We present a medium-term investment review of the AUD/USD pair.

Over the past month, the situation in the global financial market has changed significantly, and a local negative scenario for the movement of a trading instrument has become less likely: the position of the Australian currency is considered more stable compared to the American dollar, which may continue its downward correction.

At the beginning of the month, the Reserve Bank of Australia (RBA) raised the interest rate from 4.10% to 4.35%, although it had previously considered the possibility of further keeping the rate unchanged. Thus, the regulator adheres to a policy of aggressively influencing inflation risks, which may increase significantly by the end of the year. In an explanatory speech, the head of the department, Michelle Bullock, noted that this decision was made almost unanimously, and among the key factors in favor of tightening monetary policy were negative forecasts for rising consumer prices and extremely low household spending compared to previous periods. The official did not rule out the possibility of another adjustment to borrowing costs in the future to ensure that inflation returns to the target range of below 2.0% as soon as possible. In addition, the country has also noted an improvement in labor market indicators: in October, employment increased by 55.0K after an increase of 7.8K in September, and the wage change index in the third quarter increased by 4.0% compared to 3.6% in the past period.

The main factor in the growth of the trading instrument recently is the US currency, which has already lost more than 4.78% against the actions of US Federal Reserve officials, who have been keeping interest rates at 5.25–5.50% for a long time, expecting inflation to weaken. In addition, new home sales fell from 719.0K to 679.0K in October, the lowest level since April, and unemployment reached 3.9% for the first time since January 2022 amid a 150.0K increase in nonfarm payrolls compared to an increase of 297.0K a month earlier.

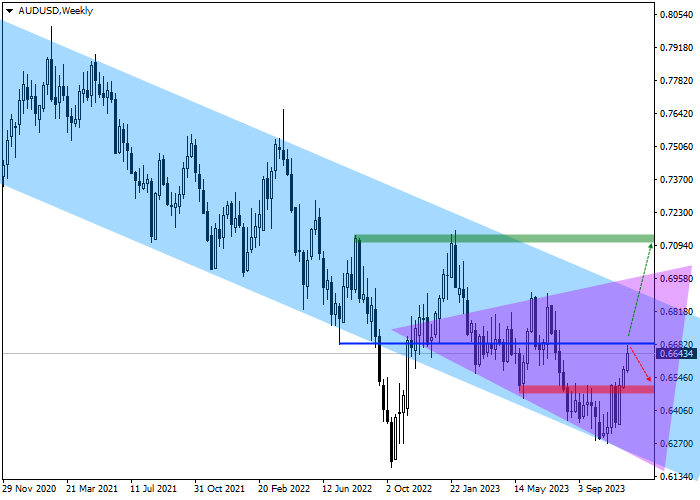

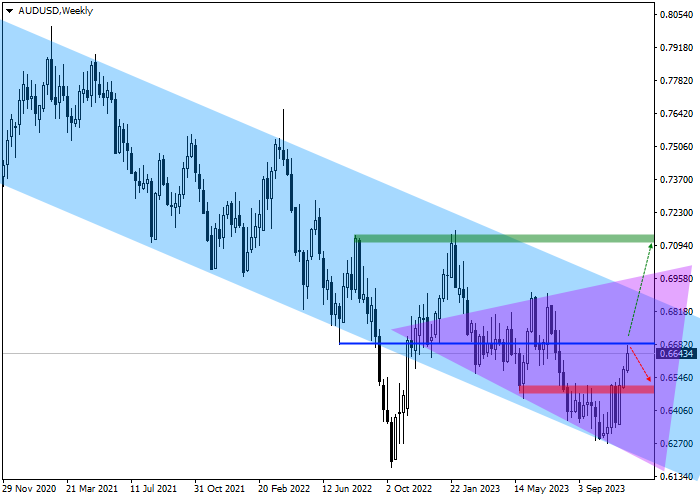

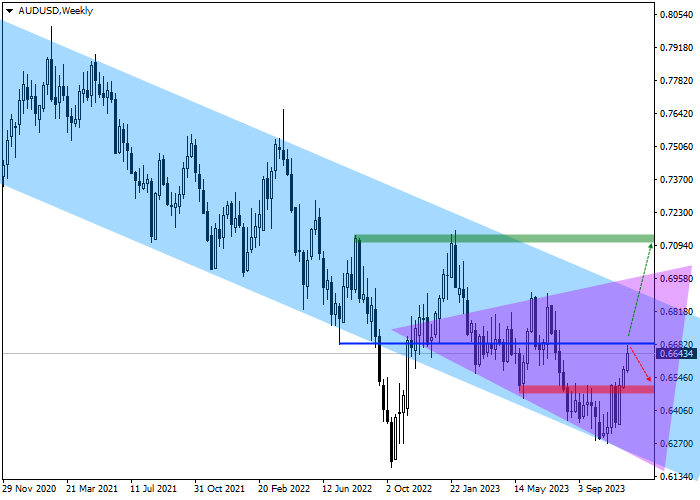

In addition to the underlying fundamental factors, the development of the positive dynamics of the asset is confirmed by the readings of technical indicators: on the weekly chart, the price is moving within a new upward wave within the global downward corridor with boundaries of 0.6830–0.6150.

After exiting the local sideways range and overcoming the resistance level at 0.6520, the quotes received the necessary support that will allow them to reach the global channel resistance level of 0.6850. Let’s consider the key levels on the daily time interval.

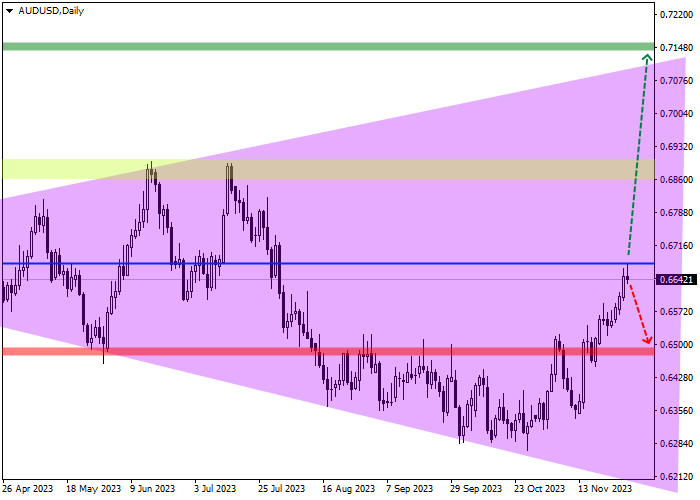

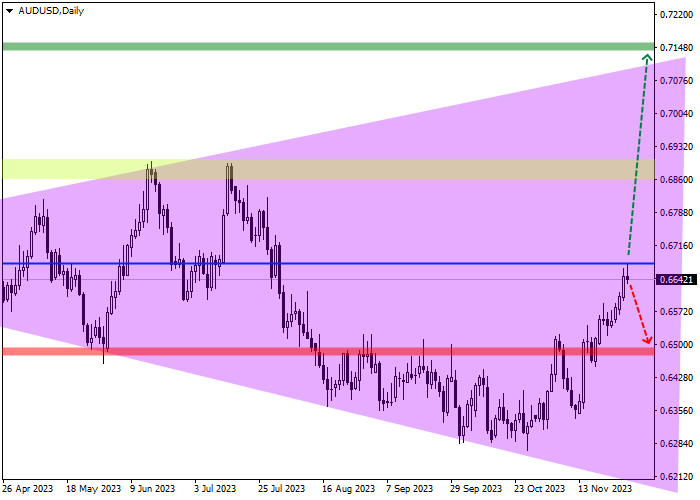

As can be seen on the chart, the trading instrument continued to implement the main pattern of this year – the Expanding formation, within which the fifth wave is intensifying. If 0.6480 is reached, coinciding with the low of May 31, the global upward scenario will be canceled or noticeably delayed, and it is better to liquidate the buy positions. At 0.7150, coinciding with the global maximum of January 22, 2022, there is the target zone, if reached, it is worth taking profits on open buy positions.

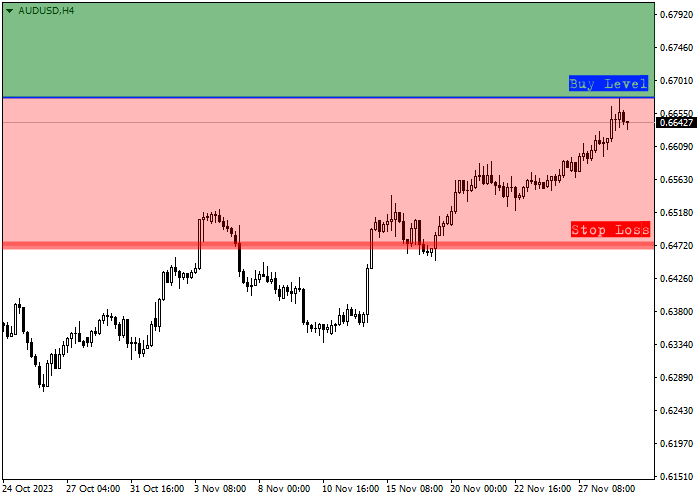

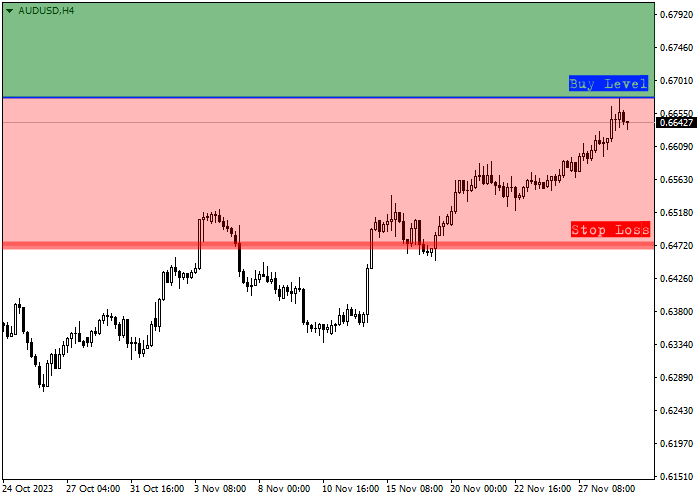

Trade entry levels should be assessed in more detail on the four-hour chart.

The entry level for buy trades is at 0.6680, and a local signal can be received in the coming days after the quotes consolidate above the local high of the current month, after which the necessary confirmation to open long positions will be generated.

Considering the average daily volatility of the AUD/USD pair over the past month, which has decreased to 36.7 points, the price movement to the target zone of 0.7150 could take approximately 49 trading sessions. With an increase in the indicator, it could reduce to 37 days.

Hot

No comment on record. Start new comment.