Current trend

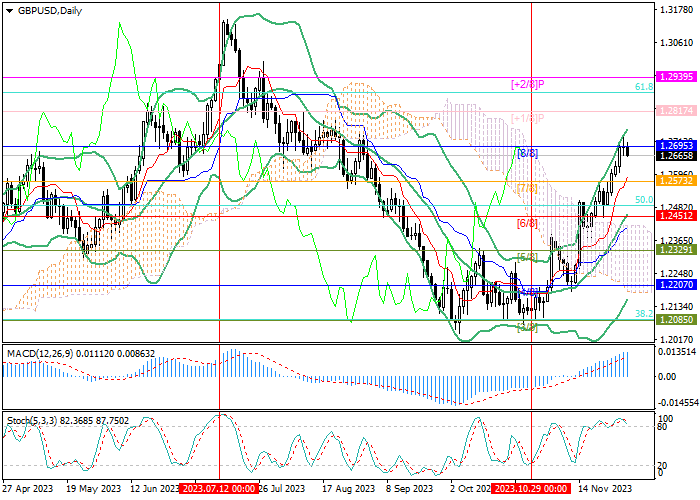

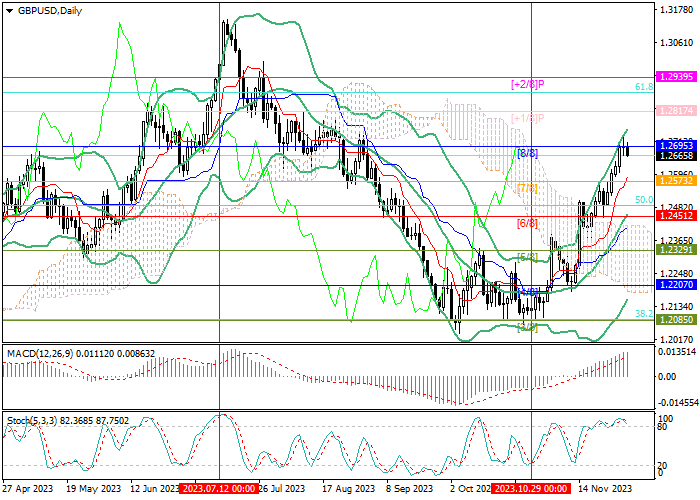

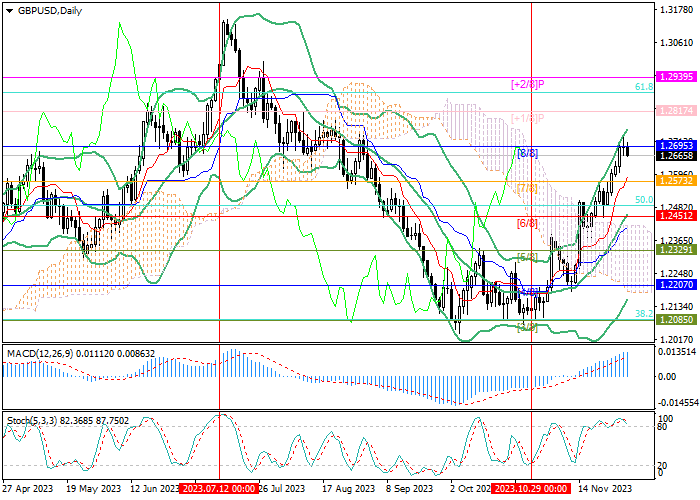

The GBP/USD pair has been showing active upward trading dynamics throughout November and is currently testing the 1.2695 level (Murrey level [8/8]) with the support of monetary factors.

Investors hope that the US Federal Reserve will soon begin discussing the beginning of the timing of interest rate cuts, however, at the same time, they allow a new adjustment in the cost of borrowing by the Bank of England (BoE). The American economy is recovering and increased by 5.2% in Q3 2023, while the labor market and demand remain stable, despite some weakening. At the same time, the inflation rate has already dropped to 3.2%, which is not so far from the target level of 2.0%. Under these conditions, the American monetary authorities are increasingly expressing the opinion that it is possible to defeat the growth of consumer prices without serious pressure on the economy. Yesterday, the member of the Board of Governors of the US Fed, Christopher Waller, even admitted that the interest rate could be reduced over the next three to five months if statistics confirm the slowdown in the consumer price index (CPI). Today, traders will pay attention to the October data on the basic price index of private consumption expenditures in the United States, which may adjust from 3.7% to 3.5%, putting pressure on the dollar's position.

Unlike their colleagues from the US Fed, BoE officials are not yet sure that they have done enough to return inflation to pre-crisis levels, although it is showing signs of decline and is now held at 4.6%. In his recent comments, the head of the regulator, Andrew Bailey, said that the current dynamics is explained by the correction of the cost of energy carriers, and not monetary factors. In addition, the official stressed that economic indicators are not conducive to discussing the timing of the start of a reduction in the cost of borrowing. The official's rhetoric significantly adjusted the mood of investors who previously believed that the regulator would begin a gradual transition to a "dovish" course by August 2024.

The difference in the monetary approaches of the BoE and the US Fed is likely to support the growth of the GBP/USD pair in the medium term.

Support and resistance

Technically, the price is testing the 1.2695 mark (Murrey level [8/8]), consolidating above which may cause further growth to 1.2817 (Murrey level [ 1/8]) and 1.2939 (Murrey level [ 2/8]). The key for the "bulls" is the level of 1.2451 (Murrey level [6/8], 50.0% Fibonacci retracement), the breakdown of which will allow the instrument to continue moving with the target of 1.2329 (Murrey level [5/8]) and 1.2207 (Murrey level [4/8]), however, this scenario seems less likely, since technical indicators confirm the current trend: Bollinger Bands are directed upwards, MACD is increasing in the negative zone, and Stochastic is horizontal in the overbought zone.

Resistance levels: 1.2695, 1.2817, 1.2939.

Support levels: 1.2451, 1.2329, 1.2207.

Trading tips

Long positions can be opened above 1.2695 with targets at 1.2817, 1.2939 and stop-loss at 1.2615. Implementation period: 5-7 days.

Short positions should be opened below the level of 1.2451 with targets at 1.2329, 1.2207 and stop-loss around 1.2530.

Hot

No comment on record. Start new comment.