Current trend

The leading Japanese stock index NI 225 is correcting near the level of 32612.0.

The period of global corporate reporting continues. Bank holding company Mizuho Financial Group Inc. recorded revenue of 698.7 billion yen, which was higher than the forecast of 586.6 billion yen, and its earnings per share amounted to 67.28 yen, exceeding the 53.35 yen that analysts had expected, but falling short of 96.75 yen, shown a quarter earlier.

Revenue of Japan Post Bank Co., Ltd. was 656.04 billion yen against expectations of 184.3 billion yen, and earnings per share were 26.37 yen, exceeding the forecast of 23.64 yen. In turn, Japan Post Holdings Co., Ltd. reported revenue of 2.770 trillion yen, which exceeded the 2.437 trillion yen estimated by experts, and its earnings per share reached 37.44 yen, which was better than the forecast of 21.24 yen and than a loss of -2.47 yen recorded a quarter earlier.

Revenue from construction company Kajima Corp. amounted to 722.33 billion yen, exceeding the 629.86 billion yen expected by analysts, but earnings per share were recorded at 63.69 yen, missing the 67.30 yen forecast.

The growth leaders in the index are Taisei Corp. ( 7.90%), Sumitomo Electric Industries Inc. ( 4.30%), Isuzu Motors Ltd. ( 3.89%), Kawasaki Heavy Industries Ltd. ( 3.83%).

Among the leaders of the decline are DIC Corp. (-5.04%), Kajima Corp. (-4.22%), Nissan Chemical Industries Ltd. (-3.54%).

Support and resistance

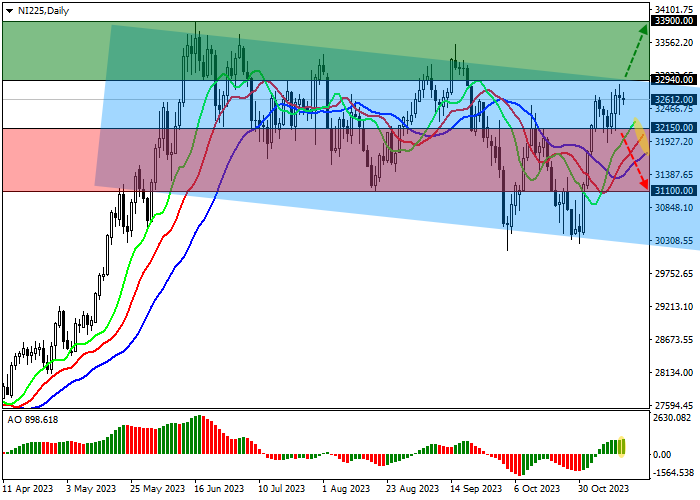

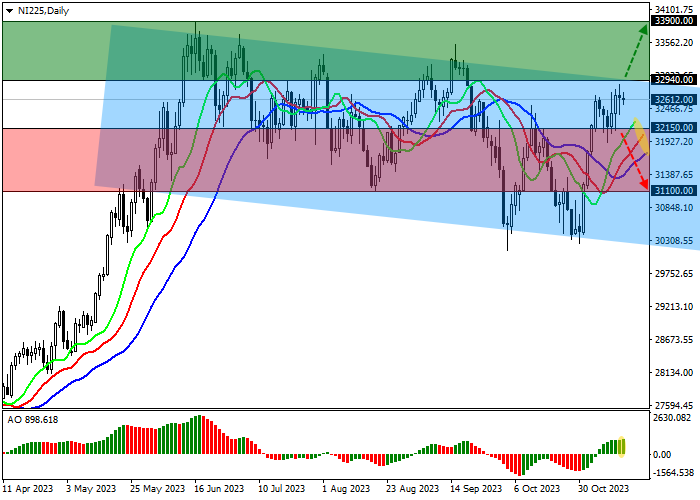

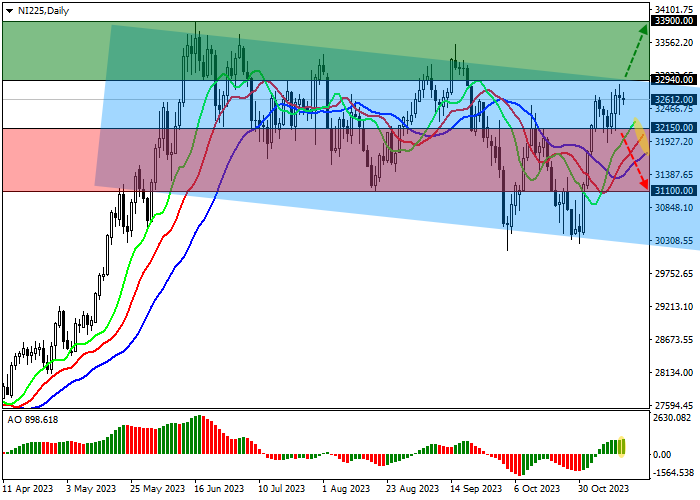

On the daily chart, the price remains within the local downward channel with dynamic boundaries of 33000.0–30300.0.

Technical indicators are still in a buy signal state, working out an upward correction: the AO histogram is forming new corrective bars, and fast EMAs on the Alligator indicator are moving away from the signal line.

Support levels: 32150.0, 31100.0.

Resistance levels: 32940.0, 33900.0.

Trading tips

If the asset continues growing and the price consolidates above the resistance level of 32940.0, long positions will be relevant with target at 33900.0. Stop-loss — 32500.0. Implementation time: 7 days and more.

If the asset reverses and continues local decline and the price consolidates below the support level of 32150.0, short positions can be opened with the target at 31100.0. Stop-loss — 32700.0.

Hot

No comment on record. Start new comment.