Current trend

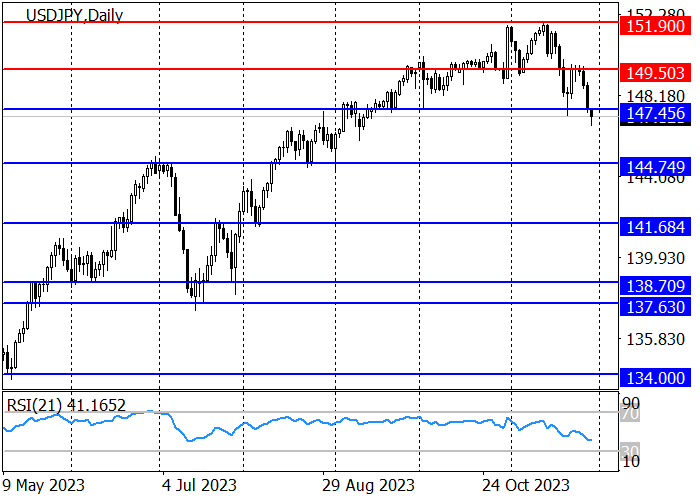

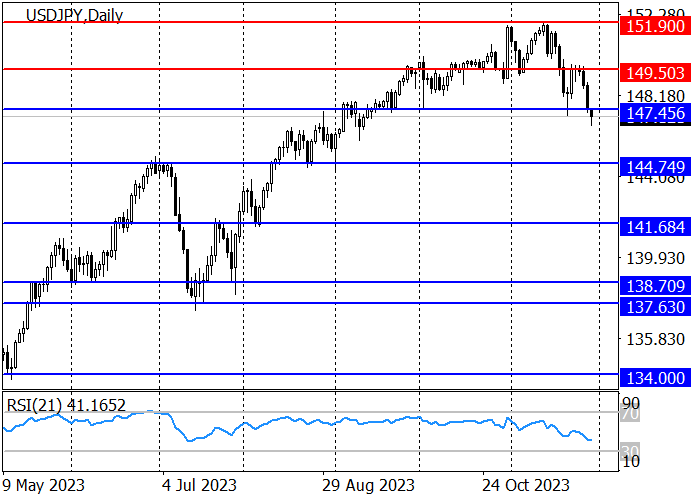

During the Asian session, the USD/JPY pair declines moderately, developing corrective dynamics in the short term and renewing the lows of September 12. The price is preparing to overcome the support level of 147.45 and continue moving to the area of 144.75.

The American dollar lost ground for the third week, reaching 102.500 in the USD Index, as investors fully factored the end of the US Federal Reserve’s monetary tightening cycle into the price. Yesterday, representatives of the regulator admitted the possibility of a transition to the “dovish” rhetoric in the coming months. Officials believe that the interest rate will need to be kept at the current level of 5.50% for some time for inflation to return to the target level of 2.00%. Board member Michelle Bowman noted that rising energy costs would likely offset some of the progress made in reducing the rate but yesterday board member Christopher Waller said that if the pace of consumer prices slows further, there will be no reason for the US Federal Reserve to insist on high borrowing costs, which provided additional support to the dollar “bears”.

Investors are waiting for the Bank of Japan to switch to the “hawkish” rhetoric: the interest rate has been in the negative zone since 2016 and currently stands at –0.10%. Inflation statistics published yesterday showed a decline in the core consumer price index from 3.4% to 3.00% YoY, worse than the forecast of 3.4%: thus, there is no reason for officials to increase borrowing costs yet, and it may weaken the yen and lead to growth of the USD/JPY pair in the medium term after the end of the correction.

Support and resistance

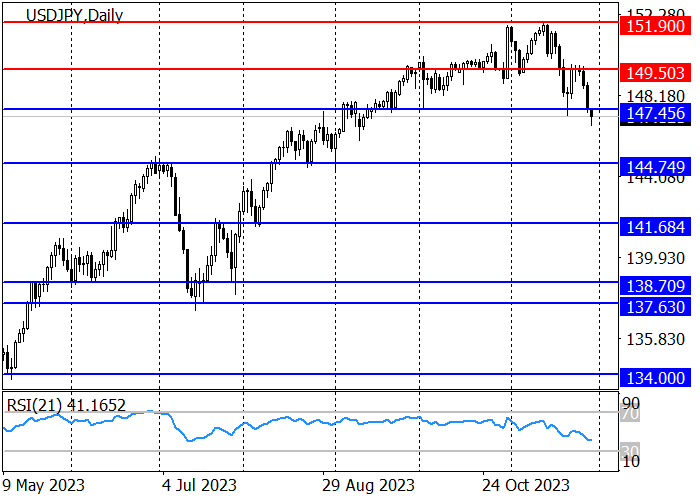

The long-term trend remains upward but now, as part of the correction, the price has reached the support level of 147.45 and is trying to consolidate below it, after which the target for the decline will be 144.75.

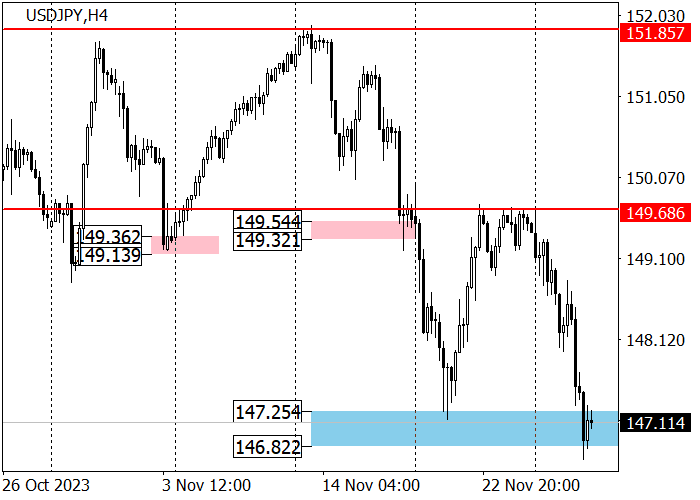

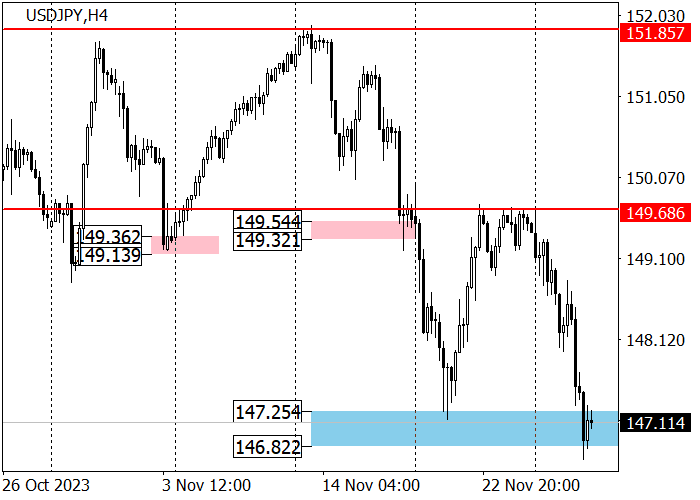

As part of the medium-term upward trend, the pair reached the key support zone of 147.25–146.82, which it could not overcome, as a result of which long positions with the targets of 149.70 and 151.85 became relevant. If the breakdown takes place, it will be possible to consider selling with the target in zone 2 (142.87–142.47).

Resistance levels: 149.50, 152.00, 155.50.

Support levels: 147.45, 144.75.

Trading tips

Short positions may be opened from 147.80 with the target at 144.75 and stop loss around 148.80. Implementation time: 9–12 days.

Long positions may be opened above 148.80 with the target at 151.85 and stop loss 147.45.

Hot

No comment on record. Start new comment.