Current trend

Shares of Pfizer Inc., the largest American pharmaceutical company, are corrected around 28.96 amid falling demand for COVID-19 vaccines.

Last month, management announced the need for additional investments of 5.6 billion dollars to compensate for the government's return of several million doses of the Paxlovid antiviral vaccine and stocks of the Comirnaty drug. Against the background of falling sales of these drugs, the revenue of Pfizer Inc. decreased by 41.0% from last year's levels, amounting to 13.2 billion dollars in Q3 2023. Also, for the first time in more than 10 years, the company reported a loss per share of -0.17 dollars and a net loss of -0.42 dollars. Nevertheless, the prospects for the growth of the trading instrument remain: in Q4, the transaction for the purchase of Seagen Inc. is likely to be closed, for which the company has already raised about 31.0 billion dollars, and this will increase annual revenue to 58.0–61.0 billion dollars, and adjusted diluted earnings per share to 1.45–1.65 dollars.

The management approved the last dividends this year, the payment of which is scheduled for December 4 and will amount to 0.41 dollars per share. Despite the drop in revenue, the yield varies around 5.32%.

Support and resistance

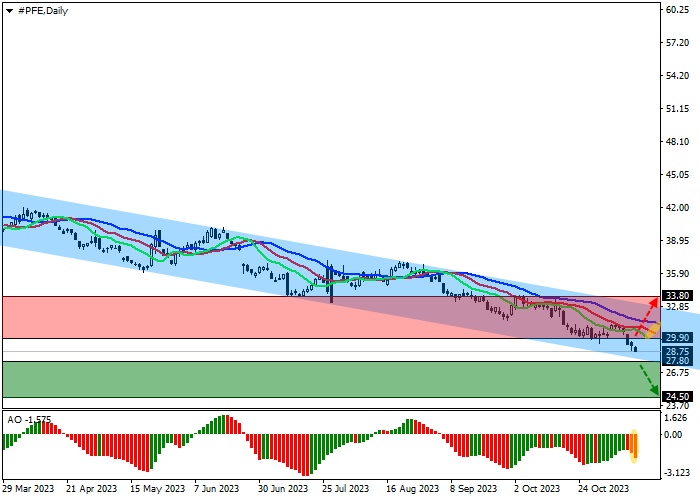

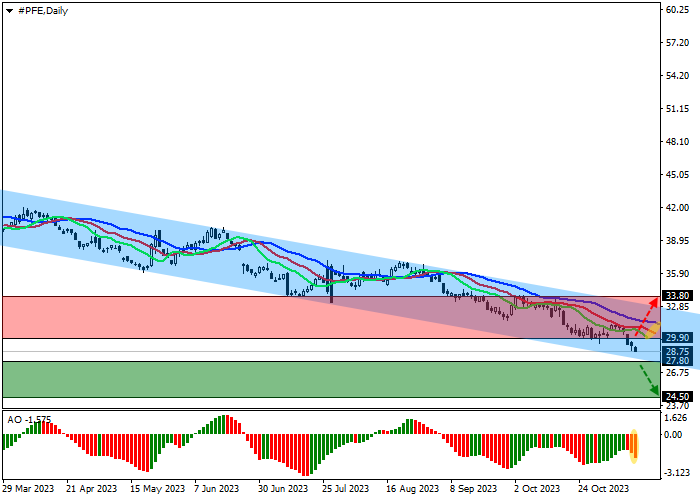

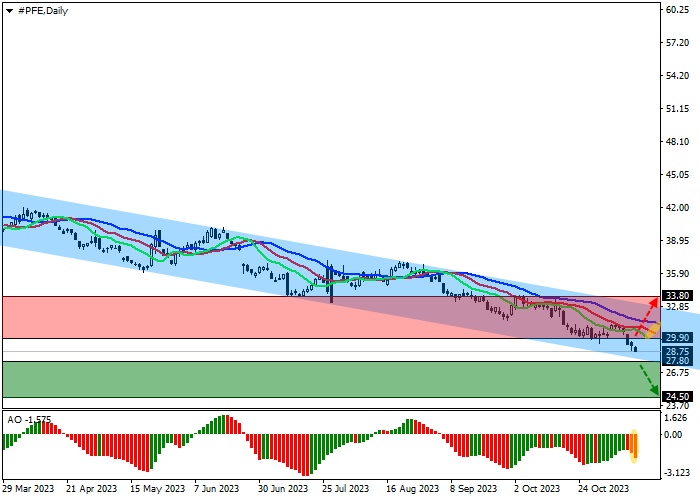

On the D1 chart, the instrument is corrected, being close to the support line of the local descending corridor with the borders of 27.80–32.80.

Technical indicators continue to hold a fairly stable sell signal: the fast EMAs of the Alligator indicator are held below the signal line, expanding the range of fluctuations, and the AO histogram is trading below the transition level, forming descending bars.

Support levels: 27.80, 24.50.

Resistance levels: 29.90, 33.80.

Trading tips

If the asset continues to decline and the price consolidates below the support level at around 27.80, one can open short positions with the target at 24.50 and stop-loss at 29.00. Implementation time: 7 days and more.

If the global growth of the asset continues and the price consolidates above the resistance level at 29.90, one may open long positions with the target at 33.80 and stop-loss at 28.00.

Hot

No comment on record. Start new comment.