To profit in the forex market, you don't necessarily have to be a skilled trader. There are options that allow you to generate profits even if you lack trading expertise. One such option is to use the services of a signal provider.

In forex trading, a signal provider is an individual or company that provides trading signals to others, either directly through their private channels or via third-party platforms. Signal providers typically charge a subscription fee if someone wants to use their services. However, some new signal providers may offer their services for free as a promotion to attract customers.

By using a signal provider's services, you no longer need to conduct independent analysis or execute trade transactions, especially if your trading account is connected to the signal provider's account. Therefore, even beginners can generate profits in the forex market by utilizing the services of a signal provider.

However, this holds true only if you choose the right signal provider. Opting for the wrong signal provider may lead to significant losses or even margin calls. To avoid mistakes in selecting a signal provider, consider the following factors.

Final Results

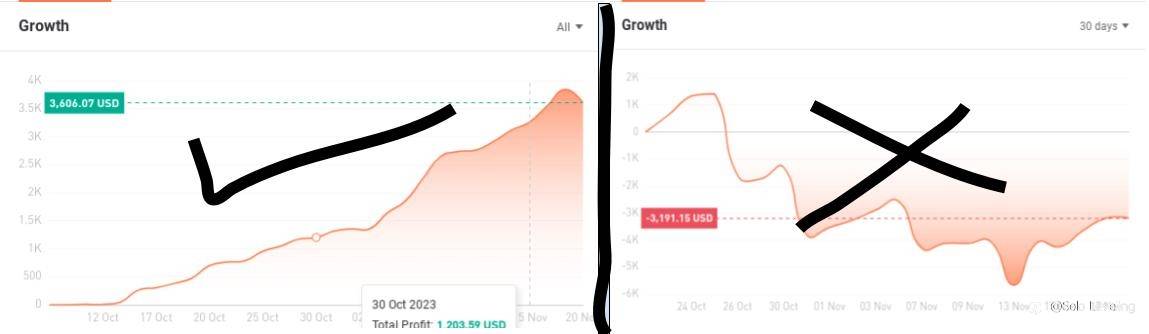

The first thing to assess when choosing a signal provider is the final results. Do their signals result in cumulative profits, or do they lead to losses? If the overall outcome is positive, it indicates that the signals provided are profitable and worth considering. Conversely, a negative outcome suggests that the signals are not suitable for use.

Final results are the most basic parameter for evaluating the suitability of a signal provider and are often a common benchmark for traders when choosing a signal provider. However, this is only an external parameter and not sufficient to truly identify the suitability of a signal provider.

Stable and Consistent Performance

Choosing a signal provider is similar to selecting stocks, mutual funds, or ETFs—you need to examine a provider's performance from the past to the present. If the performance is stable and consistent in generating profits, it is a positive aspect for the signal provider. On the other hand, if the performance is fluctuating or tends to be negative, it's advisable to look for another signal provider.

Stable and consistent performance indicates that a signal provider has good capabilities in generating profits, manages trade risks well, and adheres to their trading plan with discipline. It should be understood that a signal provider being "stable and consistent" does not mean they post profits every month. It is acceptable if there are certain months with negative accumulations, as long as the trading account's capital grows gradually and continuously.

Maximum Drawdown

Maximum drawdown refers to the worst equity decline experienced by an individual during trading. This is a crucial risk indicator to consider when choosing a signal provider, as it reflects the provider's ability to manage trading risks. A large maximum drawdown indicates poor risk management by a signal provider.

For example, if you find a signal provider with a maximum drawdown of 100%, it means the provider has experienced a margin call. In other words, the signal provider employs aggressive risk management, which is highly risky to follow. Additionally, risk management models like these suggest that they are not true professionals. A professional trader will always choose a safer approach, even if it means making slightly less profit than risking the entire capital.

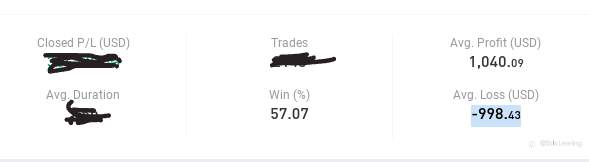

Risk-to-Reward Ratio

The risk-to-reward ratio (RR) is the comparison between the risk and reward of a trade. Generally, a lower RR is considered a positive evaluation, while a higher RR is viewed negatively.

RR is a crucial indicator to assess a signal provider. A higher RR than 1 indicates that a signal provider is taking more significant risks compared to the potential profits on each trade. Consequently, if the trade fails, the resulting losses can wipe out the gains from several trades at once. This also has the potential to make it challenging for the signal provider to recover from losses.

On many copy signal or social trading platforms, you might not find RR directly on a signal provider's profile. However, you can calculate it yourself by comparing the average loss with the average profit. The result of this comparison will show the average RR value used by the signal provider.

For example, in the above image, the average profit is 1,040.09, and the average loss is -998.43, resulting in an RR value of 0.95. A value below one indicates that the potential risk is lower than the potential reward.

Order History

Order history is valuable data to examine the behavior of the chosen signal provider. A good signal provider should have nearly identical order histories from one trade to another. This indicates that the signal provider is disciplined in using their strategy. Conversely, if there are significant differences between orders in terms of results, risk, reward, or trade size, it could mean that the signal provider lacks discipline in implementing their trading strategy.

Additionally, you can observe how a signal provider behaves during consecutive losses or large losses. If they trade more aggressively, such as conducting transactions more frequently or using larger lots and even both simultaneously, it indicates that the signal provider's mental state is unstable. It is advisable to avoid such a signal provider, as it could pose a significant financial risk.

Using the services of a signal provider can indeed make it easier for you to profit from trading. You no longer need to conduct analysis or execute trades. However, not all signal providers have the quality you need to follow. Therefore, it is crucial to filter out which signal providers are good and which are not. Selecting the wrong signal provider can result in financial losses for yourself.

To choose the best signal provider, you can refer to the parameters explained above. You may decide to follow a signal provider when they have favorable assessments based on these parameters. However, providers with such positive evaluations often charge higher subscription fees than others. Therefore, you may need to spend more money to use their services.

Nevertheless, considering the potential profits and the security of your capital, the higher cost should not be a concern. It is much better to pay a higher subscription fee than to risk your entire trading account capital.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

-THE END-