Current trend

The EUR/USD pair is trading in different directions, holding near the local highs of early September at 1.0872. The day before, the single currency showed its strongest growth in recent months, which was the market’s reaction to a significant slowdown in inflationary pressure in the United States.

The Consumer Price Index in October showed zero dynamics on a monthly basis, while analysts expected growth of 0.1%, and in the previous period the value was 0.4%. In annual terms, the indicator slowed down from 3.7% to 3.2%, which was below expectations at 3.3%, and Core CPI adjusted from 0.3% to 0.2% and from 4.1% to 4.0%, respectively. Published data confirmed investors' assumption that the US Federal Reserve will not increase borrowing costs either this year or next. At the same time, experts note that it is still somewhat premature to talk about the possible timing of the start of the interest rate reduction cycle.

The day before, the eurozone published statistics on Gross Domestic Product (GDP) for the third quarter, which remained at -0.1% in quarterly terms and 0.1% in annual terms. In addition, the Employment Rate rose marginally from 0.2% to 0.3% and 1.3% to 1.4%, respectively, and the Center for European Economic Research (ZEW) Business Sentiment Index rose from -1.1 points to 9.8 points with a forecast of 5.0 points.

Support and resistance

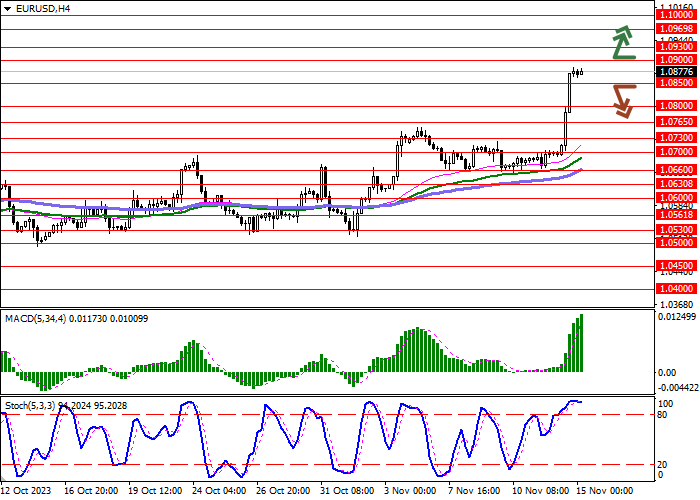

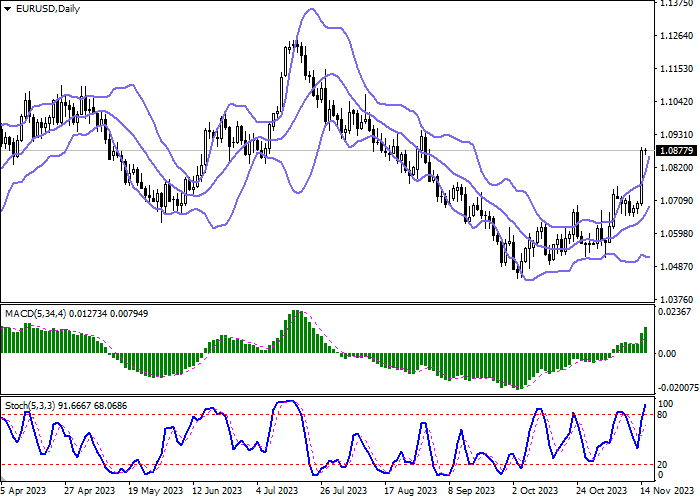

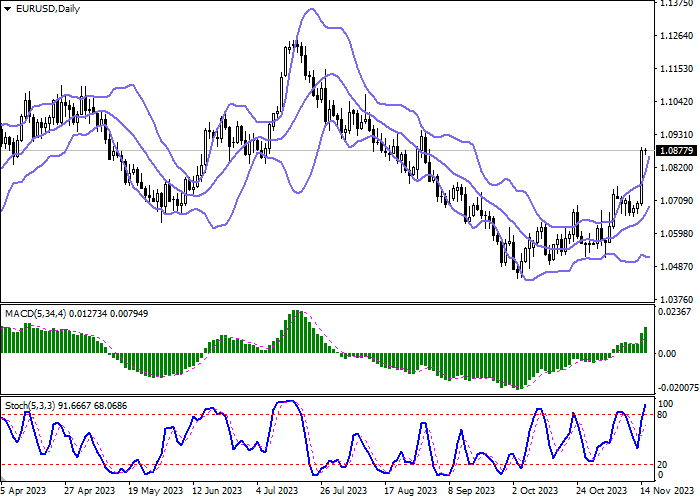

Bollinger Bands on the daily chart show a steady increase. The price range is expanding; however, it fails to catch the development of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic retains an uptrend, but is located in close proximity to its highs, which points to the risk of overbought euro in the ultra-short term.

Resistance levels: 1.0900, 1.0930, 1.0969, 1.1000.

Support levels: 1.0850, 1.0800, 1.0765, 1.0730.

Trading tips

Long positions can be opened after a breakout of 1.0900 with the target of 1.1000. Stop-loss — 1.0850. Implementation time: 1-2 days.

The return of a "bearish" trend with the breakdown of 1.0850 may become a signal for sales with the target at 1.0765. Stop-loss — 1.0900.

Hot

No comment on record. Start new comment.