Current trend

The NZD/USD pair is developing downward dynamics formed in the short term on November 6, and updating local lows from November 2. The instrument is testing 0.5865 for a breakdown, while analysts are awaiting today's publication of macroeconomic statistics from the US on inflation.

Forecasts suggest a slowdown in the Consumer Price Index in October from 0.4% to 0.1% on a monthly basis and from 3.7% to 3.3% on an annual basis. At the same time, the Core CPI excluding Food and Energy is likely to remain at 0.3% and 4.1%, respectively. These data will have a decisive influence on the future policy of the US Federal Reserve, which, as shown by representatives of the regulator last week, still does not exclude the possibility of a further increase in borrowing costs.

At the same time, the pressure on the position of the instrument is exerted by statistics from New Zealand. Business NZ's Performance of Services Index fell from 50.7 points to 48.9 points in October, while Food Price Index accelerated its negative trend from -0.4% to -0.9%.

Chief Executive Officer of ANZ Bank NZ Ltd. Antonia Watson said the company recorded a decline in full-year profits amid a weaker-than-expected second half. The bank's net income, which includes gains and losses from economic hedging, decreased by 7.0% year-on-year (2.13 billion dollars versus 2.30 billion dollars), while cash income increased by 10.0% (2.26 billion dollars versus 2.06 billion dollars). Watson also suggested the country's inflation would exceed the Reserve Bank of New Zealand's target range, allowing monetary authorities to keep borrowing costs at peak levels for longer, putting pressure on businesses and mortgage holders.

Support and resistance

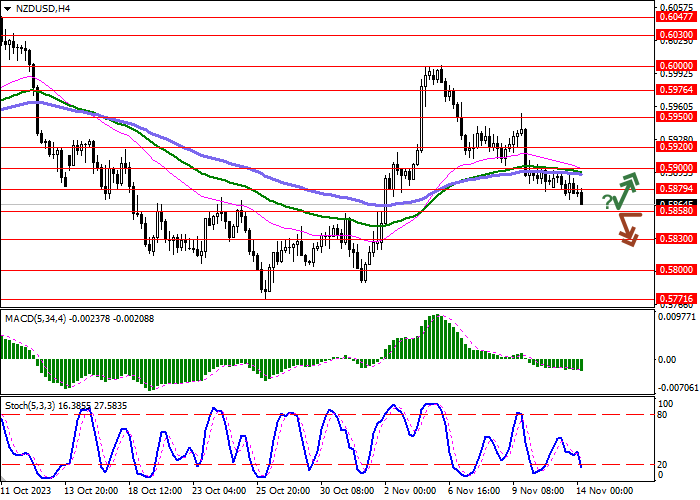

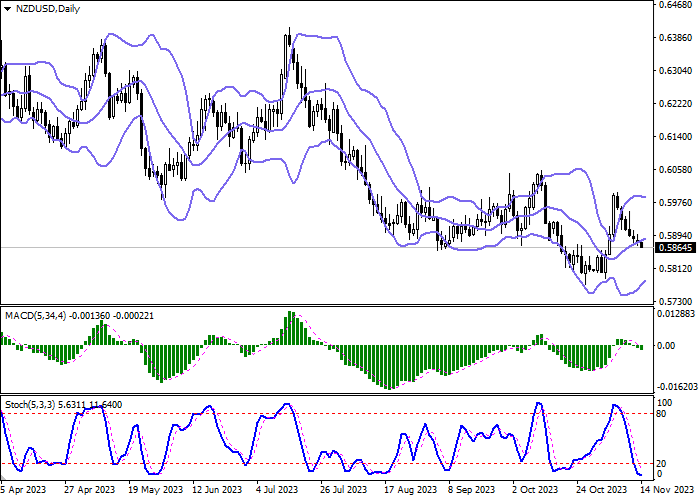

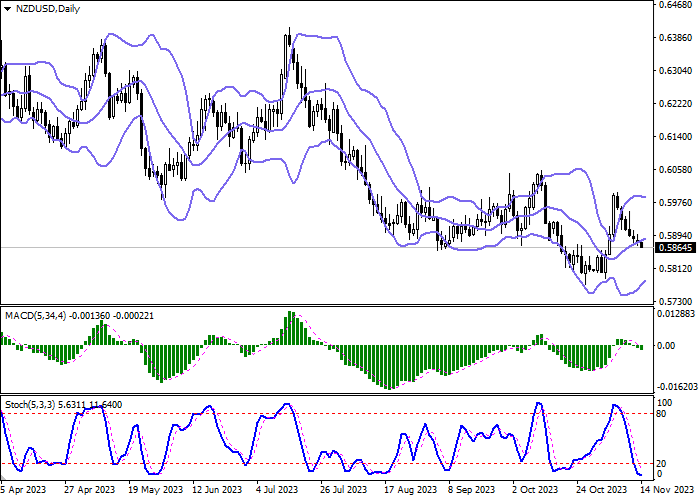

On the D1 chart Bollinger Bands are trying to reverse horizontally again. The price range is narrowing, pointing at the ambiguous nature of trading in the short term. MACD is going down preserving a stable sell signal (located below the signal line). The indicator is also consolidating below the zero level. Stochastic retains a steady downtrend but is located in close proximity to its lows, which indicates the risks of oversold New Zealand dollar in the ultra-short term.

Resistance levels: 0.5879, 0.5900, 0.5920, 0.5950.

Support levels: 0.5858, 0.5830, 0.5800, 0.5771.

Trading tips

Short positions may be opened after a breakdown of 0.5858 with the target at 0.5800. Stop-loss — 0.5879. Implementation time: 1-2 days.

A rebound from 0.5858 as from support followed by a breakout of 0.5879 may become a signal for opening new long positions with the target at 0.5920. Stop-loss — 0.5858.

Hot

No comment on record. Start new comment.