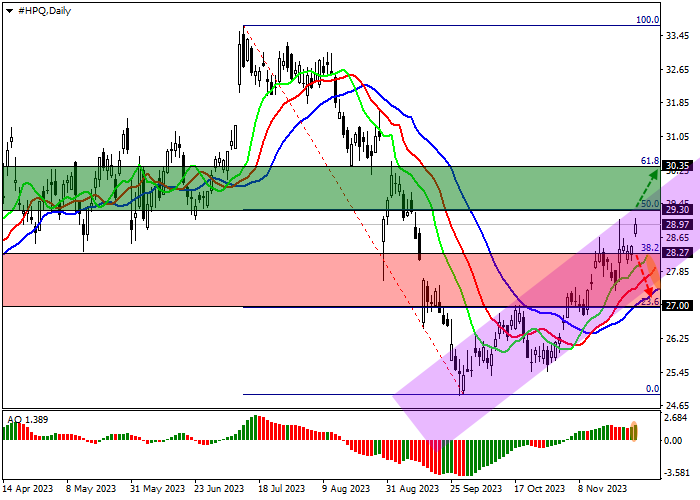

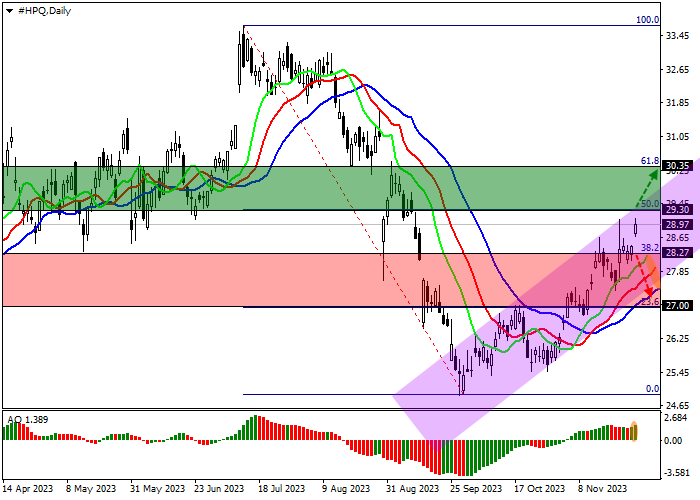

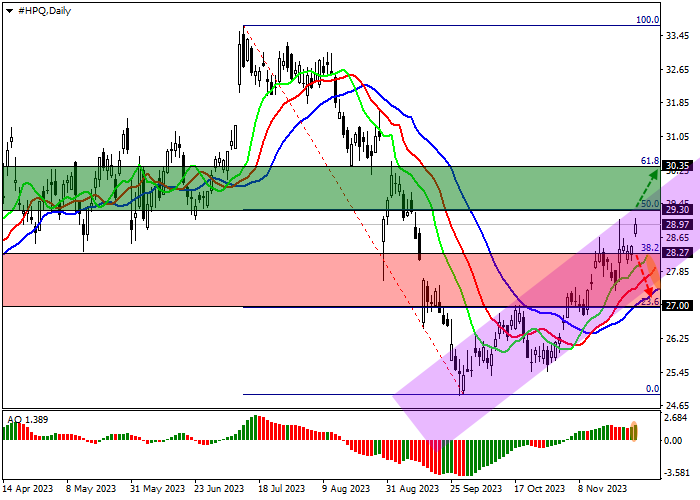

Current trend

Shares of Hewlett-Packard Co., an American giant in the field of information technology, are moving in a corrective trend around 28.97.

According to the financial statements for Q4 2023, the company failed to exceed the preliminary estimates of analysts: revenue amounted to 13.80 billion dollars instead of the expected 13.82 billion dollars. Management attributes the negative dynamics to a drop in sales in two key sectors. In the segment of personal systems, the indicator fell by 8.0% to 9.4 billion dollars, and in the segment of printing devices — to 4.4 billion dollars. In the first quarter of the new fiscal year, management expects to receive earnings per share (EPS) in the range of 0.76–0.86 dollars, and the annual forecast remained at the level of 3.25–3.65 dollars. Nevertheless, analysts are cautiously assessing the company's prospects if the printing segment, which accounts for more than 60.0% of the emitter's total revenue, does not recover. Thus, Morgan Stanley experts retained the "equal weight" rating, and the target price at the level of 31.0 dollar per share.

Support and resistance

On the D1 chart, the shares are trading in a corrective uptrend and are approaching the 50.0% Fibonacci level of an intermediate correction at around 29.30.

Technical indicators remain in a stable buy signal state: the fast EMAa of the Alligator indicator are consolidated above the signal line, and the AO histogram is in the buy zone, forming new ascending bars.

Support levels: 28.27, 27.00.

Resistance levels: 29.30, 30.35.

Trading tips

Long positions should be opened after the price consolidates above the local resistance level of 29.30 with the target at 30.35. Stop-loss – 28.80. Implementation time: 7 days and more.

Short positions should be opened after the price consolidates below the local support level of 28.27 with the target at 27.00. Stop-loss – 29.00.

Hot

No comment on record. Start new comment.