Current trend

The WTI Crude Oil quotes move within a sideways trend, trading around 76.55. After a volatile start to the month, energy prices have stabilized somewhat as the date for the next OPEC meeting has been set. The meeting will be held on November 30 in a video conference format: its postponement was due to disagreements within the alliance regarding the oil production limit. Experts expect that Saudi Arabia and Russia will keep the current production levels and limits, which agreed to reduce the figures by another 1.3M barrels per day.

The local dynamics of the asset largely depend on reports on oil reserves in the United States, and this week, the positive dynamics were interrupted: according to the American Petroleum Institute (API), after a strong increase of 9.074M barrels a week earlier, the value corrected by –0.817M barrels, which is almost guarantees a reduction in indicators according to the Energy Information Administration of the US Department of Energy (EIA), which will be published today. Analysts expect the indicator to change by –0.933M barrels after increasing a week earlier by 8.701M, supporting quotes.

Support and resistance

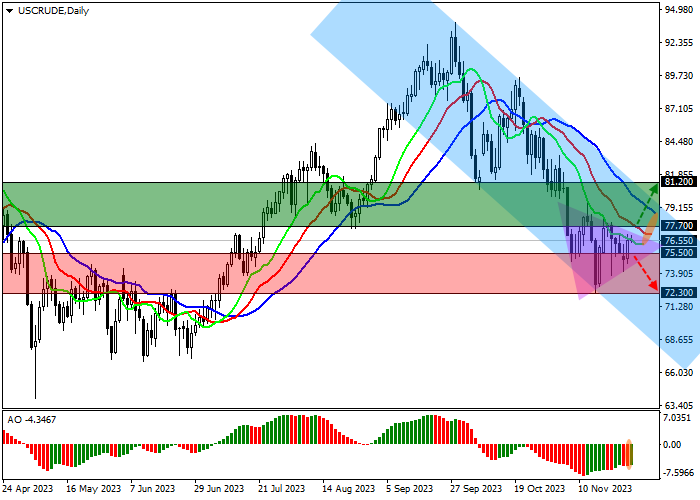

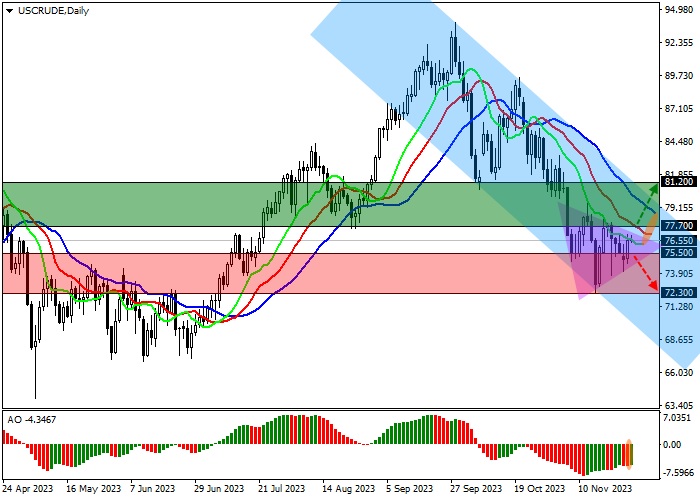

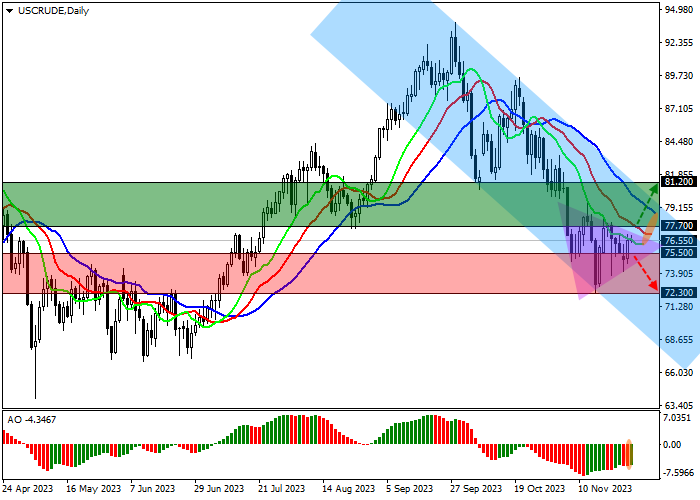

On the daily chart, the trading instrument is correcting within the global downward channel with boundaries of 79.20–71.20, and on the local interval, a Head and shoulders pattern with the implementation line at 77.70 is forming.

Technical indicators are weakening the sell signal: fast EMAs on the Alligator indicator have begun to approach the signal line, and the AO histogram is forming ascending bars, approaching the transition level.

Resistance levels: 77.70, 81.20.

Support levels: 75.50, 72.30.

Trading tips

Long positions may be opened after the price rises and consolidates above 77.70 with the target at 81.20. Stop loss – 76.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 75.50 with the target at 72.30. Stop loss – 77.00.

Hot

No comment on record. Start new comment.