Current trend

The FTSE 100 index is being adjusted around 7436.0, showing the weakest dynamics among stock indicators of developed countries, the main reason for which is still weak macroeconomic statistics and internal problems of large corporations.

Yesterday, the representatives of the financial conglomerate Barclays plc announced their intention to reduce another 900 employees of legal and risk management departments to optimize costs. Since the beginning of 2023, the shares of Barclays plc have already lost more than 27.0% in value, and the bank's capitalization has decreased by 12.5% to 21.1 billion pounds.

Currently, there is an unusual situation in the domestic bond market, where a downward correction continues, despite the fact that similar instruments in the EU and the US are actively growing. Popular 10-year UK bonds are traded at a rate of 4.1265%, which is significantly lower than the indicator of the beginning of the week at 4.332%, and 20-year securities are held at 4.598% compared to 4.760% earlier.

The growth leaders in the index are JD Sports Fashion plc ( 5.71%), Fresnillo plc ( 5.62%), Ocado Group plc ( 4.69%), Rightmove plc ( 3.60%).

Among the leaders of the decline are Enter plc (-4.10%), Prudential Plc (-3.52%), and Standard Chartered plc (-3.29%).

Support and resistance

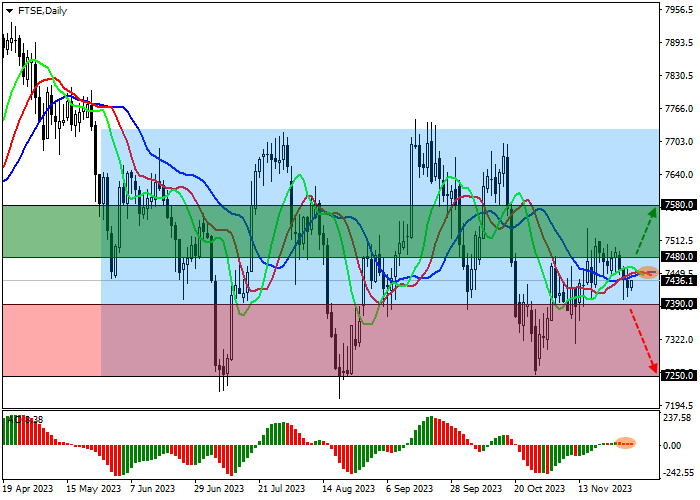

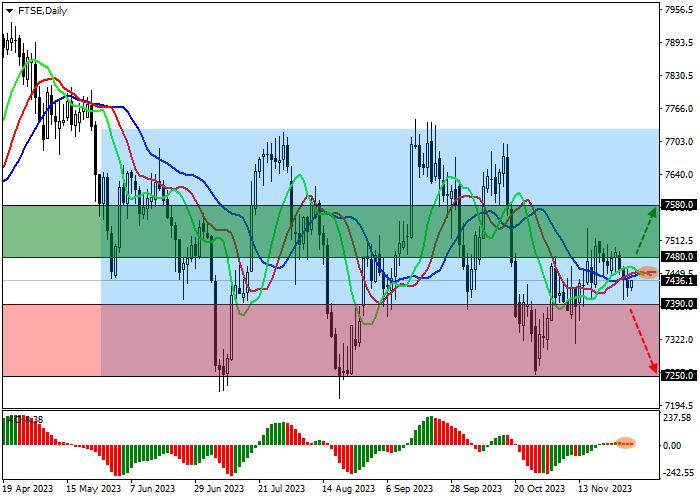

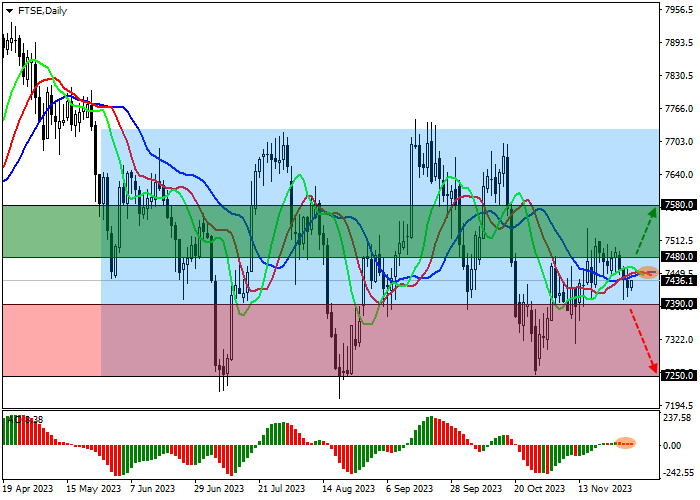

On the D1 chart, the index quotes continue the local correction, reversing up again and approaching the resistance line of the lateral channel with the borders of 7740.0–7250.0.

Technical indicators are in a state of uncertainty, confirming local correction: the range of EMAs fluctuations remains quite narrow, and the AO histogram forms new correction bars, being in the buying zone.

Support levels: 7390.0, 7250.0.

Resistance levels: 7480.0, 7580.0.

Trading tips

Long positions should be opened after the price is consolidated above the resistance level of 7480.0 with the target at 7580.0 and stop-loss at 7420.0. Implementation time: 7 days and more.

Short positions should be opened after the price is consolidated below the local support level at 7390.0 with the target at 7250.0. Stop-loss — 7460.0.

Hot

No comment on record. Start new comment.