Current trend

During the Asian session, the USD/CAD pair is actively developing the “bullish” momentum formed last week, when the asset retreated from the lows of October 18, and is testing the level of 1.3820.

Investors are awaiting the publication of macroeconomic statistics on consumer inflation in the United States: forecasts suggest a decrease in inflation pressure from 0.4% to 0.1% MoM and from 3.7% to 3.3% YoY, and the core indicators will remain at 0.3% and 4.1%. In this case, the likelihood of the US Federal Reserve’s monetary tightening cycle ending will increase: thus, data from the Chicago Mercantile Exchange (CME) FedWatch Instrument suggests that during the December meeting interest rates will remain unchanged with a probability of 86.0%.

Today, there will be a speech by Deputy Governor of the Bank of Canada Tony Gravelle, who is expected to comment on the regulator’s further actions: investors expect the gradual completion of the program to increase borrowing costs and the beginning of its reduction in mid-2024. This week, September Canadian data on wholesale sales dynamics will be published, which, according to preliminary estimates, will decrease from 2.3% to 0.0%.

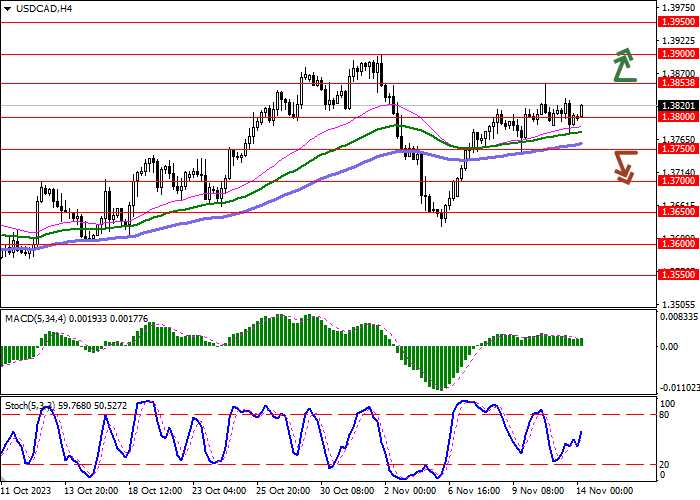

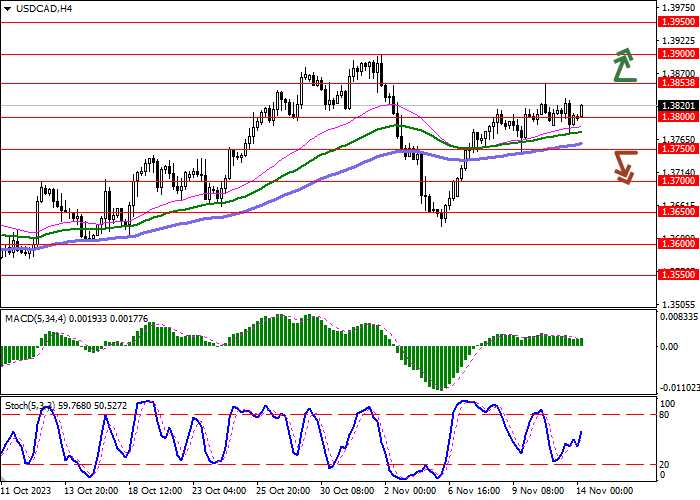

Support and resistance

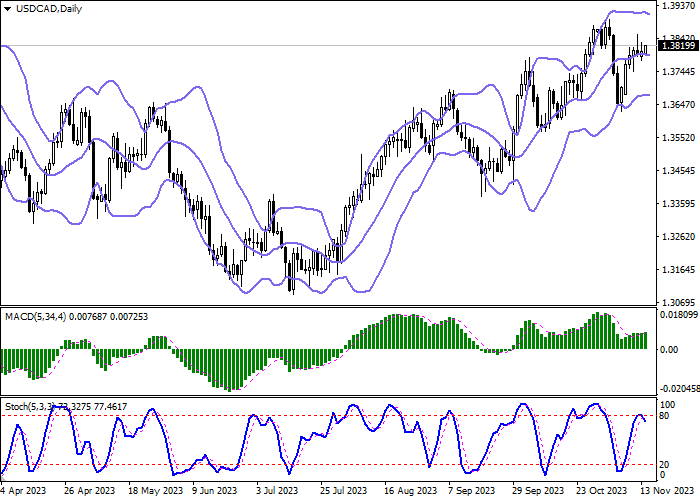

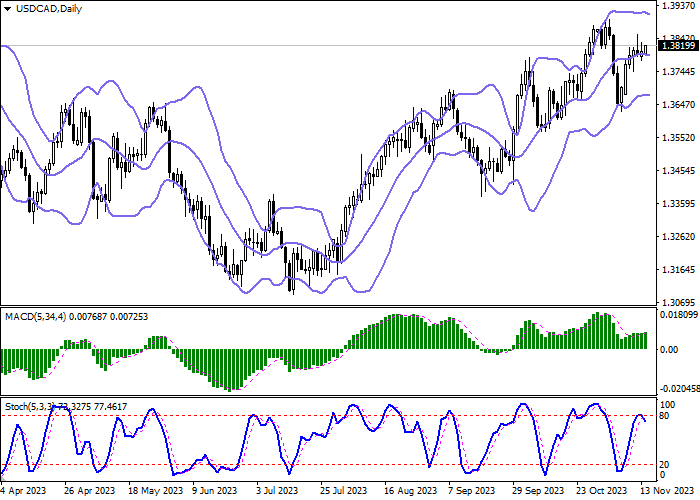

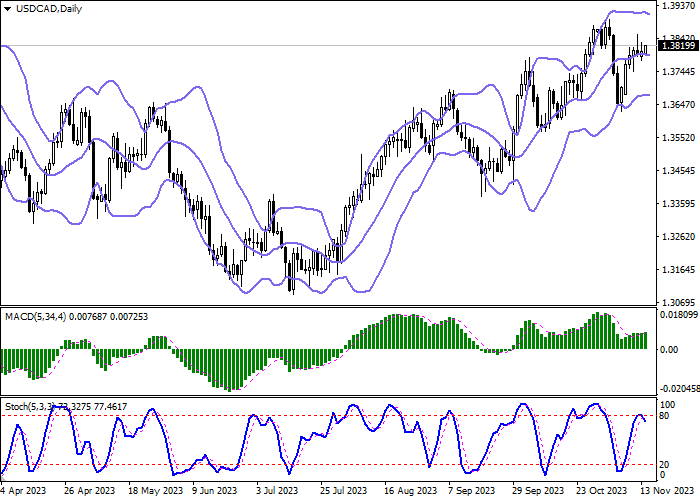

On the daily chart, Bollinger Bands are moving flat: the price range narrows slightly from above, remaining quite spacious for the current market activity. The MACD indicator is growing, maintaining a poor buy signal (the histogram is above the signal line). Stochastic reversed at “80” into a downward plane, signaling in favor of the imminent development of a correction.

Resistance levels: 1.3853, 1.3900, 1.3950, 1.4000.

Support levels: 1.3800, 1.3750, 1.3700, 1.3650.

Trading tips

Short positions may be opened after a confident breakdown of 1.3750 with the target at 1.3650. Stop loss – 1.3800. Implementation time: 2–3 days.

Long positions may be opened after growth and breakout of 1.3853 with the target at 1.3950. Stop loss – 1.3800.

Hot

No comment on record. Start new comment.