Current trend

The XAG/USD pair has reached the level of 25.20 and is preparing to continue the uptrend with the support of increased demand for jewelry during the Christmas holidays and the weakening of the USD position amid investors' expectations of a relative imminent change in the vector of monetary policy in the United States.

Statistics on gross domestic product for Q3 2023 reflected an increase of 5.2% YoY, which turned out to be 0.3% higher than the previous estimate, while analysts predicted that the indicator would reach only 5.0%, although they expected that the growth rate would be revised upwards. Nevertheless, the positive data practically did not supportUSD, as trading participants are currently focused on the next steps of the US Federal Reserve. According to the indications of the Chicago Mercantile Exchange's CME FedWatch Tool, yesterday, traders considered a 34.6% probability of an interest rate cut as early as March 2024, and after the publication of GDP data, this indicator rose to 43.6%.

Meanwhile, according to the latest report of the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in silver increased to 27.5 thousand from 22.4 thousand previously. If one pays attention to the balance, then the "bears" are actively increasing their advantage against the background of a local reduction in purchase positions: swap dealers have a balance of 41.809 thousand against 33.634 thousand for "bulls". Last week, buyers reduced the number of contracts by 1.138 thousand, while sellers increased them by 5.589 thousand.

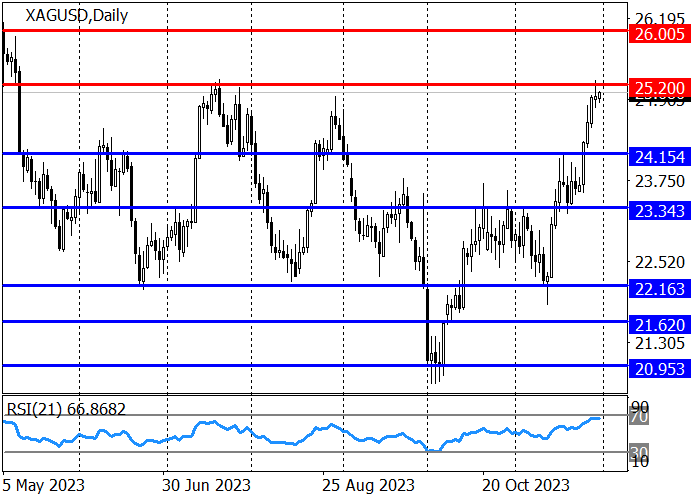

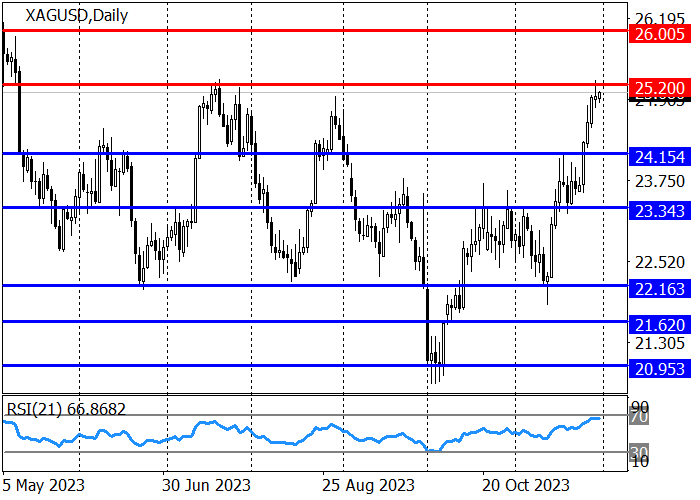

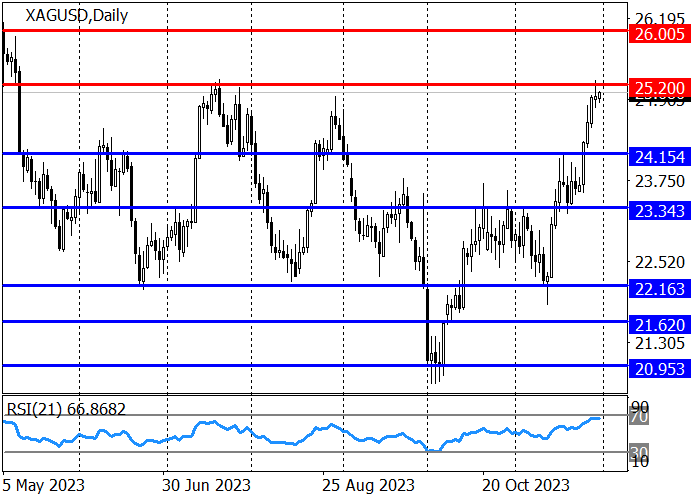

Against this background, the long-term uptrend in the XAG/USD pair continues. The traders reached the resistance level of 25.20, and if it is broken through and the price consolidates higher, then the May maximum of 26.00 will be the next target. If the resistance level of 25.20 is held by sellers, then the instrument will go into correction with the target of 24.15. The RSI indicator is approaching the overbought zone, so traders should be careful with opening and holding long positions.

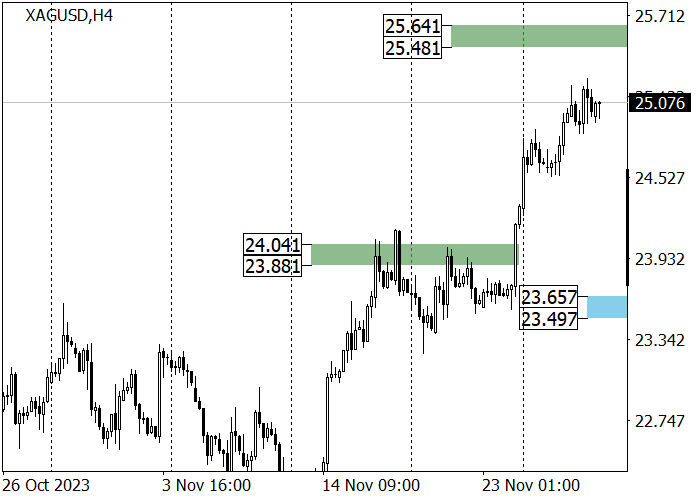

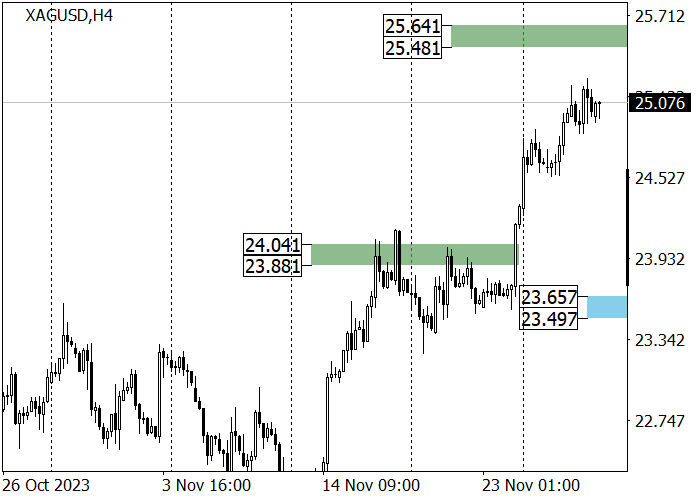

The medium-term trend is upward. Last week, trading participants broke through the target zone 2 (24.04–23.88), and now the movement continues to the levels of 25.64–25.48, after reaching which a price correction is likely. Key support for the trend is shifting to the levels of 23.65–23.49; if this zone is reached as part of the correction, then one may consider long positions with the target at the current week’s high of 25.23.

Support and resistance

Resistance levels: 25.20, 26.00, 26.85.

Support levels: 24.14, 23.35.

Trading tips

Short positions can be opened from the level of 25.20 with the target at 24.15 and stop-loss around 25.50. Implementation period: 9–12 days.

Long positions may be opened above the level of 25.50 with the target at 26.00 and stop-loss around 25.25.

Hot

No comment on record. Start new comment.